Insight into Baillie Gifford (Trades, Portfolio)’s Latest 13F Filings and Portfolio Adjustments

Baillie Gifford (Trades, Portfolio), a century-old investment management firm, recently disclosed its 13F filings for the second quarter of 2024. Renowned for prioritizing client interests and a rigorous bottom-up investment approach, the firm continues to manage substantial assets for global professional investors. This quarter’s filing highlights significant transactions in stocks like NVIDIA Corp, reflecting strategic shifts and potential growth opportunities.

Summary of New Buys

Baillie Gifford (Trades, Portfolio)’s portfolio welcomed 13 new stocks in this quarter, including:

-

e.l.f. Beauty Inc (NYSE:ELF), acquiring 3,804,541 shares, which now represent 0.62% of the portfolio, valued at approximately $801.7 million.

-

Grab Holdings Inc (NASDAQ:GRAB), with 46,925,778 shares, making up about 0.13% of the portfolio, valued at $166.6 million.

-

Vertex Pharmaceuticals Inc (NASDAQ:VRTX), adding 167,616 shares, now accounting for 0.06% of the portfolio, with a total value of $78.6 million.

Key Position Increases

The firm has also increased its stakes in 83 stocks, notably:

-

UnitedHealth Group Inc (NYSE:UNH), with an additional 821,050 shares, bringing the total to 894,006 shares. This adjustment marks a 1125.4% increase in share count, impacting the portfolio by 0.32%, with a total value of $455.3 million.

-

AutoZone Inc (NYSE:AZO), with an additional 115,924 shares, now totaling 120,194 shares. This represents a 2714.85% increase in share count, valued at $356.3 million.

Summary of Sold Out Positions

Baillie Gifford (Trades, Portfolio) exited 18 positions this quarter, including:

-

Baidu Inc (NASDAQ:BIDU), selling all 2,573,286 shares, impacting the portfolio by -0.21%.

-

HashiCorp Inc (NASDAQ:HCP), liquidating all 6,621,405 shares, with a -0.14% impact on the portfolio.

Key Position Reductions

Significant reductions were made in 164 stocks, with major changes in:

-

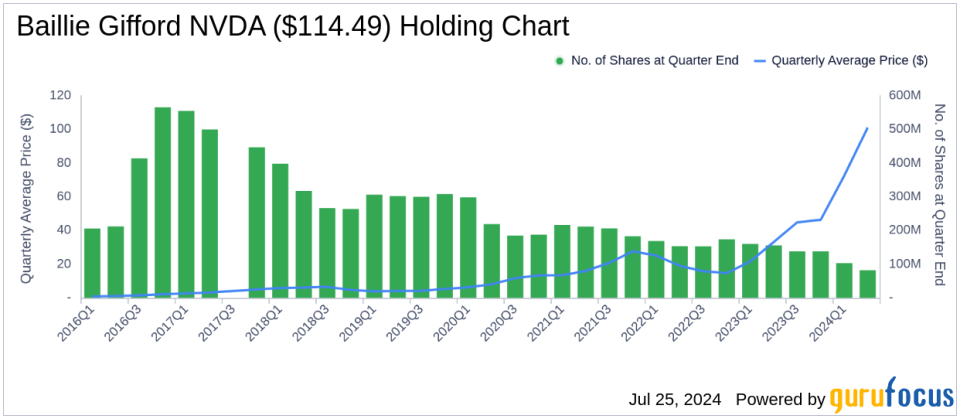

NVIDIA Corp (NASDAQ:NVDA), reducing holdings by 20,956,876 shares, a -20.34% decrease, impacting the portfolio by -1.47%. The stock traded at an average price of $101.1 during the quarter and has seen a 38.80% return over the past three months and 131.60% year-to-date.

-

Spotify Technology SA (NYSE:SPOT), cutting down by 5,358,120 shares, a -24.97% reduction, impacting the portfolio by -1.1%. The stock’s average trading price was $301.09 this quarter, with a 15.61% return over the past three months and 77.81% year-to-date.

Portfolio Overview

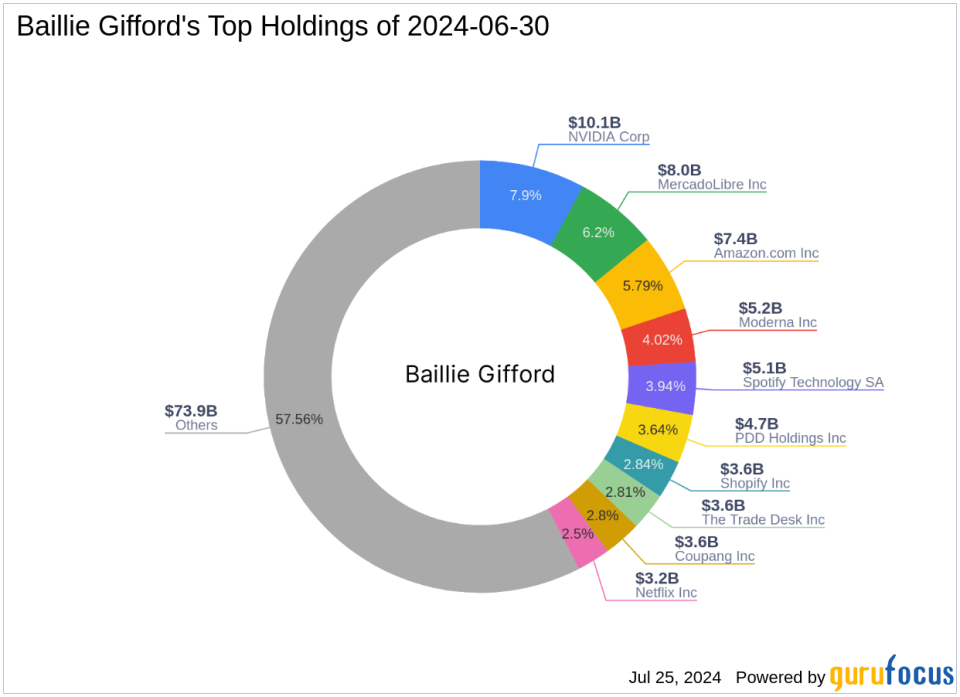

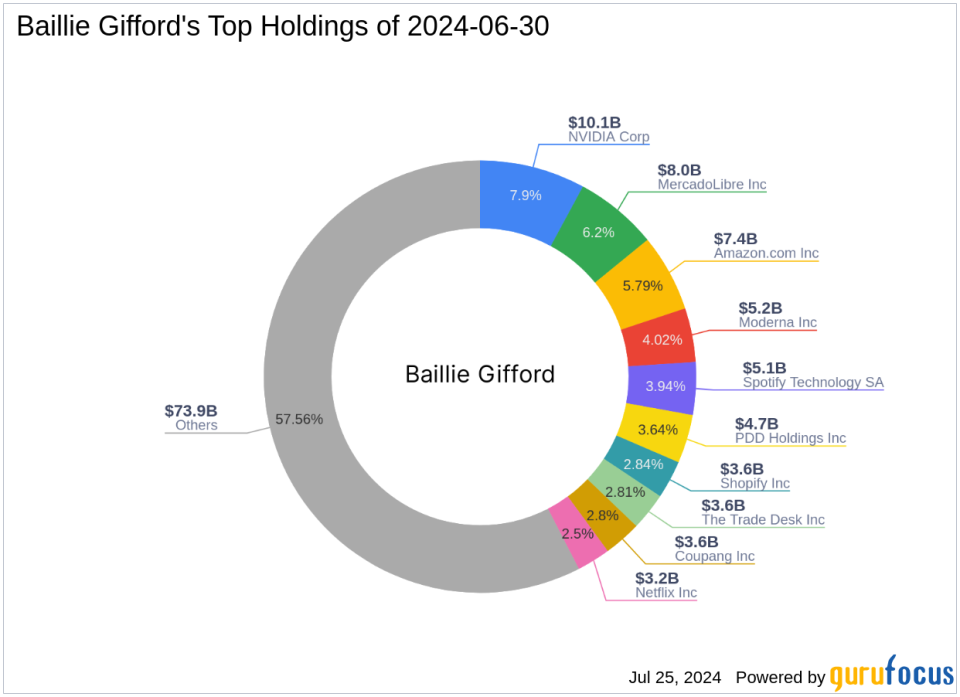

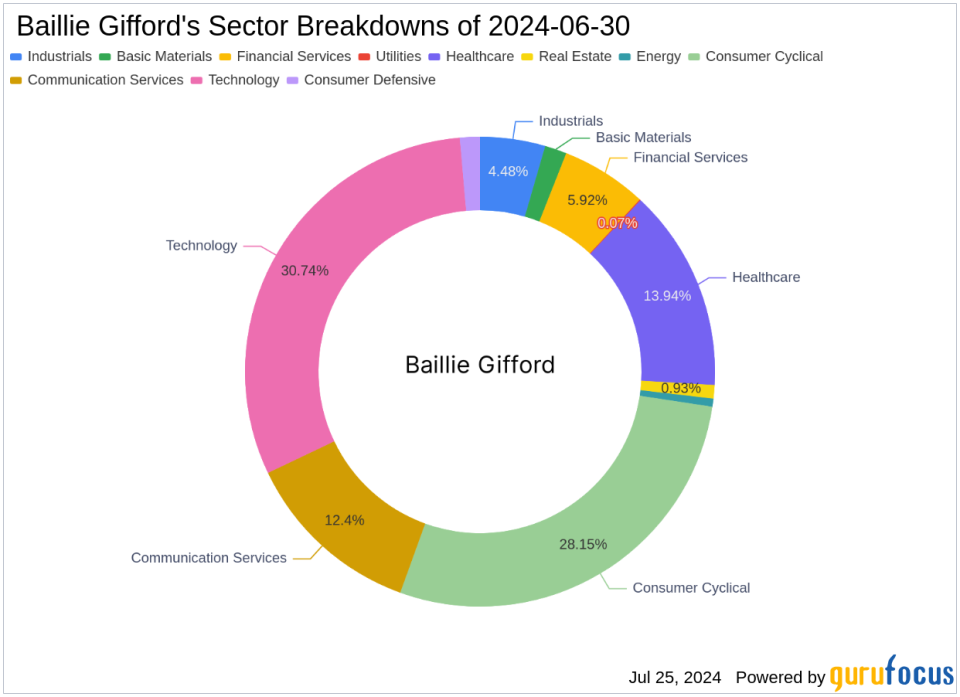

As of the second quarter of 2024, Baillie Gifford (Trades, Portfolio)’s portfolio includes 285 stocks. Top holdings are 7.9% in NVIDIA Corp (NASDAQ:NVDA), 6.2% in MercadoLibre Inc (NASDAQ:MELI), 5.79% in Amazon.com Inc (NASDAQ:AMZN), 4.02% in Moderna Inc (NASDAQ:MRNA), and 3.94% in Spotify Technology SA (NYSE:SPOT). The firm’s investments are diversified across all 11 industries, including Technology, Consumer Cyclical, and Healthcare, among others.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.