(Bloomberg) — Advanced Micro Devices Inc. jumped in late trading after giving a strong forecast for the current quarter, fueled by market-share gains and demand for server chips.

Most Read from Bloomberg

First-quarter revenue will be $5 billion, plus or minus $100 million, AMD said Tuesday in a statement. That compares with an average analyst estimate of $4.33 billion. Sales this year will be about $21.5 billion, compared with analysts’ projection of $19.3 billion.

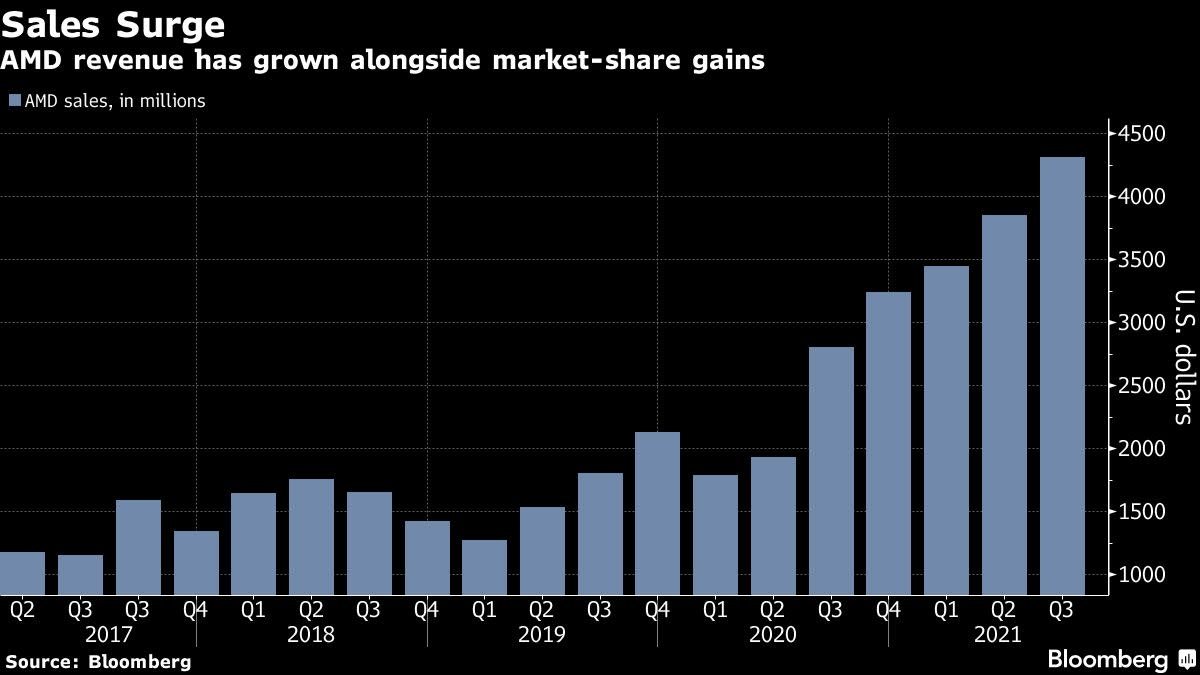

AMD, long an underdog in the chip industry, ended 2021 with record revenue — up more than threefold from its annual sales five years ago. After pouring money into AMD’s stock since Chief Executive Office Lisa Su took over in 2015, investors now want to see more evidence that the company can continue to gain on the once-dominant Intel.

AMD shares rose more than 8% in extended trading after closing at $116.78 in New York. The stock had fallen 19% this year, battered by a broader downturn.

Under Su, AMD has developed leading-edge components — something her predecessors struggled to do. That’s led more chip customers to ditch Intel in favor of AMD. But Intel CEO Pat Gelsinger, who took the helm last year, is now claiming his company is offering better PC processors than AMD.

AMD data-center sales, including chips used by companies such as Alphabet Inc.’s Google and Amazon.com Inc.’s AWS, doubled last year compared with 2020. Intel said last week that demand for those chips was strong from corporations, but sales from the biggest providers of cloud computing fell.

AMD is also the second-largest maker of graphics chips used in add-on cards by PC gamers. It competes in that market with Nvidia Corp. and will face fresh opposition from Intel, which has begun offering products for that segment for the first time in years.

AMD, based in Santa Clara, California, also supplies graphics chips used in Microsoft Corp.’s Xbox and Sony Corp.’s PlayStation.

Analysts and investors have expressed concern that surging demand for PCs, particularly the lower-end laptops needed by students and workers during the Covid 19-related lockdowns, would dissipate this year.

AMD’s processors are made by Taiwan Semiconductor Manufacturing Co., which has surpassed Intel in production technology. TSMC also supplies chips to Apple Inc., Qualcomm Inc., Nvidia and many other technology companies, and the Taiwanese company is struggling to keep up with demand.

AMD reported fourth-quarter net income of $974 million, or 80 cents a share, compared with $1.78 billion, or $1.45 a share, in the same period a year earlier. Revenue rose 49% to $4.83 billion.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.