Asian markets advanced in early trading Tuesday, after Wall Street hit new records and ahead of the U.S. Federal Reserve meeting.

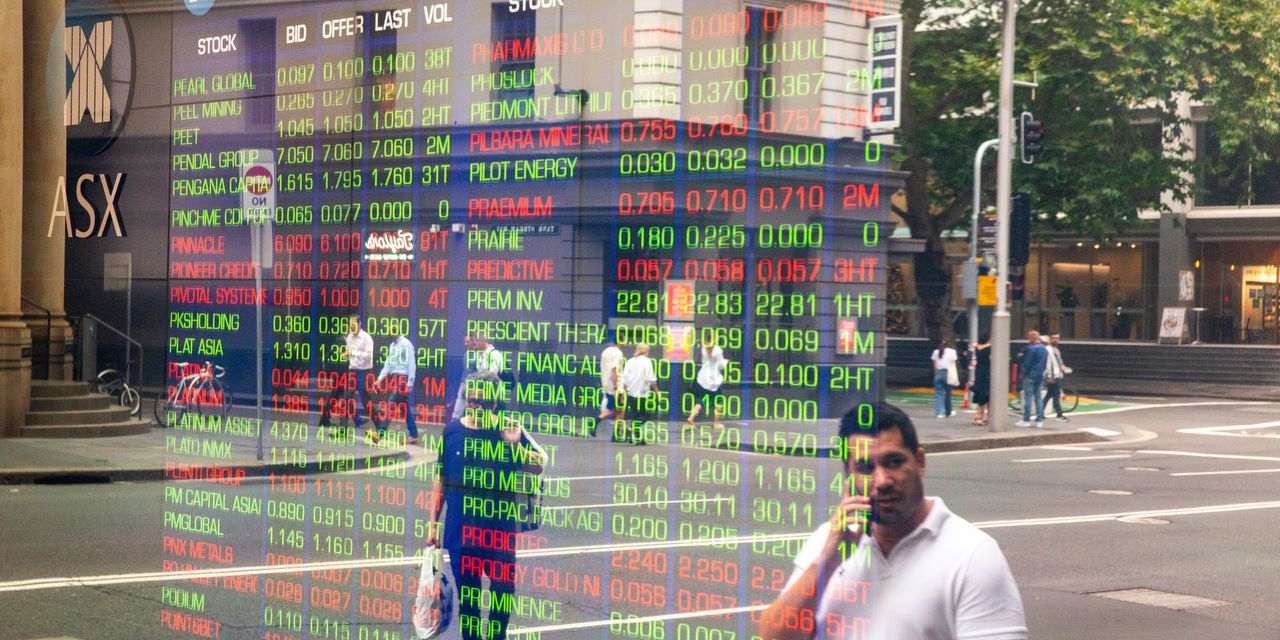

Japan’s Nikkei 225 NIK, +0.52% rose 0.6% and Hong Kong’s Hang Seng index HSI, +0.67% gained 0.5%. The Shanghai Composite SHCOMP, +0.78% inched 0.2% and the smaller-cap Shenzhen Composite 399106, +1.08% advanced 0.4%. South Korea’s Kospi 180721, +0.70% rose 0.5%. Australia’s S&P/ASX 200 XJO, +0.80% jumped 1.3%, powered by bank stocks such as Commonwealth Bank CBA, +0.90% and ANZ ANZ, +0.56%. Stocks dipped in Singapore STI, -0.12% after the government found uncertain labor market conditions, but benchmark indexes gained in Taiwan Y9999, +0.39% and Indonesia JAKIDX, -0.23%.

“The $1.9 [trillion] stimulus package in the U.S. will lead to a stronger U.S. and global recovery, hence more exports for China, which continues to resonate through Asia risk sentiment as the global synchronized growth story looks more in sync than only one week ago,” Stephen Innes, chief global markets strategist at Axi, wrote in a note.

The Dow Jones Industrial Average DJIA, +0.53% and S&P 500 SPX, +0.65% each hit new highs Monday, while the Nasdaq Composite COMP, +1.05% rose more than 1% as investors welcomed the stimulus package signed last week by President Joe Biden and shook off six weeks of rising Treasury yields.

Fed Chairman Jerome Powell is expected to speak Wednesday after the Fed’s two-day meeting, with investors expecting an update on the Fed’s assessment of the economy.

Benchmark U.S. crude CLJ21, -1.09% dipped to $64.86 per barrel in electronic trading on the New York Mercantile Exchange. Brent crude BRNK21, -1.03%, the international standard for pricing, slipped to $68.30 per barrel.

The U.S. dollar USDJPY, +0.11% was little changed at 109.17 Japanese yen.