Ecommerce is currently faced with several headwinds. Not only have consumers’ spending habits shifted following the reopening of the economy and returning from online to offline, but the segment is also under pressure from broader macro developments such as high inflation and the prospect of a looming recession.

As consumers now have more options and spend more on travel and experiences, over the near term, JMP analyst Nicholas Jones expects “incremental discretionary dollars to shift more toward offline alternatives.” However, over the next couple of quarters, as consumer behavior normalizes in the post-pandemic world, Jones anticipates online will “continue gaining share from offline.”

In the meantime, the analyst believes Amazon (AMZN) has got what it takes to make it through this trying period.

“Though near-term e-commerce pressures will likely impact Amazon, we view it as well positioned to navigate inflationary headwinds and likely to show resilience through a potential recession,” Jones wrote.

Amazon – both the company and the stock – has been hit hard in 2022. Q1 earnings were a big disappointment as growth stuttered while the company reported its first quarterly loss since Q2 2015. The main culprits for the weak showing are well-known by now. Inflation pressurizing costs, Russia’s invasion of Ukraine, Omicron and rising fuel prices, amongst others.

While these near-term pressures are unlikely to completely abate for now, some are expected to moderate as the year progresses, and Jones thinks 2H22 will bring with it some improved conditions.

“More importantly,” the analyst went on to say, “given the ongoing longer-term shift of commerce from offline to online, we anticipate more leverage in 2023 and beyond.”

And if you think the growth runway for the ecommerce giant is capped by now, think again.

In The U.S., which is one of the “most mature” ecommerce markets, ecommerce sales reached $871 billion last year, representing 13.2% of all retail sales. By 2025, ecommerce sales are expected to reach $1.2 trillion and account for 15% of total U.S. retail sales. Jones reckons that in 2021, Amazon’s share of the market stood at 56%, but by 2025, expects this to increase to almost 58%.

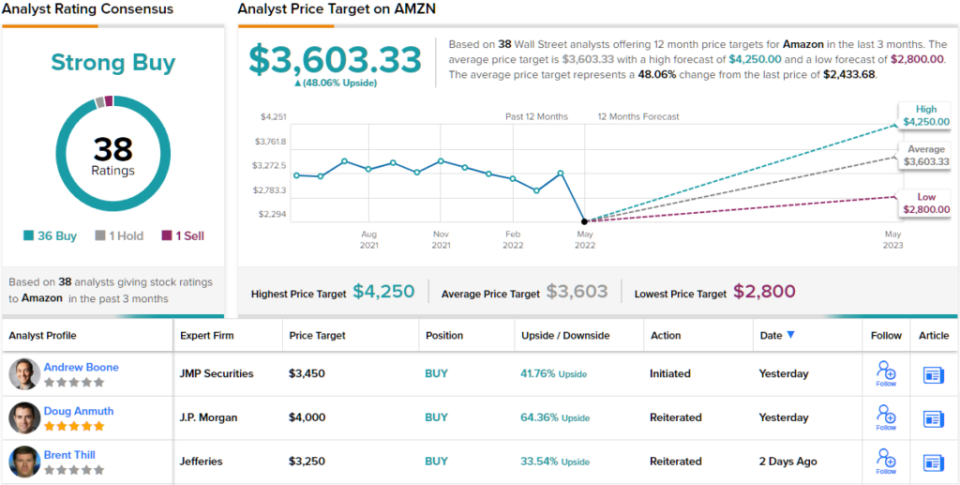

As such, Jones launches coverage on AMZN stock with an Outperform (i.e., Buy) rating and $3,450 price target. What does this mean for investors? Potential upside of 42% from current levels. (To watch Jones’ track record, click here)

Overall, 38 Wall Street analysts have posted reviews on AMZN over the past three months, and barring one Hold and Sell, each, all the others are positive, providing the tech giant’s stock with a Strong Buy consensus rating. The average price target currently stands at $3,603 and change, making room for one-year gains of 48%. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.