Amid all the hype about the tech sector and artificial intelligence (AI) this year, one stock that has surprisingly not done well is Advanced Micro Devices (AMD -2.89%), aka AMD. As of Monday, shares of the chipmaker were down 15% year to date. It’s now near its 52-week low, despite its long-term potential.

Could this be a great time to invest in AMD stock?

Why hasn’t AMD stock been a better performer this year?

AMD’s peer Nvidia (NVDA -1.14%) has been a scorching hot buy over the years and is now among the three most valuable companies in the world. Its market cap of $3.2 trillion is more than 16 times AMD’s $200 billion.

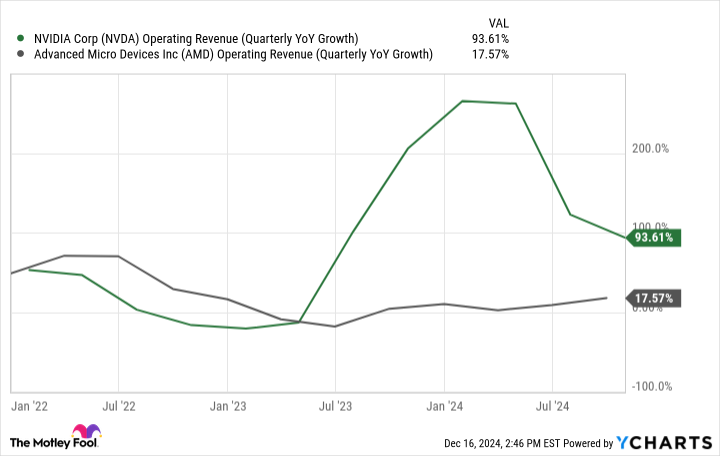

AMD stock trades at more than 110 times its trailing earnings. And it’s not just its valuation that looks worrisome: AMD’s revenue growth rate has been modest recently when compared to Nvidia’s.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts.

It has been a tale of two vastly different growth stocks. While many businesses have been taking off due to AI-fueled demand, AMD has been a bit underwhelming in that regard. For it to win back growth investors, it will need a catalyst.

The company says it is on track for record revenue for 2024, and that it’s experiencing “significant growth” in multiple areas of its business. Yet investors may be unimpressed given how much growth they’ve been seeing from other tech companies this year.

There is some good news, however: AMD anticipates an acceleration of its growth rate for the fourth quarter. Management projects sales of around $7.5 billion, which would be an increase of 22% from the prior-year period.

AMD’s new chip could determine how the stock does next year

AMD is aggressively pursuing a piece of the AI chip market, and there could be room for it to steal some market share from Nvidia. Companies may be seeking cheaper chip options or simply looking to diversify their supply chains so that they’re not overly dependent on a single vendor.

According to AMD, the MI325X chip it launched recently is 30% faster than Nvidia’s H200. If that’s the case, it could offer some competition to the GPU leader, provide AMD with some strong top- and bottom-line growth, and potentially give the stock a much-needed boost in 2025.

Is AMD stock worth buying right now?

Although it hasn’t been a good investment in 2024, AMD may be an underrated stock to hold in the new year. With its new chip rolling out to customers and AMD anticipating an acceleration of its growth rate, the pieces are there for the stock to do better in 2025.

While it may look like an expensive stock to buy based on its trailing metrics, it’s trading at a forward price-to-earnings multiple of 25 (based on analysts’ consensus expectations), which would make it a much more comfortable purchase for long-term investors. Given AMD’s potential in the AI chip market, it may even be one of the better stocks to buy right now as investors generally appear to be overlooking it, and that could prove to be a mistake.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.