New venture to be backed by SoftBank.

Arm Holdings (ARM -3.43%) shares slipped after the company reported its fiscal 2024 fourth-quarter earnings results on May 8. However, the stock later rallied after reports came out that the company was set to develop its own artificial intelligence (AI) chips.

Let’s take a look at Arm’s most recent quarterly report (for the fiscal year ending March 31, 2024), long-term guidance, and how its plans to design its own AI chips could fuel growth.

Strong first-quarter results

Arm turned in strong Q4 results, with revenue jumping 47% year over year to $928 million. License revenue surged 60% to $414 million, while royalty revenue climbed 37% year over year to $514 million. License revenue was driven by more companies signing long-term license agreements as well as more companies choosing to use the company’s most advanced CPU (central processing units) technology to run AI applications.

The company added four additional Arm Total Access agreements, bringing the total to 31 customers. This is a newer program being offered by Arm whereby customers can pay an annual recurring subscription for the right to broad use of Arm’s intellectual property. The company said more than half of its 30 largest customers and now using this subscription. Meanwhile, 222 customers are now using its more limited Arm Flexible Access program designed for early-stage companies.

This is a nice new subscription model from Arm that looks to drive revenue growth. It also lets the company get more revenue upfront than waiting for customer designs to go into production.

Royalty revenue, meanwhile, was bolstered by the continued shift to Armv9-based chips, which carry a higher royalty rate versus older-generation Arm technology. This is being seen in several markets, including smartphones, where Arm has a dominant position, with its technology incorporated in about 99% of all global smartphones. Armv9 is also seeing increased adoption in cloud servers, automobiles, and Internet of Things (IoT). Armv9 now contributes about 20% of its royalty revenue, up from 15% a year ago.

Looking ahead, Arm forecasts fiscal year 2025 (ending March 31, 2025) revenue to come in between $3.8 billion to $4.1 billion, which would represent growth of between 18% to 27%. It is expecting adjusted EPS to come in between $1.45 to $1.65, up from $1.27 in fiscal 2024.

Looking further out, the company said it sees revenue growth of at least 20% for both fiscal year 2026 and 2027.

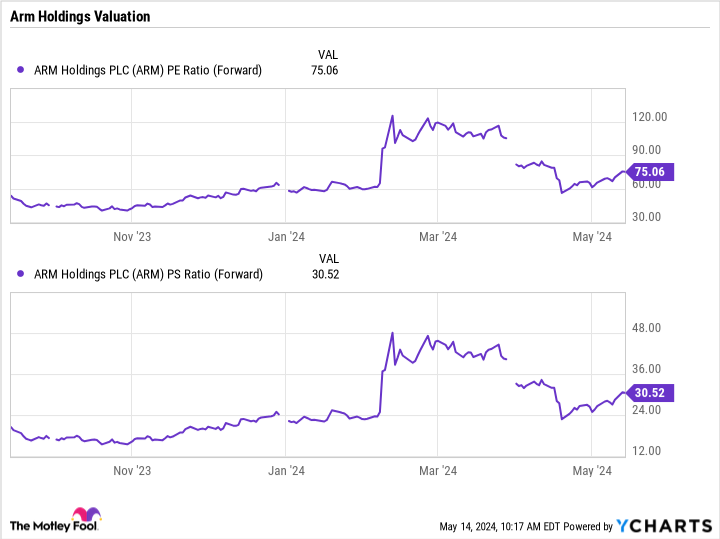

While Arm’s results were strong, expectations going into the quarter were also very high. This can be seen in the company’s valuation, as it trades at over 30 times the forward price to sales (P/S) and 75 times the forward P/E multiple. Arm has an attractive, high-margin, largely recurring business model, but those are some lofty valuation metrics nonetheless. When carrying high valuations, investors are often looking for results that are not just good but considerably better than forecasts as well.

ARM PE Ratio (Forward) data by YCharts

AI chip venture

While Arm shares sagged immediately following its earnings, shares quickly rebounded on later news that it was set to design its own AI chips. According to a report from Nikkei Asia, Arm will set up an AI chip division that will be partially funded by SoftBank (SFTBF 2.02%), which owns 90% of the company.

It is aiming to to have its first prototype by spring of next year with mass production in the fall of 2025. SoftBank is negotiating with Taiwan Semiconductor Manufacturing (NYSE: TSM) and other semiconductor fabrication companies to secure production capacity at their facilities. Most semiconductors today just design chips and outsource production to companies like TSMC.

The report added that once Arm reaches mass production with its AI chips, the division could be spun off into SoftBank. Softbank is planning to build out data centers across the world using its own chips.

Arm has been making strides in AI data center applications as Nvidia (NASDAQ: NVDA) has started to make superchips that combine its GPUs (graphic processing units) with Arm-based CPUs. While its new AI chip venture could increase competition between the two chip giants, it does look like it will already have a large built-in customer with SoftBank.

Image source: Getty Images.

Is it time to buy Arm stock?

As discussed above, Arm’s stock is not cheap. It’s also controlled by SoftBank, so there could be some conflicts of interest between what is best for Arm shareholders and SoftBank. The latter is looking to make a big bet on AI and plans on using Arm as a launching point for its AI chip and data center ambitions.

While this could be good for the company, it is getting a bit out of the company’s purview. It could be better for the company to stay in its lane and work on its partnership with Nvidia, which is currently the leader in the GPU space and is powering AI data center applications. With Arm architecture being incorporated into Nvidia superchips, now might not be the time to compete against the clear AI chip leader in the space.

Given its valuation and this consideration, I’d keep any positions in Arm on the smaller side at the moment. The semiconductor stock still has a lot of long-term potential, but there are also risks involved if it starts to compete with some of its large customers.