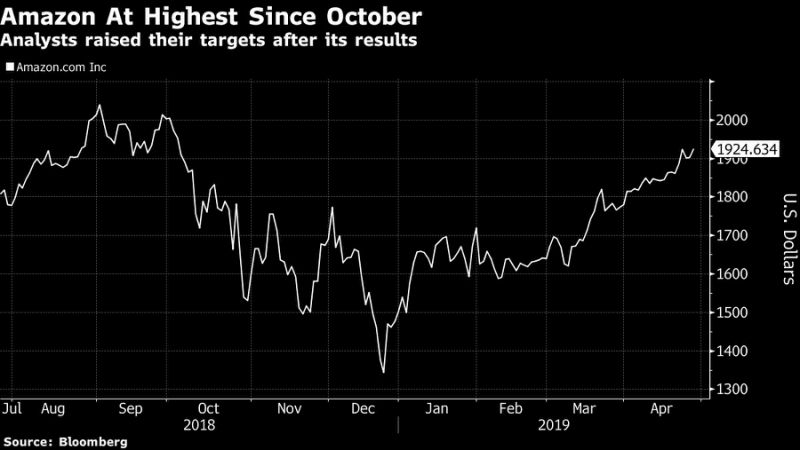

(Bloomberg) — Amazon.com Inc. rose as much as 2 percent on Friday, after reporting first-quarter earnings that beat expectations, helped by continued growth in its advertising and cloud-computing businesses. The stock was on track for its highest close since October before paring some of the gains.

Analysts were also optimistic about the announcement that the e-commerce company would offer free one-day shipping for its Prime subscribers — it previously offered free two-day shipping — which was seen as a possible catalyst for sales. Multiple firms raised their price targets on the stock.

Meanwhile, traditional retailers slumped on the news. Target Corp. tumbled as much as 8.6 percent, its biggest decline since Nov. 20. Walmart Inc. fell as much as 3.7 percent for its biggest intraday decline since Dec. 20.

Here’s what analysts are saying about Amazon’s results:

D.A. Davidson, Tom Forte

Results “checked most of our boxes.” Street-high price target raised to $2,550 from $2,450. Buy rating.

The move to one-day shipping “is important because it makes the instant gratification from shopping in physical stores less of a reason to shop at physical stores versus online.” This could act as a catalyst for revenue “at a time when the company needs one, with sales growth slowing, but profitability exploding.”

Citi, Mark May

Results were “good but not great,” as revenue came in “at the high end of the guidance range but slightly below (1 percent) forecasts.”

While Amazon’s guidance for operating income “is below guidance, the company’s history of OI beats actually suggests upside potential to forecasts.”

Buy rating, price target raised to $2,200 from $2,000.

JPMorgan, Doug Anmuth

The results gave JPMorgan “more confidence in Amazon’s ability to stabilize & potentially accelerate revenue growth, and more clarity on AMZN’s 2019 investment spend.”

Prime one-day shipping “is consistent with AMZN’s long-standing goal of convenience & selection, but also likely reflects the increasingly competitive retail environment.”

Overweight rating, target raised to $2,200 from $2,050.

Deutsche Bank, Lloyd Walmsley

“The move to 1-day Prime delivery — on top of wage increases in November — will help further separate Amazon from competitors, driving more Prime subscriptions, expanding the [total addressable market] and widening the company’s competitive advantages.”

Buy rating, price target raised to $2,315 from $2,300.

Goldman Sachs, Heath Terry

Raised price target to $2,400 from $2,100 and wrote that the market still doesn’t appreciate the long-term benefit from cloud-computing and advertising.

What Bloomberg Intelligence Says

The “move to one-day free shipping for Prime members could lift near-term spending and reduce market expectations for 2019 operating profit as the e-commerce giant chases market share and digs a wider moat around its retail business.”– Jitendra Waral– Click here for the research

To contact the reporter on this story: Ryan Vlastelica in New York at [email protected]

To contact the editors responsible for this story: Catherine Larkin at [email protected], Steven Fromm, Brad Olesen

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”46″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.