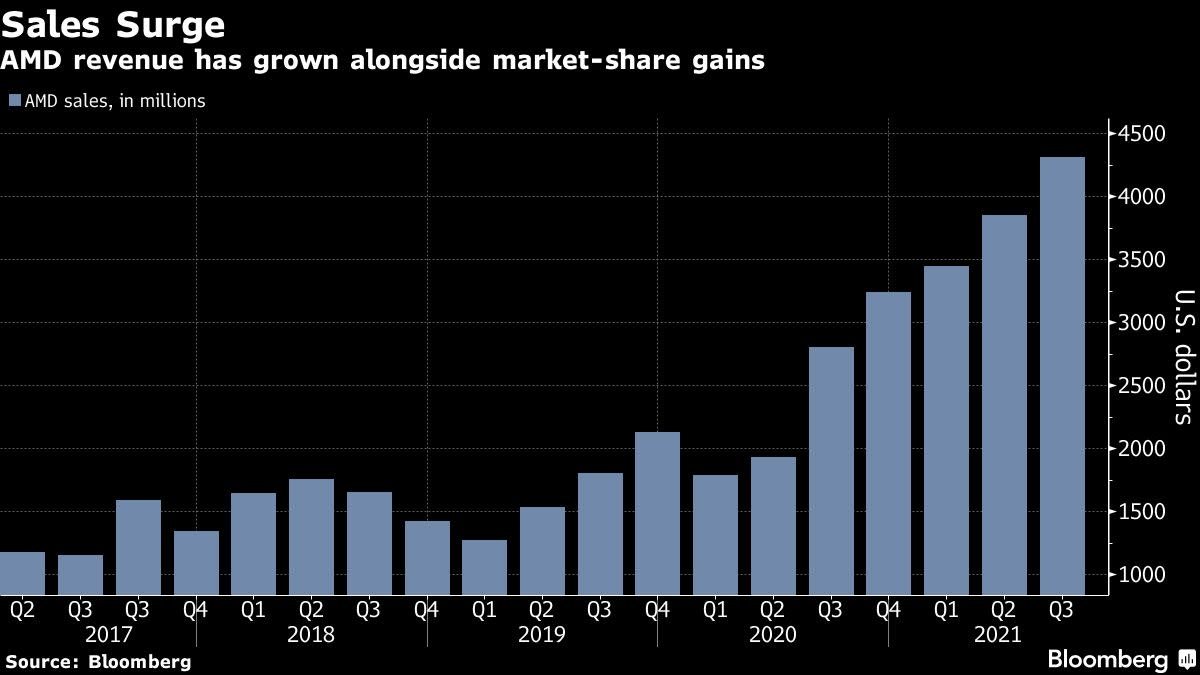

(Bloomberg) — Advanced Micro Devices Inc. rallied as much as 12% in late trading after giving a surprisingly strong sales forecast, suggesting it’s making further gains on archrival Intel Corp. in computer processors.

Most Read from Bloomberg

The chipmaker’s first-quarter sales outlook outpaced Wall Street estimates on Tuesday, and AMD is reaching a level of profitability that’s nearly identical to Intel’s — something that would have been inconceivable just a few years ago. Fourth-quarter sales and earnings also topped analysts’ predictions.

AMD, long an underdog in the chip industry, ended 2021 with record revenue — up more than threefold from its annual sales five years ago. After pouring money into AMD’s stock since Chief Executive Office Lisa Su took over in 2015, investors had been waiting for more evidence that the company can continue to gain on the once-dominant Intel. Su delivered.

“We still have a very ambitious set of goals in terms of what we believe we can do,” she said in an interview. “We see secular growth over the next five years because people need more computing.”

First-quarter revenue will be $5 billion, plus or minus $100 million, AMD said. That compares with an average analyst estimate of $4.33 billion.

AMD’s profitability is reaching lofty levels. Its gross margin — the percentage of sales remaining after deducting costs of production — will be about 51% this year. That’s nearly on par with Intel’s projection for 51% to 53%.

Compare that with five years ago, when Intel boasted a margin of more than 63% and AMD was at 31%.

AMD shares rose as high as $130.65 in extended trading after closing at $116.78 in New York. The stock had fallen 19% this year, battered by a broader downturn.

The company’s outlook helped soothe concerns that the chip industry is slowing after a pandemic-fueled boom. AMD predicted a sales gain of about 31% to $21.5 billion this year, compared with an analyst projection of $19.3 billion.

Under Su, AMD has developed leading-edge components — something her predecessors struggled to do. That’s led more chip customers to ditch Intel in favor of AMD. But Intel CEO Pat Gelsinger, who took the helm last year, is now claiming his company is offering better PC processors than AMD.

“I usually let the numbers speak for themselves and the products speak for themselves,” Su said. “But we’re a very competitive bunch over here.”

Fourth-quarter data isn’t available from industry researchers yet, but AMD picked up more than 2 percentage points of market share from Intel in the third quarter, according to Mercury Research.

AMD data-center sales, including chips used by companies such as Alphabet Inc.’s Google and Amazon.com Inc.’s AWS, doubled last year compared with 2020. Intel said last week that demand for those chips was strong from corporations, but sales from the biggest providers of cloud computing fell.

In contrast with those remarks, AMD said Tuesday that demand increased from its cloud customers, which are deploying its Epyc server chips in their data centers.

AMD is also the second-largest maker of graphics chips used in add-on cards by PC gamers. It competes in that market with Nvidia Corp. and will face fresh opposition from Intel, which has begun offering products for that segment for the first time in years.

AMD, based in Santa Clara, California, supplies graphics chips used in Microsoft Corp.’s Xbox and Sony Corp.’s PlayStation. Demand for the two game consoles “continues to outpace all prior generations,” AMD said in slides prepared for its earnings call.

Analysts and investors have expressed concern that surging demand for PCs, particularly the lower-end laptops needed by students and workers during the Covid-19 lockdowns, would dissipate this year.

AMD’s processors are made by Taiwan Semiconductor Manufacturing Co., which has surpassed Intel in production technology. TSMC also supplies chips to Apple Inc., Qualcomm Inc., Nvidia and many other technology companies, and the Taiwanese company is struggling to keep up with demand.

AMD reported fourth-quarter net income of $974 million, or 80 cents a share, compared with $1.78 billion, or $1.45 a share, in the same period a year earlier. Sales rose 49% to $4.83 billion.

Revenue in AMD’s enterprise and semicustom unit, which makes server and gaming console chips, rose 75% from a year earlier.

Its computing division posted a revenue increase of 32% from a year earlier. That performance was helped by increasing sales of higher-priced Ryzen processors, AMD said.

The company, which analysts once expected to run out of money, now has $3.6 billion of cash and only $313 million of debt.

AMD also said it expects to close its acquisition of Xilinx Inc. in the first quarter. Chinese regulators granted approval for the purchase, which will make AMD one of the largest makers of programmable processors and increase its ability to compete directly with Intel.

(Updates with CEO comment in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.