(Bloomberg) — The chief of Australia’s sovereign wealth fund said monetary policymakers and investors are facing a tough task navigating turbulent inflation.

Most Read from Bloomberg

While inflation “is subsiding in much of the developed world,” it remains “higher and more volatile than investors have been used to,” Future Fund Chief Executive Officer Raphael Arndt said in a portfolio update Friday. It returned 11.9% in the 12 months to Sept. 30, taking the fund’s assets under management to A$230 billion ($151 billion).

Subscribe to The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you listen.

“Central banks around the world are in an easing cycle which is positive for risk assets,” Arndt said. “However, the path to lower rates will not be straightforward as continued geopolitical risks and big economic drivers including defence spending, the energy transition and deglobalization are all inflationary.”

In the US, the Federal Reserve is widely expected to hand down a quarter-point interest-rate cut at its meeting next week, after a half-point reduction in September. Elsewhere, the Bank of Japan kept its benchmark interest rate unchanged Thursday, while in Australia, market expectations of a borrowing cost reduction have been pushed further into 2025 amid persistent inflation.

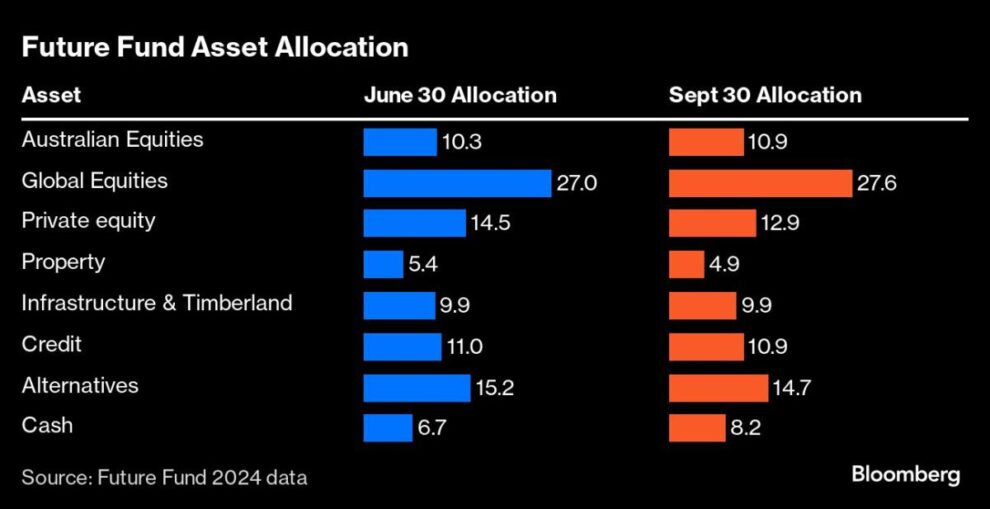

The Future Fund’s cash allocation rose to 8.2% in the September quarter, compared with 6.7% as at June 30. It has about 38.5% of its portfolio in local and global equities. It now has a lower allocation to private equity.

Arndt said the strong result in the year to Sept. 30 was partly due to the rally in equities. “The Future Fund benefited from this and also experienced positive contributions from its alternatives, credit and infrastructure holdings,” he said.

“We have continued to pursue investments that provide greater exposure to the local currency and protection against higher inflation,” Arndt said. “The portfolio is positioned toward the middle of its risk settings.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.