If you’ve signed up for the Apple Card, your payment history won’t be reflected on your credit reports.

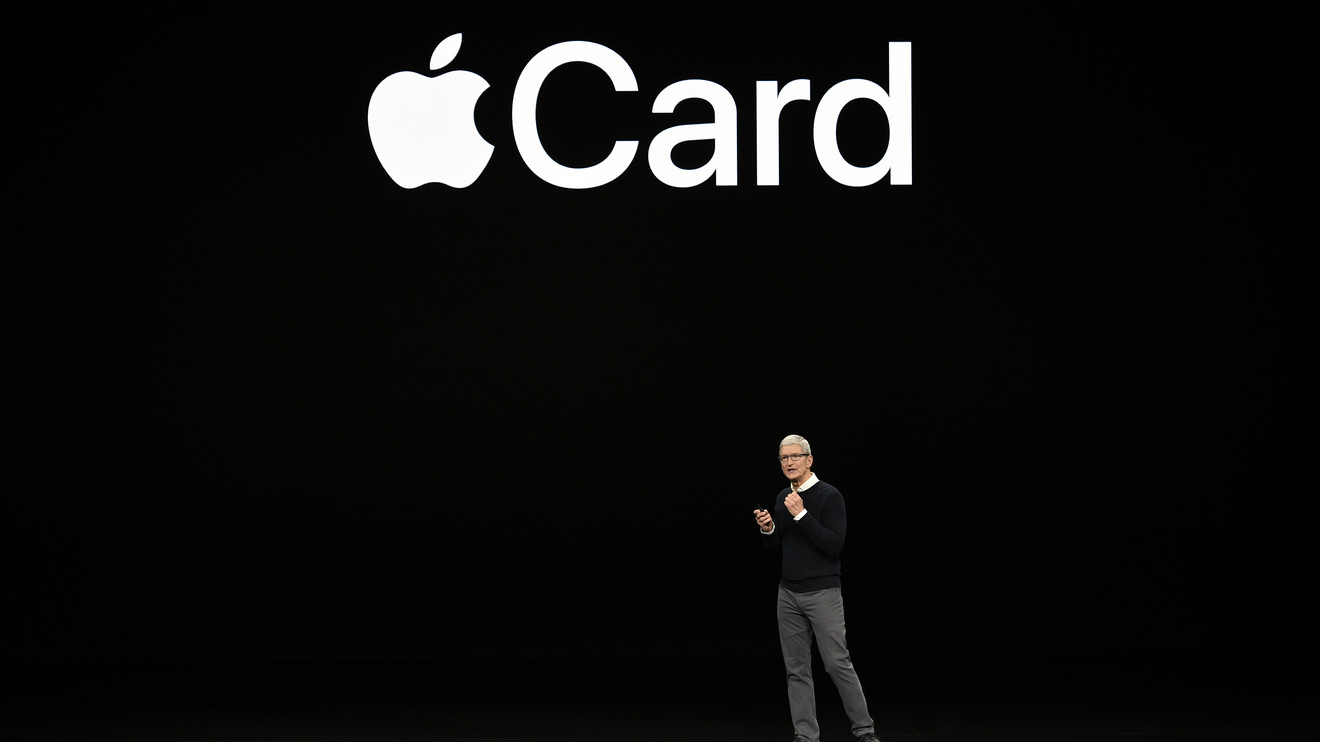

Apple AAPL, -0.33% and Goldman Sachs GS, -0.24% have yet to start reporting consumers’ payment information for the Apple Card to the major credit bureaus, a source close to Goldman Sachs confirmed to MarketWatch on Monday. The source later said that the companies will begin reporting to the credit bureaus later this quarter.

This means that the two companies have yet to send details on customers’ balances and on-time payments to Experian EXPN, -1.33%, Equifax EFX, -1.34% and TransUnion TRU, -0.46% — information that is used to calculate people’s credit scores.

The source attributed the lack of reporting to the Apple Card being a brand new product. Apple referred a request for comment from MarketWatch to Goldman Sachs. Experian, Equifax and TransUnion did not immediately return requests for comment.

The Apple Card is the first credit card Goldman Sachs has ever offered. When it was unveiled, some observers suggested that card holders could encounter customer-service difficulties given that Apple and Goldman Sachs were both new to the credit-card space.

Goldman believes the release of the Apple Card “is the most successful credit-card launch ever,” Goldman Sachs CEO David Solomon said during the company’s quarterly earnings call with investors on Tuesday, citing high consumer demand.

Details regarding the lack of reporting to credit bureaus were first revealed by Bloomberg reporter Mark Gurman on Twitter. In a screenshot he posted, a source at one of the two companies appeared to imply that once Apple and Goldman Sachs develop the functionality, the two companies will report consumers’ payment data retroactively.

Don’t miss: Here’s everything Apple isn’t telling you about its new credit card

While credit-card companies are not technically obligated to report to the major credit bureaus, industry experts said the decision was rather unusual.

“I’ve never heard of a mainstream credit card that doesn’t report to the credit bureaus,” said Ted Rossman, industry analyst at CreditCards.com. “I’ve heard of a few fringe instances of cards failing to report to the bureaus, like certain secured cards, but nothing nearly as widely known as the Apple Card.”

Rossman suggested the card was an example of a “minimum viable product,” a concept that’s pervasive in the technology space. Companies are increasingly shifting toward getting a starter version of a product out into the market and then improving it gradually, rather than working out all the kinks before release.

“I suspect they wanted to launch Apple Card by late summer because that’s what they promised back in March,” he said. “I’m thinking they probably felt they couldn’t wait anymore, so they launched when they felt it was good enough, and then they’ll improve further over time.”

Apple and Goldman’s delay in sending Apple Card data to the credit-reporting firms could be an issue for some people who signed up for the card.

When the card was announced, Apple played up the financial management features associated with it through the Wallet app to help people keep track of their spending habits. The companies also touted the speed of the sign-up process, saying that users would be approved in less than a minute and suggesting that people with thin or poor credit history would be able to obtain the card.

Read more: Apple’s titanium credit card comes with surprisingly strict care instructions

Because of its relatively competitive rewards program, this made the card potentially popular with people looking to improve their credit score. But this new revelation could hamper them in achieving that goal.

“With any retail card, a lot of folks who get those cards want to either get started with credit or rebuild their crummy credit,” Matt Schulz, chief industry analyst at CompareCards TREE, -1.99%, told MarketWatch. “If there’s a card that’s not reporting people’s credit history to the credit bureaus that would be troubling.”

When Apple and Goldman do start reporting consumers’ data to the credit bureaus, they likely will be providing a more detailed picture of these customers than other credit card companies. The personal-finance tools in the Wallet app allow Apple Card users to customize how often they pay off their balances and how much they pay. Users have the option to pay off their balances in more frequent payments, instead of on the traditional monthly basis.

Over time, that could influence how credit bureaus assess these people, experts said, because some Apple Card users may shift to paying off their balance on a weekly or even daily basis, rather than monthly like many credit-card holders.

“That’s extremely valuable information that completely changes the algorithms and considerations of someone’s creditworthiness,” Richard Crone, a consultant in the payments industry, said.

(This story has been updated.)