(Bloomberg) — Asian stocks are set for a listless day following a cautious session on Wall Street as traders keenly await Wednesday’s earnings from Nvidia Corp., the chipmaker at the heart of the artificial-intelligence frenzy that’s powered the bull market.

Most Read from Bloomberg

Futures pointed to gains for Japanese stocks, losses in Hong Kong and a slight dip in Australia. The S&P 500 closed up 0.1% around 5,308, near all-time highs. Nvidia — — the last of the so-called Magnificent Seven companies to report earnings this season — rallied on a bullish analyst call. Investors are waiting for evidence that the numbers will renew confidence in the insatiable demand for its chips. US futures were steady in early Asia trading.

“For the market to keep momentum this week, it may come down to just one stock – Nvidia,” said Jay Woods at Freedom Capital Markets. “Well, that’s not exactly true, but it sure feels like the hype for this earnings event will be the talk of trading desks and financial media all week.”

Ether led a surge in digital assets on speculation that opposition is easing to an exchange-traded fund tracking the second-biggest cryptocurrency. JPMorgan Chase & Co. slid as Jamie Dimon said the bank won’t buy back much stock at “these prices.”

Another raft of Federal Reserve speakers only reiterated the wait-and-see approach on rates. Treasuries edged lower at the start of a busy week for investment-grade issuance as firms rush to sell bonds ahead of the US holiday weekend. Ten-year yields rose two basis points to 4.44%. Australia’s equivalent also climbed in early trading Tuesday.

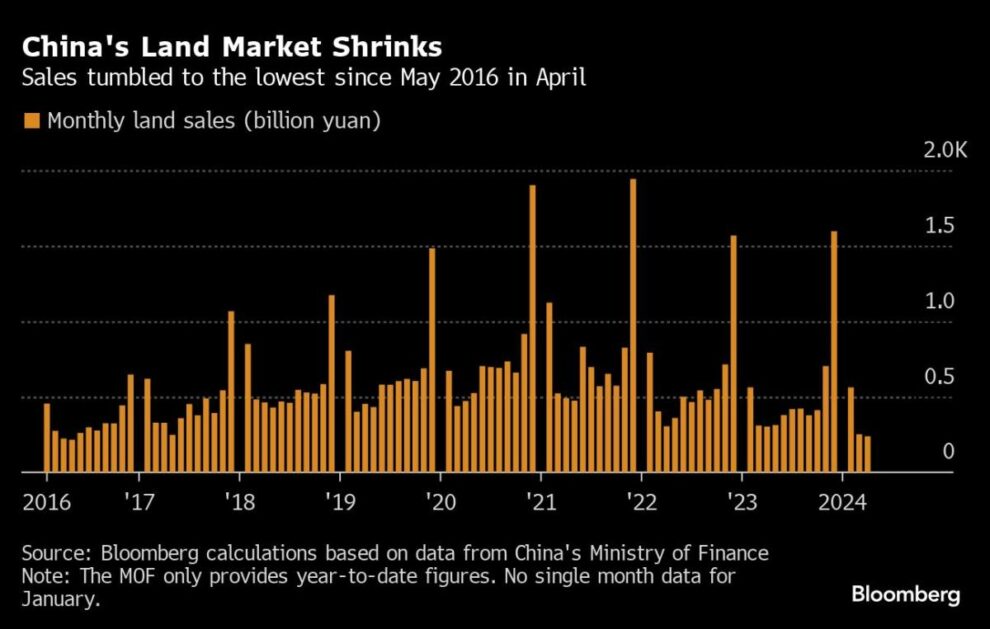

In Asia, China’s economic struggles remain in the spotlight, with fresh data showing there’s little sign of a turnaround in its debt-plagued property sector. Local governments reaped the least revenue in eight years through land sales last month, showing the fiscal strains faced by those authorities who depend on such revenue for a large chunk of their total income.

On Monday, Japan’s benchmark government bond yield climbed to the highest since 2013 on bets the central bank will further raise interest rates to support the struggling yen. The yield on 10-year government debt rose 2.5 basis points to 0.975%.

Meanwhile, the S&P 500 has set multiple records in 2024 as US stocks have been on a $12 trillion rally since late October. One part of that is hopes for a soft landing with the economy staying moderately strong while inflation cools, which is spurring bets the Fed will cut rates this year.

Another part is enthusiasm for AI technology. Chip giant Nvidia on its own is responsible for about one-fourth of the gains in S&P 500. And together with Microsoft Corp., Amazon.com Inc., Meta Platforms Inc. and Google’s parent Alphabet Inc., roughly 53% of the benchmark’s rise is coming from just five stocks.

“Not since the likes of Cisco in the late ‘90s can we remember a single stock having such an enormous influence on the outlook for the market as a whole,” said Jason Trennert at Strategas Securities. “Nvidia’s earnings announcement last May made even the most-skeptical investors on the future of AI take notice.”

Morgan Stanley’s Michael Wilson now sees the S&P 500 rising 2% by June 2025, a major about turn from his view that the benchmark will tumble 15% by December. The strategist — whose bearish 2023 outlook failed to materialize as markets kept rallying — finally gave in and boosted his target for the S&P 500 to 5,400 points from 4,500.

Elsewhere, commodities traders will be looking to see if the rallies that saw both copper and gold surge to all-time highs on Monday can be maintained. Brent hovered near $84 a barrel after posting its first weekly advance this month, while West Texas Intermediate settled near $80.

Key events this week:

-

Fed’s Thomas Barkin, Christopher Waller, John Williams, Raphael Bostic, Susan Collins, Loretta Mester speak, Tuesday

-

US existing home sales, Wednesday

-

Fed minutes, Wednesday

-

Nvidia earnings, Wednesday

-

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, consumer confidence, Thursday

-

G-7 finance meeting in Stresa, Italy, May 23-25

-

US new home sales, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

US durable goods, University of Michigan consumer sentiment, Friday

-

Fed’s Christopher Waller speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 rose 0.1%; futures were flat as of 8:24 a.m. Tokyo time

-

Hang Seng futures fell 0.7%

-

S&P/ASX 200 futures fell 0.1%

-

Nikkei 225 futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0861

-

The Japanese yen was little changed at 156.27 per dollar

-

The offshore yuan was little changed at 7.2458 per dollar

Cryptocurrencies

-

Bitcoin rose 2.1% to $70,970.7

-

Ether rose 4.6% to $3,662.98

Bonds

Commodities

-

Spot gold rose 0.1% to $2,427.93 an ounce

-

West Texas Intermediate Crude fell 0.2% to $79.65 a barrel

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.