The U.S. box office is gearing up for a record weekend, with the release of “Avengers: Endgame” expected to chalk up $275 million in box-office receipts and provide the next catalyst for shares of Walt Disney Co.

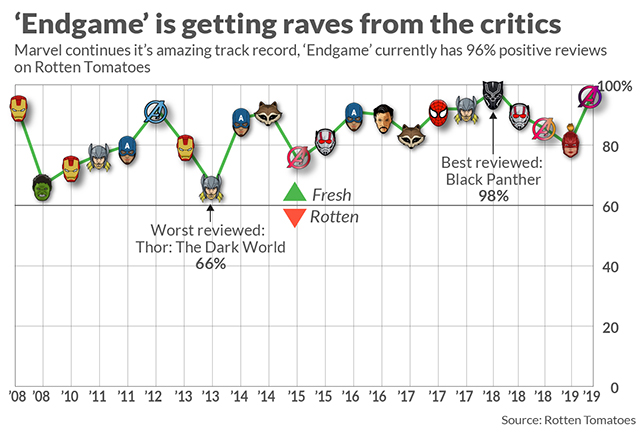

Analysts are expecting the three-hour film to dominate the box office, buoyed by stellar reviews — it has a 96% Rotten Tomatoes score — and to mark an industry inflection point for both the second quarter and the full year. Only “Black Panther” has a higher Rotten Tomatoes score, at 97%.

The box office is down 18% through April 23 versus the year-earlier period, but it could still grow 3% for the quarter, according to MKM analyst Eric Handler.

“Although the film is 30 minutes longer than last year’s “Avengers: Infinity War,” it will likely account for more than 50% of all the industry’s screens during the weekend and in a number of cases will be running for 72 straight hours,” he wrote in a note to clients.

Cinema chain AMC Entertainment Holding Inc. AMC, +0.65% said earlier that the film has already set a record for Thursday-night box office, a fact confirmed by Disney DIS, +1.95% . The record has shattered AMC’s previous record for single-movie screenings over a weekend, and the film will have 10,000 more showtimes than the previous record weekend, held by the opening of “Avengers: Infinity War” in 2018.

“We have set aside approximately 10 million seats and 58,000 showtimes for this historic event,” said AMC CEO Adam Aron, according to a company statement.

Don’t miss: A urologist shares how to watch the 3-hour ‘Avengers: Endgame’ without a bathroom break

Related: Googling ‘Thanos’ reveals amazing ‘Avengers: Endgame’ Easter egg

Disney said Thursday previews chalked up $60 million in receipts, topping the previous record of $57 million set by “Star Wars: The Force Awakens.” Internationally, the film has earned $305 million in its first two days, setting records in China, Hong Kong, Taiwan, Thailand, Australia, New Zealand, the Philippines, South Korea, the U.K., Brazil, Egypt, Panama, Peru, Colombia, Argentina, Chile, Bolivia, Paraguay, Trinidad and Uruguay, according to a Disney spokesman.

It also registered the biggest-ever opening day in Indonesia, Malaysia, the Netherlands, Greece, Portugal, Bosnia-Herzegovina, the Czech Republic, Serbia, Slovakia, Turkey and Ukraine, he said.

See: Some tickets to ‘Avengers: Endgame’ are selling for $500 online

IMAX Corp. IMAX, -2.44% said the film delivered its biggest-ever opening in China, generating $21 million at the box office and helping it to its second strongest quarterly performance in China of $106 million.

“IMAX’s global box office should also receive a substantial jolt this weekend from Avengers: Endgame,” said Handler. “We estimate ‘Endgame’ could garner more than $50 [million] from IMAX’s worldwide circuit. Domestically, we look for the title to contribute $23 [million]–$24 [million] with a market share of approximately 8.5%.”

At Benchmark, analyst Mike Hickey is also expecting the film to lead IMAX to a record above the existing $47 million. “We expect the continued rollout of movie subscription plans similar to the AMC AList program, could drive incremental attendance and EBITDA for IMAX.

For Disney, the latest installment of the Marvel franchise is expected to boost its stock, coming at a time of major change for the entertainment giant. In March, Disney completed the $71 billion acquisition of film and select TV assets held by 21st Century Fox FOXA, +0.87% , giving it control of Fox’s movie and TV production studios, its FX cable networks, the Fox Searchlight label and National Geographic properties.

See: How the Disney-Netflix streaming war will create collateral damage

The deal has propelled Disney to the top of the Hollywood food chain, expanding on its existing network of films, toys and theme parks.

The next step is the November launch of a $6.99-a-month streaming service, which brings it into direct competition with streaming pioneer Netflix Inc. NFLX, +1.77% . While Netflix executives appear unfazed by their new rival, analysts are expecting Disney to offer formidable competition given its backlog of family-friend films, TV shows and franchises, not to mention sporting events through ESPN.

Analysts came away from an investor day with Disney earlier this month upbeat on the near-term outlook.

David Miller at Imperial Capital is expecting “Avengers: Endgame” to have a global cumulative audience of $2.15 billion. The film cost an estimated $475 million to make including marketing costs, according to Deadline.

“Awareness is high, and [Disney] did show an extended cut of the film at the analyst day,” he said. Miller rates the stock as outperform, the equivalent of buy, and recently raised his price target to $139 from $129.

JPMorgan analysts led by Alexia Quadrani expect “Avengers: Endgame” and “The Lion King,” which is expected to be released later in the year, to be two of the biggest films of 2019. For 2020, she has high hopes for two more Disney-backed films, “Frozen 2” and “Star Wars Episode IX.”

While the studio segment faced a tough year-earlier comparable in the first quarter, which is expected to continue into the second quarter, “we are encouraged by the slate ahead,” the Quadrani team wrote in a note following the analyst meeting. JPMorgan’s rating was put at overweight, while the firm set a $137 share-price target.

AT BTIG, Richard Greenfield, a former Disney bear, upgraded the stock to neutral from sell after the analyst meeting and lauded the company for shifting its focus away from its “secularly challenged media network portfolio, especially with Disney management willing to set an ambitious 60-90 million five-year subscriber target for Disney.”

However, he cautioned that subscriber targets may be overly aggressive, given that the service has not even launched and based on its plan to invest just $2.5 billion in original content by 2024. Netflix, in contrast, is spending about $8 billion a year on original content.

See now: Netflix at risk of losing 8.7 million subscribers to Disney+, survey finds

Also: Netflix’s $2 billion junk-bond offering comes at a risky time for the streaming giant

“While Disney is admittedly not going as far as we would like in their direct-to-consumer strategy (collapsing windows and proactively cannibalizing legacy businesses), Iger and Disney are clearly listening to much of what we have written over the past few years and appear to realize an even more dramatic shift in Disney’s strategy will be required as its legacy businesses erode,” Greenfield wrote.

Disney shares were up 1.1% Friday and have gained 26% to date in 2019. The Dow Jones Industrial Average DJIA, +0.31% , which counts Disney as a member, has gained 13% this year, while the S&P 500 SPX, +0.47% has risen 17%.

Last weekend: Horror flick tops weekend box office, but ‘Avengers’ are coming