Much was anticipated from Amazon.com Inc.’s (NASDAQ:AMZN) stock at the turn of the year, but it’s drawn down by 6% and there haven’t been any real signs of rejuvenation. I thought I’d do a holistic risk analysis of the stock to analyze its prospects.

Company structure

Amazon turned into a conglomerate after it expanded into a range of industries with notable acquisitions such as Whole Foods, Twitch, MGM and Zoox, to name a few.

The company has traversed from an integrated e-commerce platform to a powerhouse, but this doesn’t necessarily add to its stock’s prospects. The market often assumes conglomerates are overpriced due to a lack of capital efficiency and the obligation of the central company to commit resources to a wide range of industries to stay competitive.

On the other hand, Amazon is now seen as a lower-risk asset, thus owning the prospects of positively skewed stock price gains.

Recent operating performance

In February, Amazon beat its earnings per share estimate by $24.09 for the fourth quarter, but missed revenue expectations by $173.16 million.

Driving earnings during the quarter were international e-commerce sales, which rose by 1% year over year, and Amazon Web Services, which increased 40% over the same period.

Amazon’s quarterly cash flow to capital expenditure has risen by 31.07% since this time last year, suggesting the company is monetizing itself impressively. Additionally, the company’s total assets have increased by 16.72% since this time last year, while its financial leverage decreased by 0.69%, meaning its intrinsic value has increased.

Key risk-return metrics

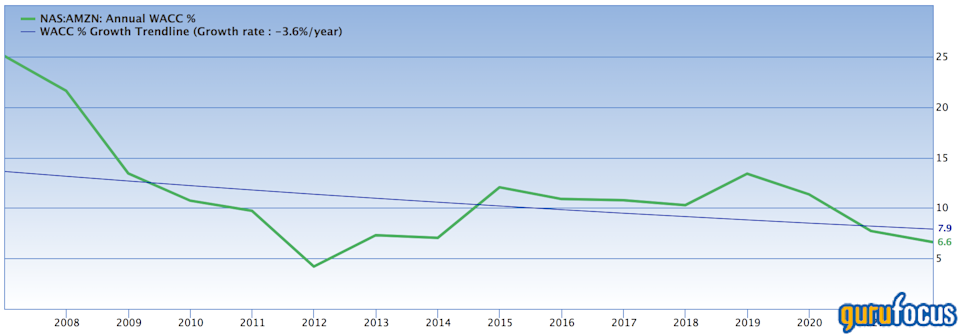

Amazon has a weighted average cost of capital of 6.61% and a cost of equity of 7.945%. The cost of equity (otherwise known as CAPM) provides investors with an indication of the expected return on the stock, given its sensitivity to the market’s risk premia and the 10-year yield.

Amazon’s expected return on equity of 7.945% comes at a Sharpe ratio of 0, which means the stock’s return relative to overall market volatility isn’t worth the risk as you’d ideally want to see a Sharpe ratio above 1 as an investor.

The bottom line

This analysis ignores the Securities and Exchange Commission’s latest probe on Amazon’s business disclosures and looks at the stock holistically. Key metrics and practices suggest the stock isn’t a good investment for its given level of risk and that it’s likely to underperform the market.

This article first appeared on GuruFocus.