Even the second round of “meme stock mania” in GameStop (GME), which took Wall Street by storm last week, can’t hold a candle to the continuous hype train that is semiconductor and market leader Nvidia. Best known for its high-performance semiconductors, Nvidia has been a Wall Street force since going public in January 1999. Founded in 1993 by CEO Jensen Huang, Nvidia personifies one of history’s most unlikely Wall Street stories.

Though the semiconductor industry is one of the most cutthroat industries on Wall Street, Zacks Rank #1 (Strong Buy) stock Nvidia (NVDA) found its niche in the space and has dramatically outperformed well-known competitors such as Advanced Micro Devices (AMD) and Intel (INTC).

Nvidia has recaptured investors’ attention more recently as it benefits from the robust growth of the artificial intelligence (AI) market. Driven by unquenchable growth from mega-cap tech companies like Microsoft (MSFT) and Tesla (TSLA), Nvidia has grown into one of the largest companies in the world by market cap and has seen its stock soar more than 3,000% over the past five years. NVDA is garnering the Street’s attention his week for its 10-for-1 stock split.

What is a Stock Split?

A stock split is a corporate action in which a company increases the number of shares for existing shareholders while decreasing the value of shares.

How Does a Stock Split Work?

To simplify the concept, investors can think of a stock split as swapping two nickels for a dime (representing a 2-for-1 split). In other words, if you have one share of a $100 stock pre-split, post-split you would hold two shares at a $50 value. Investors must understand that the market cap or value of the stock does not change. In Nvidia’s case, shareholders received ten shares for every share they held before the split date – a 10-for-1 split.

Conversely, a reverse split represents the opposite – the share price increases while the number of shares held by the investor decreases. Again, there is no immediate change in the stock’s value due to a stock split.

Why Does a Company Split its Stock?

Companies typically split their stocks to make shares more attractive to investors. For example, retail investors may prefer a lower-priced stock. Conversely, institutional investors may perceive penny stocks as low quality or be mandated not to invest in them.

Are Stock Splits Bullish?

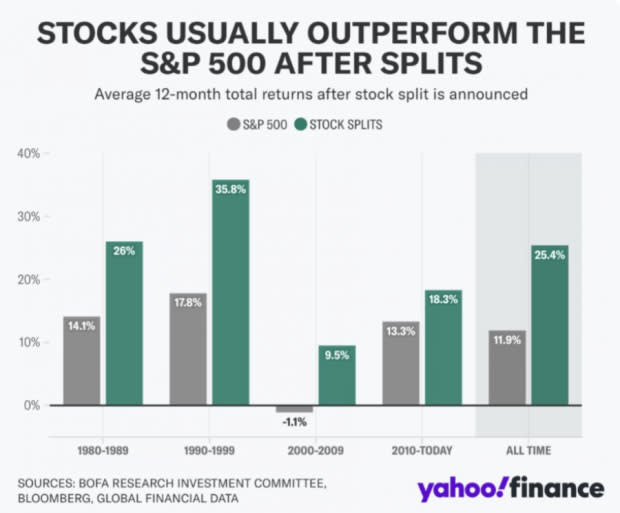

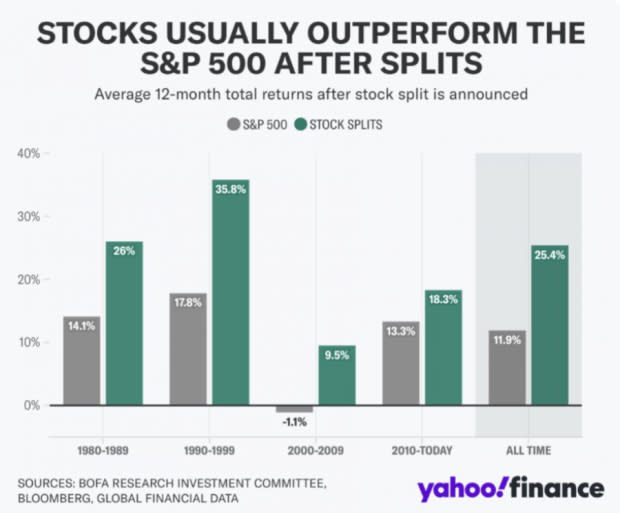

Like many things on Wall Street, stock splits should be weighed on a case-by-case basis by investors. Overall, historical stats indicate that stocks that split tend to outperform the S&P 500 Index over the next 12 months.

Image Source: BofA Research, Bloomberg

Excessive Splits: A Word of Caution

Excessive stock splits, or two or more stock splits in a year, may be a red flag for investors. A company that splits its stock too many times may be trying to compensate for deteriorating fundamentals or may simply be getting too greedy. Qualcomm (QCOM), one of the best-performing stocks of the late 1990s, split twice in 1999, with the last split occurring in December. The next month, QCOM stock value topped out, and it would not make fresh highs again for two decades.

Image Source: Zacks Investment Research

Stock Split: Factors to Consider

A stock split is just one factor investors need to consider. Investors should consider how far a stock has run pre-split and, as always, avoid chasing the stock if not already long. Fundamentals and future EPS expectations play a crucial role in determining the stock’s outlook. Finally, a stock split can add needed liquidity to an options market if the options became too expensive prior to the split.

Bottom Line

Stock splits are making headlines again after Nvidia split its stock on Monday. Investors should consider several factors when weighing the prospects of a recently split stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.