(Bloomberg) — Arm Holdings Plc’s legal dispute with Qualcomm Inc. is being argued before a federal jury in Delaware this week, pitting two of the world’s most influential chipmakers against each other in an intellectual property case that threatens to roil the technology industry.

Most Read from Bloomberg

Qualcomm is one of Arm’s biggest customers and a longtime partner, but they’ve grown increasingly at odds. At the heart of this legal fight is Qualcomm’s 2021 acquisition of chip startup Nuvia and a licensing agreement to use Arm’s technology.

Arm claims the agreement it had with Nuvia had to be renegotiated after Qualcomm bought the company, and it demanded Qualcomm destroy the chip designs gained from the acquisition. Qualcomm, which is counting on Nuvia products to push into the market for computer processors, argued it already had a separate licensing contract for Arm technology that covers its work.

The dispute has riveted the chip industry. Many of the world’s biggest tech companies rely on technology licensed from Arm and Qualcomm to make products, so the weeklong trial could have far-reaching implications.

“The fact is we have someone using our unlicensed technology,” Arm Chief Executive Officer Rene Haas said told jurors Monday during the first day of court testimony. “Arm is an intellectual-property company and we have to protect our inventions.”

Qualcomm lawyer Karen Dunn defended the company during her opening arguments. She said Qualcomm had its own license to use Arm technology, and that it had always made it a practice to “respect contracts.” Internal files at Arm will show during the trial that executives there acknowledged Qualcomm’s licensing contract was “bombproof,” she told jurors.

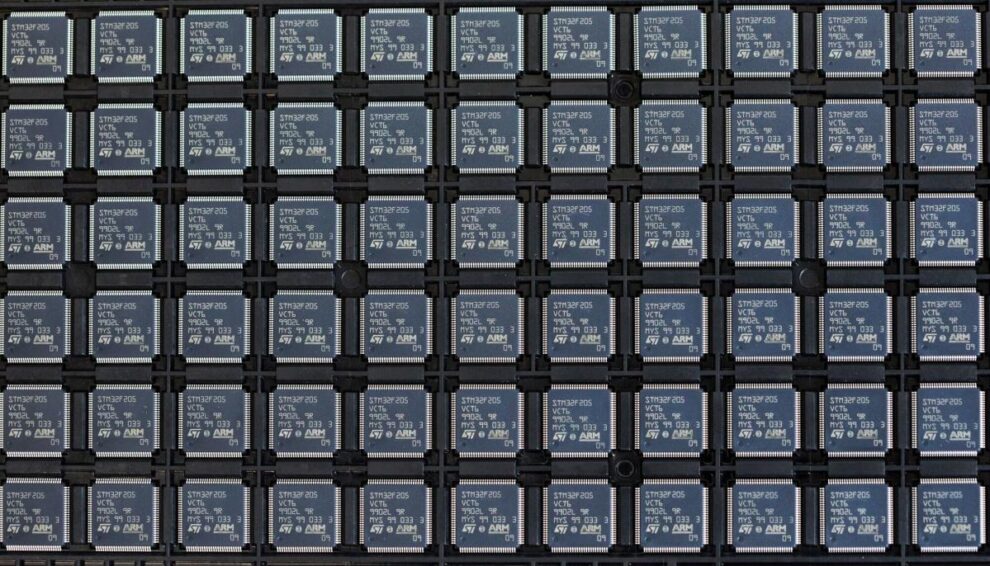

UK-based Arm, which is majority-owned by Japan’s SoftBank Group Corp., sells chip designs and licenses a so-called instruction set — code used by software to communicate with processors.

Arm says it negotiates contract terms for use of its technology with companies on an individual basis. Startups like Nuvia typically get less burdensome financial terms than established businesses such as Qualcomm, which argues that its own license is broad enough to cover the intellectual property in question.

Arm moved to cancel Qualcomm’s license this year, saying the US company never renegotiated terms after the Nuvia acquisition. Qualcomm countered that it hasn’t done anything wrong and that Arm is trying to unfairly bully it into paying more.

Both companies declined to comment before the trial.

Besides the dispute over the license – worth an estimated $1.5 billion – the case highlights the growing rivalry between two companies that previously had been tightly aligned. Qualcomm is the biggest chip supplier to the mobile-phone market. Arm’s technology is incorporated into most of those chips.

CEOs to Testify

Arm — under Chief Executive Officer Rene Haas — wants to become more of a chip supplier and less of a technology provider. But that makes it more of a rival to Qualcomm, which wants to differentiate its technology and cut reliance on Arm’s designs.

“They wanted to take the code, but they didn’t want to pay for it,” Arm lawyer Daralyn Durie told jurors during opening arguments.

Qualcomm, based in San Diego, acquired Nuvia to buttress its technology and offer more powerful chips tailored to high-end applications. It’s part of Qualcomm CEO Cristiano Amon’s plan to expand beyond the smartphone industry and grab a share of the laptop-chip market.

Amon and Haas are slated to testify in the trial.

This isn’t the first time Qualcomm has tussled with Arm. In 2020, Nvidia Corp. threw the companies into conflict when it announced plans for a $40 billion takeover of Arm. The deal sparked backlash from a variety of semiconductor firms and was ultimately abandoned in the face of regulatory opposition in the US, China and Europe.

Among the opponents was Qualcomm, which complained to regulators around the world that Nvidia would prioritize its own use of Arm’s technology, or even cut off access to its competitors entirely. While Nvidia said such concerns were baseless and promised to maintain open access to Arm designs, those arguments ultimately won the day with regulators.

Flex Its Power

Arm’s move to cut off Qualcomm’s existing license is seen by the San Diego chipmaker as a way for the British company to flex its power over chip designs that are critical for much of the industry.

Bloomberg Intelligence’s Tamlin Bason and Kunjan Sobhani have predicted the companies will settle the case before the jury reaches a verdict, with Qualcomm paying a higher licensing fee to access Arm’s technology.

Yet when it comes to court fights, Qualcomm has a strong track record in computer-chip patent litigation. In 2019, it managed to secure a favorable settlement in a two-year licensing fight with Apple Inc.

The Arm case is being heard in Delaware because Qualcomm is incorporated in the state — home to almost 70% of Fortune 500 companies. Delaware’s federal court also is a US hub of patent-infringement and licensing litigation. In 2021, that court was the country’s second-busiest patent forum, behind a federal court in west Texas.

The case is Arm v. Qualcomm, 22-cv-01146, US District Court, District of Delaware (Wilmington).

(Updates with testimony from Arm CEO.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.