Shares of Amgen Inc. popped 3% Monday after the company said it would buy psoriasis drug Otezla from Celgene Corp.

It wasn’t a cheap buy: Amgen AMGN, +2.81% said it would pay $13.4 billion in cash for the blockbuster anti-inflammatory medication.

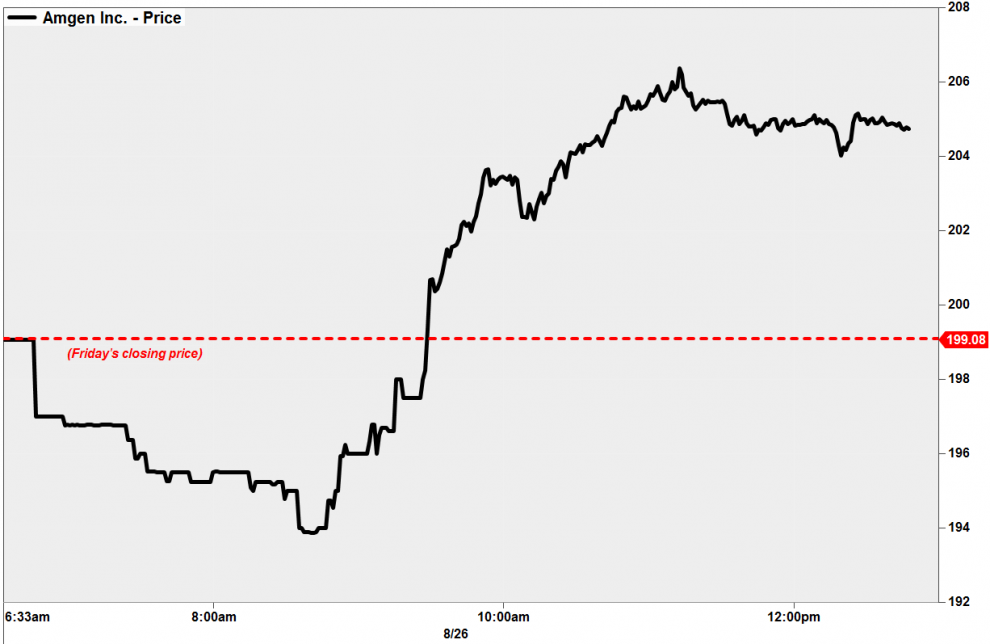

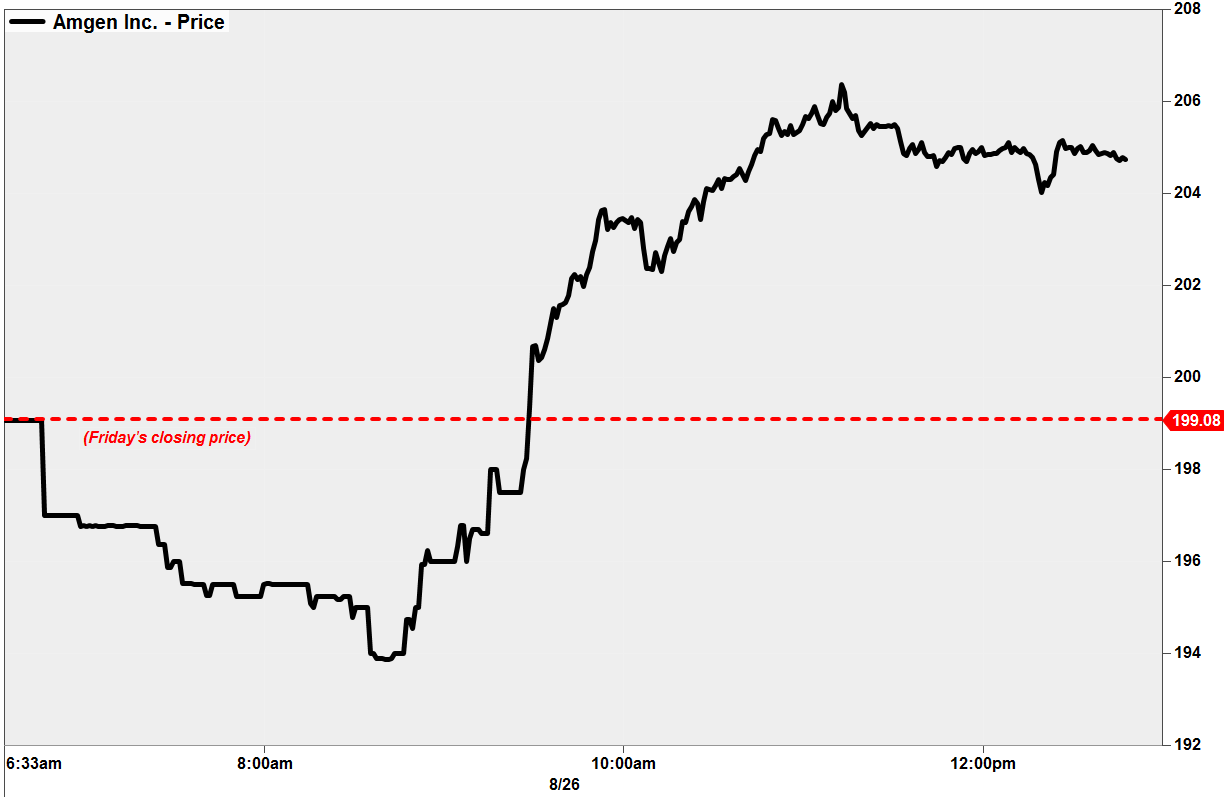

Amgen-covering analysts were excited about the purchase, with Jefferies’ Michael Yee calling it a “positive and smart deal“ and raising his revenue estimate for 2020 to $25.2 billion from $23 billion. He also raised his 2020 EPS to $15.94 from $15.34. In an early-morning note, he said he thought the stock would fall — at least initially — and recommended investors “buy the dip today.”

Read: Bristol-Myers deal for Celgene moves ahead after the sale of psoriasis drug

Also: Amgen’s earnings weren’t a thrill, but promising cancer-drug results are lifting the stock

Indeed, investors initially seemed spooked by the hefty price tag, sparking a pre-market selloff that sent Amgen shares down as much as 2.6%. However, the stock more than recovered during intraday trading, settling at around $205 a share by early afternoon.

Analysts see Otezla as a good strategic buy for Amgen. The drug’s key patents don’t expire until 2028, and it fits in well with the company’s anti-inflammatory injectable Enbrel, whose prospects got a recent boost after a U.S. judge upheld two patents protecting the drug’s active ingredient until 2029, effectively denying a biosimilar challenge by Novartis AG NVS, -0.10% . Amgen also sells Amgevita, a biosimilar of AbbVie Inc.’s ABBV, +1.04% Humira that treats several inflammatory diseases.

Read: AbbVie confirms deal to buy Allergan for 45% premium, valuing Allergan at $61.7 billion and Allergan acquisition is ‘a major bailout’ for shareholders, according to analysts

“Otezla should certainly be immediately profitable for Amgen,” SVB Leerink’s Geoffrey Porges wrote in a note to clients Tuesday morning. The psoriasis pill brought in $1.6 billion in sales in 2018, and analysts polled by FactSet expect that number to grow to $1.9 billion in 2020 and $3.1 billion in 2021.

Celgene CELG, +2.83% , which is set to merge with Bristol-Myers Squibb Co. BMY, +2.75% , is selling Otezla to allay anti-competitive concerns raised by the U.S. Federal Trade Commission around anti-inflammatory drugs. Bristol currently has an investigational psoriasis drug in late-stage drugs. The merger is now expected to close by the end of 2019, the companies said.

But some analysts wondered how anti-competitive the sale really was, given Amgen’s anti-inflammatory portfolio.

“From a policy standpoint, it is hard to understand how Amgen’s commercialization of Otezla is any less anti-competitive than Bristol’s,” Porges wrote. “The FTC is trading the anti-competitive effects of one combined portfolio (Bristol’s TYK2 in phase III + Celgene’s Otezla) for another combined portfolio (Amgen’s Enbrel + Amgen’s Amjevita biosimilar + Celgene’s Otezla).”

Adding Enbrel to Amgen’s portfolio actually seems to be the “more truly anti-competitive” move, Porges added. However, the FTC doesn’t seem to see it like that, he wrote, which suggests “the structure of the transaction, rather than the portfolio effects, is sufficient to avoid such regulatory review.”

Shares of Amgen have gained 5.3% so far this year, while the Dow Jones Industrial Average DJIA, +0.98% has gained 9.9%. The S&P 500 SPX, +0.93% has gained 14.5%.