Asian markets were mixed in early trading Friday, with stocks in Hong Kong and mainland China retreating amid ongoing trade tensions with the U.S.

An executive order by the Trump administration, aimed at banning Huawei equipment from U.S. networks, took effect on Thursday. The order also subjects the Chinese telecommunications giant to strict export controls. China has threatened to retaliate. It remains to be seen how the move will affect trade negotiations.

On Thursday, China’s Commerce Ministry said it had no knowledge of a resumption in trade talks, according to the Wall Street Journal, contradicting U.S. Treasury Secretary Steve Mnuchin, who said Wednesday that negotiations were likely to resume in Beijing “in the near future.”

A spokesman for the Commerce Ministry said this week’s escalation of tariffs on Chinese goods has “severely hampered” negotiations, the Journal reported.

Hong Kong’s Hang Seng Index HSI, -0.77% slipped 0.9%, and the Shanghai Composite SHCOMP, -1.46% fell 1.6%. Japan’s Nikkei NIK, +1.05% rose 1.6%, and South Korea’s Kospi SEU, +0.12% gained 0.3%. Taiwan’s Taiex Y9999, -0.50% gave up early gains, and stocks declined in Singapore STI, -0.74% and Indonesia JAKIDX, -1.42% . Australia’s S&P/ASX 200 XJO, +0.68% advanced 0.8%.

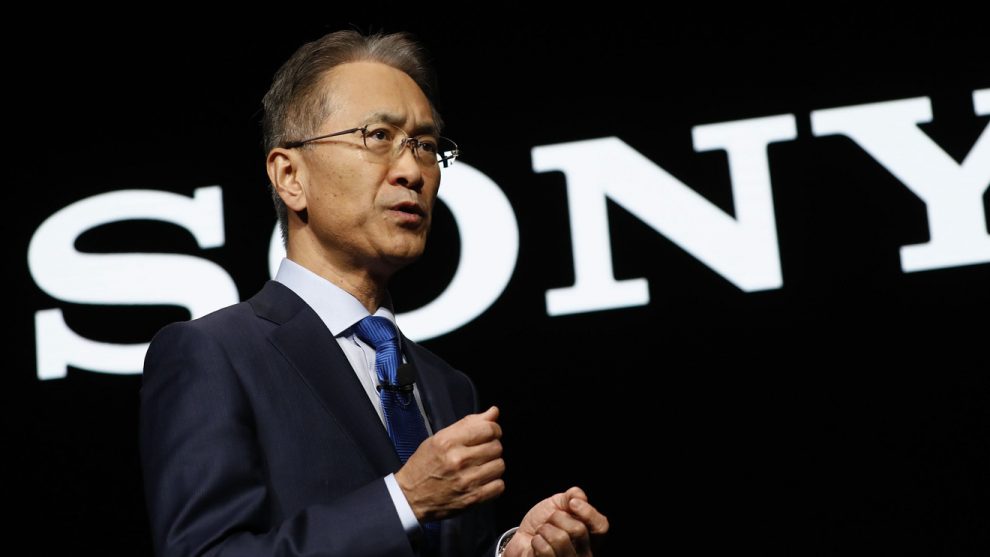

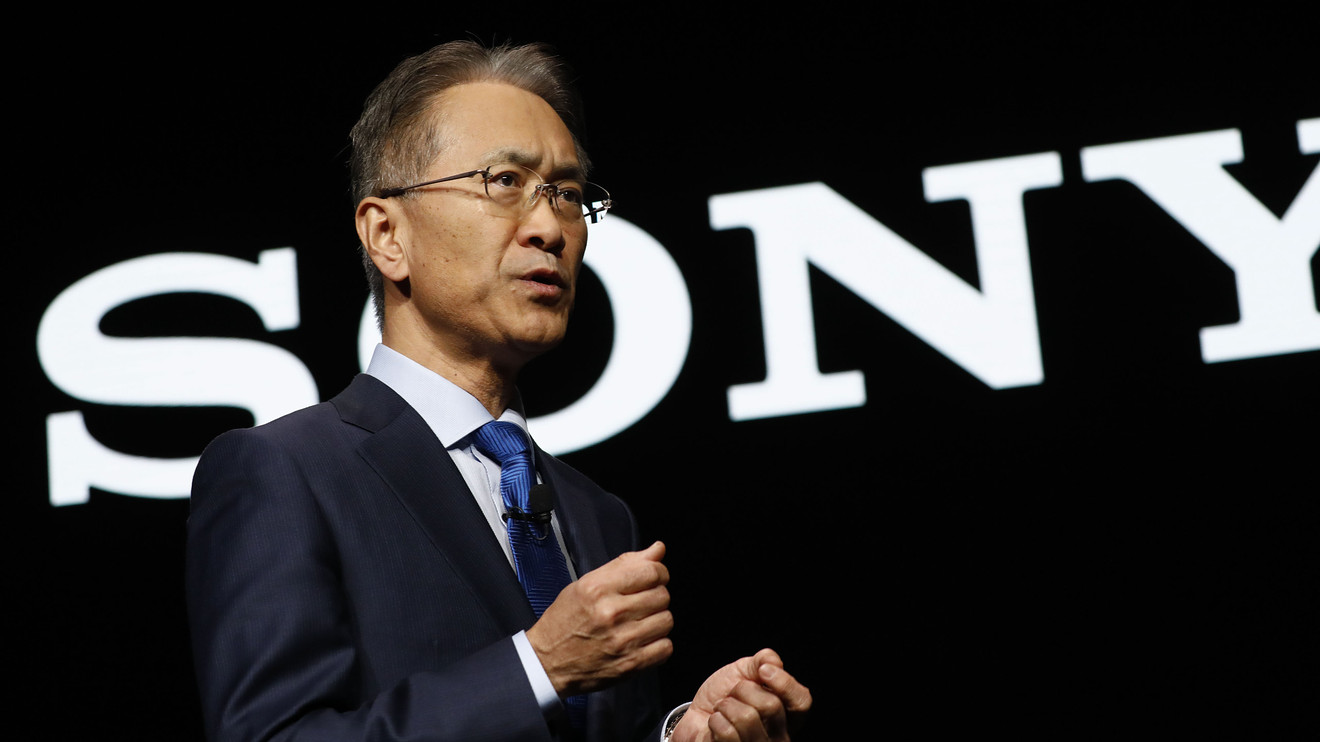

Among individual stocks, Sony 6758, +10.80% surged in Tokyo trading after announcing it would buy back $1.83 billion of its own stock. Earlier in the day, Sony also announced a partnership with Microsoft MSFT, +2.31% for artificial intelligence and direct-to-consumer entertainment. SoftBank Group 9984, +3.13% and Honda 7267, +1.00% also rose. In Hong Kong, China Mobile 0941, +1.47% gained while Sunny Optical 2382, -9.23% and food processor WH Group 0288, -3.33% declined. Chip maker SK Hynix 000660, +0.70% advanced in South Korea. In Australia, Rio Tinto RIO, +2.11% and Beach Energy BPT, +1.46% rose.

Some investors took cues from Wall Street, which closed higher for the third straight day, led by strong performances from technology companies and banks.

The broad S&P 500 index SPX, +0.89% climbed 0.9% to 2,876.32 on Thursday. The Dow Jones Industrial Average DJIA, +0.84% rose 0.8% to 25,862.68 and the Nasdaq composite COMP, +0.97% rebounded 1% to 7,898.05.

“The street appears to have temporarily given up trying to predict the fluid situation that is U.S.-China trade relations and concentrate on the here and now,” Jeffrey Halley of OANDA said in a commentary.

“The march higher will be tentative at best though with sentiment both incredibly cautious and fragile,” he added.

Benchmark U.S. crude CLM9, +0.37% gained 45 cents to $63.32 a barrel in electronic trading on the New York Mercantile Exchange. It picked up 85 cents to $62.87 per barrel on Thursday. Brent crude LCON9, +0.26% , the international standard, added 39 cents to $73.01 per barrel.

The dollar USDJPY, -0.11% edged up to 109.86 Japanese yen from 109.85 yen late Thursday.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.