(Bloomberg) — With investors on edge about an economic slowdown, Apple Inc. offered just enough good news Thursday to calm fears — and bought itself some time to ready a wave of new products.

Most Read from Bloomberg

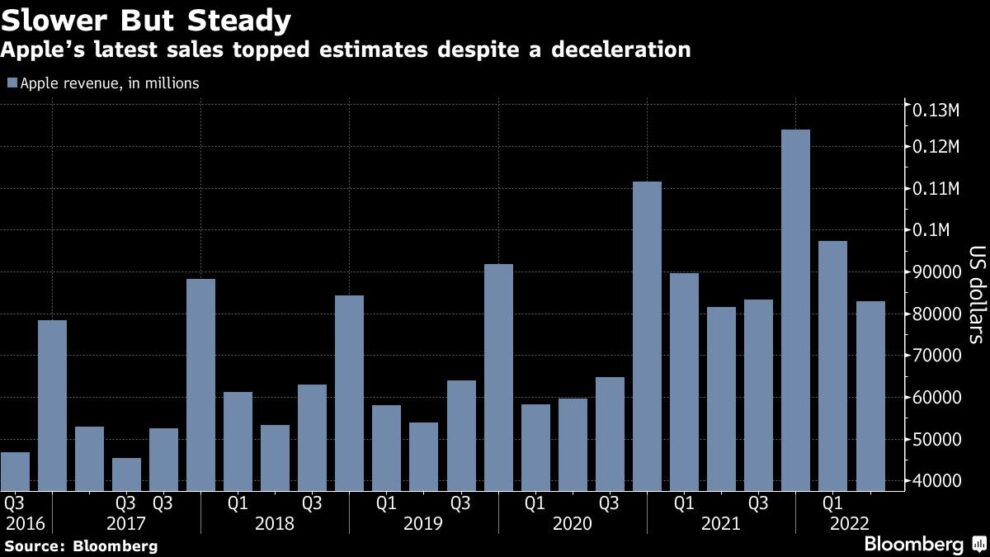

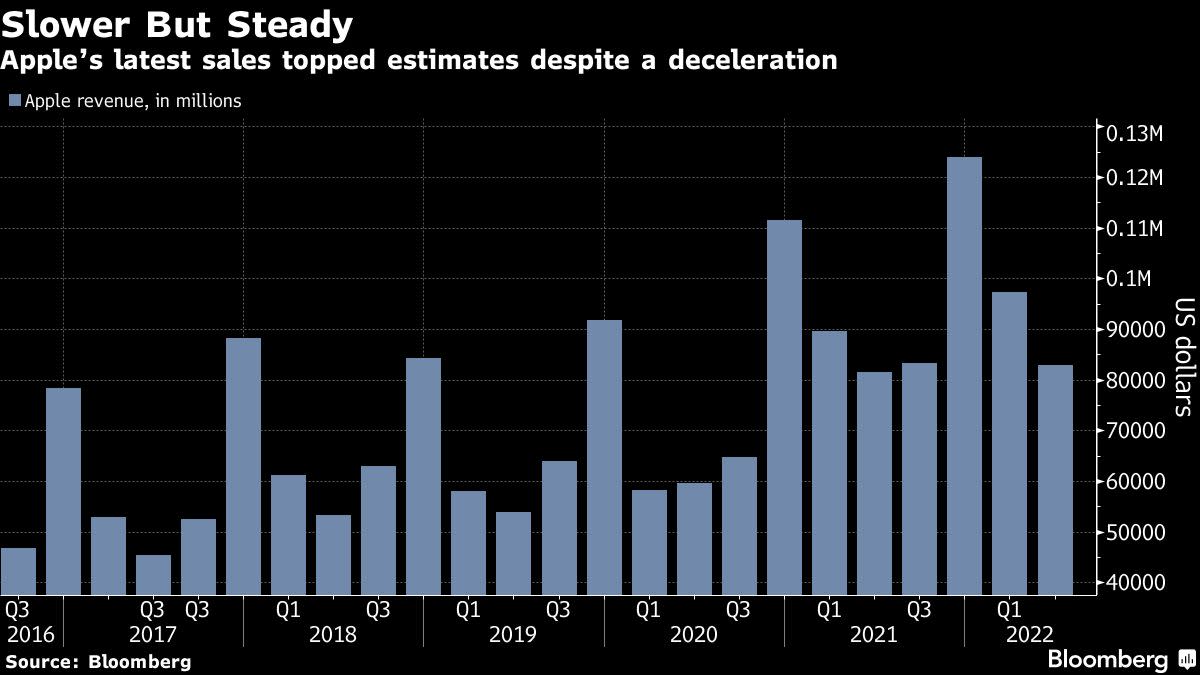

The company’s fiscal third-quarter revenue and profit narrowly topped analysts’ estimates, with iPhone sales holding up better than expected. Though Chief Executive Officer Tim Cook decried a “cocktail of headwinds” hampering Apple’s business, he predicted that sales would begin to pick up in the coming months.

“This quarter has ultimately been a reflection of our resilience and our optimism,” Cook said on a conference call with analysts. “As we look forward, we’re clear-eyed about the uncertainty in the macro environment. Yet we remain ever focused on the same vision that has guided us from the beginning.”

The shares gained as much as 4.2% to $164.01 in late trading after the results were released. Apple had fallen 11% this year through Thursday’s close, dragged down by a broader slide among tech stocks.

Apple warned earlier this year that the third quarter would be a rough stretch, with supply chain snags cutting sales by $4 billion to $8 billion. But in typical Apple fashion, the reality was better than expected. The constraints ultimately cost the company less than $4 billion, Cook said during the call. And that number will be lower in the current period.

Revenue rose 2% to $83 billion in the third quarter, which ended June 25, compared with an average analyst prediction of $82.8 billion. Earnings amounted to $1.20 a share, topping the $1.16 projection.

Apple’s iPhone and iPad both performed better than feared during the quarter, though other products — including Macs and wearables — fell short of projections. Services, a key growth area for Apple, narrowly missed estimates.

Still, the iPhone numbers suggest that Apple is weathering a slowdown in smartphone spending. Amazon.com Inc., which also reported quarterly results Thursday, provided its own reassurance to wary tech investors with stronger-than-expected sales and an upbeat forecast.

Cook acknowledged in an interview with Bloomberg Television’s Emily Chang that the company was dealing with “some softness” and a slower economy, but said he expects revenue to pick up again in the fourth quarter. Apple didn’t provide specific guidance for the period, continuing an approach it adopted at the beginning of the pandemic.

Though it’s faring better than some tech peers, Apple has grown more cautious as it confronts a sputtering economy. The iPhone maker is planning to slow hiring and spending for some teams in 2023, Bloomberg reported earlier this month.

Apple struggled to get enough supply last quarter after China’s Covid-19 precautions shuttered some factories and hamstrung deliveries. Those problems have eased but aren’t over.

China’s tough stance against the virus has led to some production restrictions for supplier Foxconn as recently as this week. The manufacturer, along with several others in the region, was forced to operate within a “closed loop” system for seven days. That means factory workers can’t have contact with people outside of their plants for that period.

The strong dollar also threatens to eat into sales. And Cook noted that supply constraints may have masked whether consumer demand is softening. Because Apple struggled to get enough inventory, it’s hard to judge whether some of it might have gone unsold.

With the Mac and iPad, “we didn’t have enough product to test the demand,” he said.

The third quarter is typically one of Apple’s slower sales periods, and the company had little in the way of new products to offer. It released an updated iPhone SE back in March and is expected to launch fresh iPhones in September, missing the quarter that just ended.

Even so, the iPhone generated $40.7 billion last quarter, beating estimates of about $39 billion.

Qualcomm Inc. had stoked investors’ fears about the smartphone market on Wednesday, when the chipmaker said consumers’ appetite for the devices had slowed. But the company said demand was particularly weak for low-end and mid-tier phones running Android, rather than the iPhone.

Last quarter’s sales from digital services like iCloud, AppleCare, Apple TV+ and Apple Music climbed 12% to $19.6 billion during the period. That made it Apple’s fastest-growing category, but the division came up shy of Wall Street predictions of about $19.7 billion.

Apple’s wearables, home products and accessories — the division that includes its smartwatch, HomePod, AirPods and Beats headphones — had sales of $8.08 billion last quarter. Wall Street had called for about $8.8 billion.

Apple generated $7.38 billion from the Mac, badly missing predictions of about $8.45 billion. The company launched new MacBook Pro and MacBook Air models in July, but those didn’t contribute to the latest results because the quarter ended in June. That means many consumers probably stopped buying the old versions of the products — Apple’s two most popular Macs — hurting that category.

Without supply constraints, the Macs would have come out sooner. Earlier in 2022, Apple’s main manufacturing partners for laptops were shuttered in China due to the Covid lockdowns. That delayed the release of the new MacBook Air and MacBook Pro by several weeks.

The Cupertino, California-based company is planning a slew of new Macs over the next several months, including high-end MacBook Pros, an iMac, upgraded Mac minis and a revamped Mac Pro, Bloomberg has reported.

The iPad, which was a strong performer at the height of Covid-19 lockdowns, has been slipping back toward pre-pandemic levels. Still, it generated $7.22 billion last quarter, above the $6.93 billion estimate. The company last updated the iPad in March with a new iPad Air model with an M1 chip. And it’s planning faster iPad Pro models for later this year.

The ongoing Covid restrictions in China have sparked concerns about the effect on consumer spending there. In a sign that Apple has had to get more aggressive in that market, it’s currently cutting the price of the iPhone, Apple Watch and AirPods in China for a few days as part of a rare sale.

Apple generated $14.6 billion from the country in the third quarter, down from a year earlier but better than analysts had projected.

Chief Financial Officer Luca Maestri said that Apple would see accelerated growth in the fourth quarter compared with the third, but that the services business would slacken. The company blamed a digital advertising slump for that slowdown. Still, Maestri said that Apple has over 860 billion paid subscriptions across its platforms, including its own services and third-party offerings on the App Store.

Asked about mergers, Cook said that the company is “constantly surveilling” the market for acquisitions but that Apple wouldn’t buy a company just for additional revenue. He said he wouldn’t rule out any big deals in the future, though.

“We would buy something that is strategic for us,” he said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.