Cloud computing stocks have surged amid widespread adoption that’s being driven by artificial intelligence (AI). In this article, I will use the TipRanks Stock Comparison Tool to evaluate the three biggest players in the sector: Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT). Although I consider all three stocks a Buy, Amazon stands out as the best investment based on its cloud business.

Amazon (AMZN)

I rate Amazon a Buy largely because of its position as the undisputed leader in cloud computing. Amazon Web Services (AWS) holds a 31% market share. Under CEO Andy Jassy, the company has shifted its focus to higher-margin services, scaling AI across AWS and lessening its reliance on first-party retail sales.

AWS is arguably Amazon’s most important business unit, boasting an impressive operating profit margin of 35.5%. Although the current margin is down slightly from 37.6% in the previous quarter, it remains nearly 40 times more profitable than Amazon’s international segment, which has operating margins of 0.9%.

AWS supports open-source projects and tools, and is popular for its flexibility, scalable infrastructure, and AI services. As enterprises increasingly adopt open-source models, AWS could gain a competitive edge and better protect its market share. AWS’ net sales growth has accelerated from 12% to 19% over the past four quarters, with Q2 2024 revenues reaching $26.3 billion and an annual run rate of $105.2 billion.

Is AMZN Stock A Buy According to Wall Street Analysts?

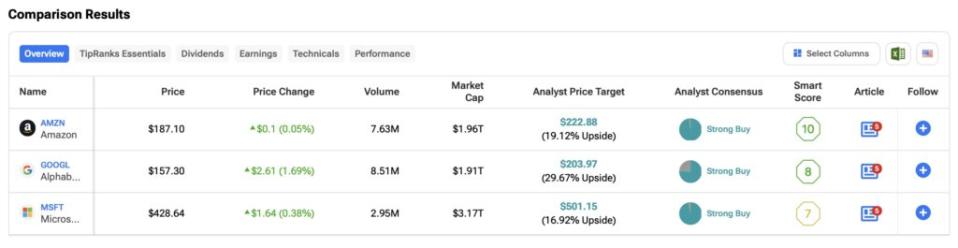

The consensus among Wall Street analysts is that AMZN stock is a Strong Buy. Currently, 42 of 43 analysts rate the stock a Buy. There is one Hold rating on the stock and no Sell ratings. The average price target of $222.88 suggests potential upside of 20.68% based on the current share price.

Bank of America (BAC) analyst Justin Post points to the upcoming 2025 partnership between Oracle’s (ORCL) databases and AWS applications, which could drive increased demand for cloud infrastructure and applications using Oracle’s databases—an area where the two companies previously competed.

Read more analyst ratings of AMZN stock

Alphabet (GOOGL)

My bullish stance on Alphabet is based on the rapid growth of Google Cloud and its improving margins. Currently, Google Cloud holds an 11% share of the cloud computing market. However, it is the fastest-growing among the three major players.

One of Google Cloud’s key strengths is its integration with other Google services, such as AI-driven applications and Google Workspace. This synergy enables Google Cloud to offer a strong suite of solutions in areas such as automation, cybersecurity, and productivity.

In Q2 of this year, Google Cloud’s revenue increased 29% to $10.3 billion, marking the sixth consecutive quarter of growth. However, Alphabet’s Cloud segment reported operating margins of 11.3% last quarter. While this was an improvement, it is still significantly lower than AWS’ margin of 35.5%. Enhancing these margins should be a top priority at Alphabet.

Is GOOGL Stock A Buy Or Sell?

Wall Street is also bullish on Alphabet. The consensus view is that GOOGL stock is a Strong Buy, with 27 out of 36 analysts saying the shares are a Buy. The other nine analysts rate the stock a Hold. There are no Sell ratings on the stock currently. The average price target of $203.72 implies upside potential of 29% from current levels.

Goldman Sachs (GS) analyst Eric Sheridan highlights that Alphabet’s focus on balancing growth with cost discipline should lead to steady margin expansion within the cloud segment.

Read more analyst ratings on GOOGL stock

Microsoft (MSFT)

I also rate Microsoft’s stock a Buy based on the success of the company’s Azure cloud unit. Azure’s market share has steadily grown to 25%, making it Amazon’s closest competitor. This growth is largely attributed to Microsoft’s strong enterprise relationships. Azure’s integration with Microsoft’s other enterprise products—such as Office 365, Dynamics, and LinkedIn—makes it an attractive option for businesses that already use Microsoft’s ecosystem.

However, it’s important to note that Azure’s growth slowed in the company’s most recent quarter. The server products and cloud services revenue category reached $28.5 billion in revenue, an 18% year-over-year increase. That growth was slower than the 24% annualized increase recorded in the previous quarter and negatively impacted Microsoft’s overall earnings.

Microsoft was the only major player in the cloud sector to experience a slowdown in revenue growth, while AWS and Google Cloud grew their revenues. Regardless, Microsoft still leads its peers with the highest operating margins, boasting an impressive 45%.

Is MSFT A Buy According to Wall Street Analysts?

Wall Street analysts are extremely bullish on Microsoft, giving the stock a consensus Strong Buy rating. Currently, 29 out of 30 analysts rate the stock a Buy. The other analyst rates it a Hold. As with Amazon and Alphabet, there are no Sell ratings on Microsoft’s stock. The average price target of $501.15 suggests potential upside of 16.3%.

Morgan Stanley (MS) analyst Keith Weiss points out that Azure is growing faster when considered separately from other Microsoft services. He expects Azure to experience significant growth in the second half of this year due to reduced capacity constraints.

Read more analyst ratings on MSFT stock

Conclusion – Amazon Web Services Is the Best Choice

Microsoft’s cloud service boasts the best operating margins, despite a slowdown in growth in the last quarter. Google Cloud, while having the lowest operating margins and smallest market share, is experiencing the fastest growth. However, Amazon Web Services (AWS) stands out with the biggest market share, strong operating margins, and accelerating growth. Given Amazon’s sizable cloud ecosystem and strong financial metrics, it represents the strongest investment opportunity in cloud computing today.