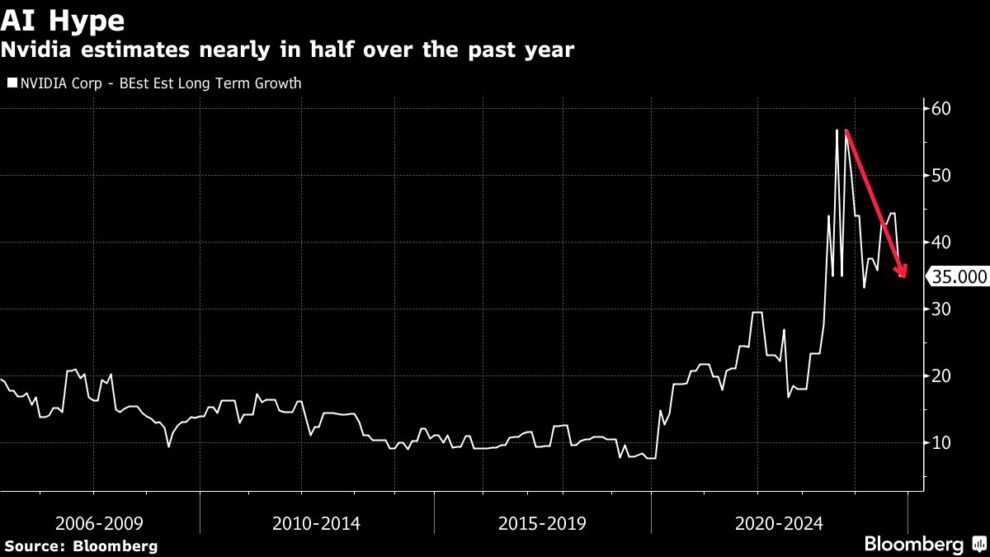

(Bloomberg) — Asian equities slipped, reflecting macroeconomic concerns and a muted mood on Wall Street triggered by Nvidia Corp.’s lackluster revenue forecast.

Most Read from Bloomberg

A gauge of Asian equities edged down 0.3%, with the region’s tech heavyweights among the biggest drags. Contracts for US benchmarks dipped Thursday after Nvidia’s third-quarter results fell short of the highest estimates for future revenue. Indian benchmarks underperformed as US indictment of Gautam Adani over an alleged bribery plot led to a tumble in the group’s shares.

Nvidia’s earnings outlook rippled across its suppliers and global markets, given the company’s size and role in the artificial intelligence boom. Geopolitical tensions also loomed over markets after Ukraine fired British cruise missiles at military targets inside Russia for the first time.

“Stellar results from Nvidia still couldn’t meet market’s lofty expectations,” said Charu Chanana, chief investment strategist at Saxo Markets. “Asian stocks are also facing a wave of risk-off as Russia-Ukraine escalation risks remain on the radar.”

Shares of India’s Adani Group units fell in Mumbai and the conglomerate scrapped a $600 million dollar bond sale after US prosecutors’ charges. The group’s existing US-currency notes plunged. US prosecutors charged Adani, one of the world’s richest people, with participating in a scheme that involved promising to pay more than $250 million in bribes to Indian government officials to secure solar energy contracts.

Bitcoin set a fresh record, hitting $97,000 for the first time, as President-elect Donald Trump’s team is holding discussions over whether to create a new White House post dedicated to cryptocurrency policy.

Shares of Taiwan Semiconductor Manufacturing Co. fell as much as 1.5%. Korea’s SK Hynix, a supplier of Nvidia, sank as much as 1.4% in Seoul.

Elsewhere in Asia, Starbucks Corp. is exploring options for its Chinese operations including the possibility of selling a stake in the business.

Read: Asian Stocks More Vulnerable to Outflows Than Trump’s First Term

Japanese Prime Minister Shigeru Ishiba is set to unveil a $140 billion economic stimulus package to address a range of challenges from inflation to wage growth.

Treasury yields slipped Thursday after rising across the curve in the prior session, partly reflecting lukewarm demand in a 20-year US government debt auction.

An index of the dollar edged down after gaining Wednesday.

“Following the US election, there’s been a clear shift in macro environment,” Goldman Sachs Chief APAC Regional Equity Strategist Timothy Moe said in a Bloomberg TV interview. “A stronger dollar tends to be more headwinds for Asian equities.”

More Cuts

Federal Reserve Bank of Boston President Susan Collins said more interest-rate cuts are needed, but policymakers should proceed carefully to avoid moving too quickly or too slowly. Swaps market pricing indicated a less than 50% chance the Fed will cut rates again in December.

Traders are also monitoring Trump’s administration picks, especially his selection for the Treasury secretary role. Former Federal Reserve Governor Kevin Warsh and Apollo Global Management’s Marc Rowan are contenders, according to people familiar with the matter.

“As I look at the Treasury secretary race, I want to see exactly who is in that role because the tax policies, the debt limit all come back,” Ed Mills, Washington policy analyst at Raymond James, told Bloomberg Television. “We need to see exactly how that person has a relationship with the Federal Reserve, because monetary policy will quickly figure into all of this.”

Gold was up Thursday, notching its fourth daily advance. Oil steadied as the market monitored developments in Ukraine and the Middle East after US crude stockpiles rose for a third week.

Key events this week:

-

Eurozone consumer confidence, Thursday

-

US existing home sales, initial jobless claims, Philadelphia Fed factory index, Thursday

-

Eurozone HCOB Manufacturing & Services PMI, Friday

-

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 2:25 p.m. Tokyo time

-

Nikkei 225 futures (OSE) fell 0.8%

-

S&P/ASX 200 futures fell 0.2%

-

Japan’s Topix fell 0.3%

-

Hong Kong’s Hang Seng fell 0.1%

-

The Shanghai Composite rose 0.1%

-

Euro Stoxx 50 futures rose 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0550

-

The Japanese yen rose 0.2% to 155.08 per dollar

-

The offshore yuan was little changed at 7.2485 per dollar

-

The Australian dollar rose 0.2% to $0.6517

Cryptocurrencies

-

Bitcoin rose 3.4% to $97,648.29

-

Ether rose 1.5% to $3,127.93

Bonds

Commodities

-

West Texas Intermediate crude rose 0.4% to $69.03 a barrel

-

Spot gold rose 0.2% to $2,656.02 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.