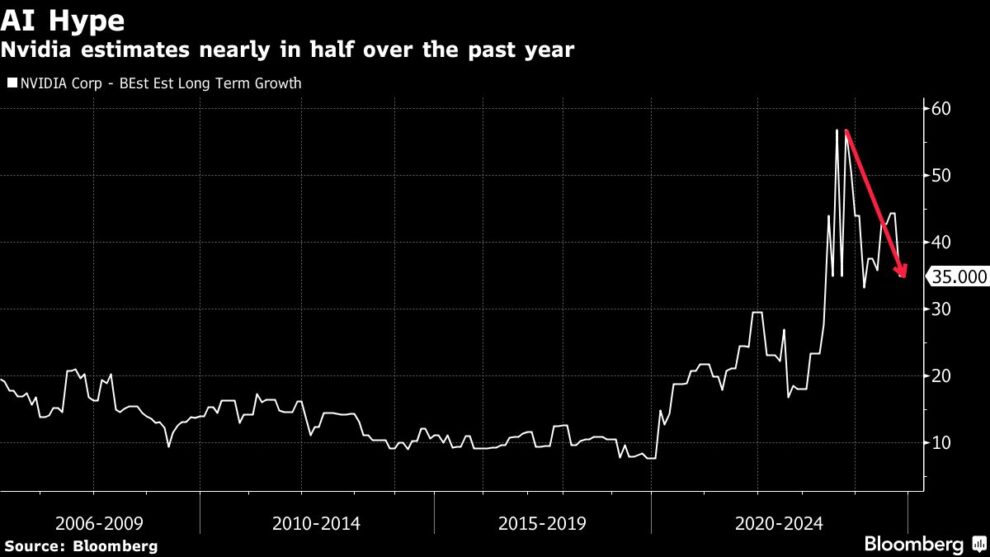

(Bloomberg) — Asian equities declined in Thursday trading, reflecting a muted mood on Wall Street triggered by Nvidia Corp.’s lackluster revenue forecast. Bitcoin set a fresh record.

Most Read from Bloomberg

Shares in Japan, China, Hong Kong and Taiwan fell. Contracts for US benchmarks continued to decline Thursday in Asian trading after Nvidia reported third-quarter revenue and earnings that met estimates but fell short of the highest estimates for future revenue.

Nvidia’s earnings outlook may ripple across its suppliers and global markets, given the company’s size and role in the artificial intelligence boom. Traders will also assess any fallout from a US indictment of Gautam Adani and await President-elect Donald Trump’s nominee for the Treasury secretary.

A gauge of Asia’s semiconductor stocks slid as much as 1%. Dollar-denominated notes issued by the Adani Group fell as much as 10 cents on the dollar Thursday after the US indictment. Adani Group’s renewable units scrapped a $600 million bond offering after the charges.

Treasury yields slipped after edging higher earlier Thursday after yields rose across the curve in the prior session, partly reflecting lukewarm demand in a 20-year US government debt auction. An index of the dollar edged down after gaining Wednesday amid geopolitical tensions. Ukraine used British cruise missiles against Russian targets for the first time during the conflict.

“I have a feeling we’ve reached peak Nvidia,” Amy Xie Patrick, head of income strategies for Pendal Group, said on Bloomberg Television. “This is a stock that beat analyst estimates but didn’t beat enough.”

Shares of Taiwan Semiconductor Manufacturing Co. fell as much as 1.5% at the opening.

US prosecutors charged Adani, one of the world’s richest people, with participating in a scheme that involved promising to pay more than $250 million in bribes to Indian government officials to secure solar energy contracts. Prosecutors in Brooklyn, New York, alleged on Wednesday that Adani and other defendants lied about the plan as they sought to raise money from US investors.

Data set for release in Asia includes the current account balance for Indonesia and inflation in Hong Kong. Turkey will deliver an interest rate decision.

Elsewhere, Japan’s largest labor union chief is calling for Prime Minister Shigeru Ishiba’s government to accelerate efforts to boost wages.

Bitcoin set another all-time high, supported by a series of developments highlighting the deepening embrace of the digital-asset industry in the US under crypto cheerleader Trump. The world’s largest cryptocurrency is fast approaching $100,000, helped along by MicroStrategy Inc.’s massive purchases.

More Cuts

Federal Reserve Bank of Boston President Susan Collins said more interest-rate cuts are needed, but policymakers should proceed carefully to avoid moving too quickly or too slowly. Swaps market pricing indicated a less than 50% chance the Fed will cut rates again in December.

Traders are also monitoring Trump’s administration picks, especially his selection for the Treasury secretary role. Former Federal Reserve Governor Kevin Warsh and Apollo Global Management’s Marc Rowan are contenders, according to people familiar with the matter. Meanwhile, Trump tapped Cantor Fitzgerald LP Chief Executive Officer Howard Lutnick to lead the Commerce Department, a key role to facilitate his tariff and trade policies.

“As I look at the Treasury secretary race, I want to see exactly who is in that role because the tax policies, the debt limit all come back,” Ed Mills, Washington policy analyst at Raymond James, told Bloomberg Television. “We need to see exactly how that person has a relationship with the Federal Reserve, because monetary policy will quickly figure into all of this.”

Gold was up early Thursday, notching its fourth daily advance. Oil prices also climbed after retreating Wednesday.

Key events this week:

-

Eurozone consumer confidence, Thursday

-

US existing home sales, initial jobless claims, Philadelphia Fed factory index, Thursday

-

Eurozone HCOB Manufacturing & Services PMI, Friday

-

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 10:12 a.m. Tokyo time

-

Hang Seng futures fell 0.5%

-

Japan’s Topix fell 0.2%

-

Australia’s S&P/ASX 200 was little changed

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0547

-

The Japanese yen rose 0.3% to 154.93 per dollar

-

The offshore yuan was little changed at 7.2494 per dollar

Cryptocurrencies

-

Bitcoin rose 0.4% to $94,804.14

-

Ether rose 0.1% to $3,083.63

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.40%

-

Japan’s 10-year yield advanced 1.5 basis points to 1.080%

-

Australia’s 10-year yield advanced two basis points to 4.58%

Commodities

-

West Texas Intermediate crude rose 0.4% to $69.03 a barrel

-

Spot gold rose 0.2% to $2,655.93 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.