Interest rates will be cut in August, according to major investment banks, even after inflation came in higher than expected last month.

Wall Street giant Goldman Sachs and Paris-based BNP Paribas both said the Bank of England will still begin cutting borrowing costs this summer from their 16-year highs.

It comes after the consumer prices index tumbled from 3.2pc to 2.3pc in April, its lowest level in nearly three years, after a record decline in energy prices.

However, money markets were spooked by strong services inflation, which is closely watched by the Bank of England and fell less than expected from 6pc to 5.9pc.

ADVERTISEMENT

As a result, traders have pushed back their expectations for interest rate cuts from as early as June to as late as November – and are only pricing in one reduction this year.

Goldman Sachs and BNP Paribas had both predicted a first cut in borrowing costs in June but said this would now come in August.

Goldman analyst Sven Jari Stehn said this would “provide two more rounds of inflation and labour market data, which we expect to show renewed inflation progress”.

In a note to clients, BNP Paribas said it was still forecasting three cuts this year from 5.25pc to 4.5pc, which it expects in August, September and November.

Read the latest updates below.

07:13 PM BST

Signing off…

Thanks for joining us today. We’ll be back in the morning. In the meantime, do click through to our election coverage here on the day Rishi Sunak called a general election.

07:11 PM BST

Federal Reserve minutes show rate-setters retain faith in hitting inflation target

The US Federal Reserve has just released minutes from its interest-rate decision body, the Federal Open Market Committee, for their meeting on April 30 to May 1.

They indicate that, despite disappointment over recent inflation readings, rate-setters still had faith price pressures would ease, if only slowly.

The minutes said:

Participants … noted that they continued to expect that inflation would return to 2pc over the medium term [but] the disinflation would likely take longer than previously thought.

While the policy response for now would “involve maintaining” the central bank’s benchmark policy rate at its current level, the minutes also reflected discussion of possible further hikes. They say:

Various participants mentioned a willingness to tighten policy further should risks to inflation materialise in a way that such an action became appropriate.

The minutes also reflected debate about just how restrictive current monetary policy is given the strength of the economy, an important discussion given the need for policy to be “sufficiently” restrictive to cool inflation.

Officials since that meeting have tamped down expectations for imminent interest rate cuts, which investors now see beginning in September.

But even as Fed officials acknowledged the risk of inflation pressures again building in the economy, they largely viewed the data from the start of the year as a temporary setback in the battle to return inflation to the central bank’s 2pc target.

06:50 PM BST

European Space Agency awards contracts in push for European answer to SpaceX

The European Space Agency said today that it has selected two companies to develop a vehicle to transport cargo to the International Space Station by 2028, in a move to ensure a European alternative to SpaceX.

The intergovernmental agency, which counts the UK as a member, has recently struggled to find rockets to launch its missions into space, and is following in the footsteps of Nasa by purchasing services from firms rather than developing them itself.

In November, the ESA launched a competition allocating up to €75m (£63.8m) to a maximum of three firms to build a vehicle to take cargo to the ISS and back.

Out of seven proposals, the ESA selected those from Franco-German The Exploration Company and Franco-Italian company Thales Alenia Space, each of which will receive €25m. A third contract award to a division of France’s ArianeGroup may also occur, according to the FT, if a revised proposal can be agreed.

The contracts, which run until June 2026, will focus on developing the technology and structure of the vehicles.

05:53 PM BST

North Sea helicopter strike goes to arbitration as £142,000 pay offer revealed

A pay dispute involving North Sea helicopter pilots that left oil workers stranded during recent strikes will go to arbitration after their employer agreed to talks at ACAS. Christopher Jasper reports:

A date and time for the negotiations has yet to be agreed, and Bristow Helicopters said the British Air Line Pilots’ Association (Balpa) must be prepared to discuss employment terms and conditions alongside pay if a deal is to be reached.

Bristow said a package rejected by Balpa remains a “very good” one and has sought to bypass the union by sending details directly to the pilots.

According to the proposals, a captain in Bristow’s offshore and search and rescue divisions receiving an average salary of £124,500 would see that increase to a maximum of £141,850 next year, excluding allowances. Technical crews would be paid as much as £73,200.

A spokesman said: “It is imperative that Balpa enter any discussions able to demonstrate precisely, to all of us, what areas of the deal offered are serious enough to continue striking over. Only then will we be able to move on.”

Balpa said Bristow should come to the table with a fair and acceptable offer. It said talks have been held at ACAS on previous occasions without a breakthrough in a dispute that has been simmering for more than a year. A fourth round of strikes is slated for next week.

05:52 PM BST

UK’s fifth largest accounting firm appoints new boss after vote

Accounting giant BDO has elected Mark Shaw as its new managing partner. Adam Mawardi reports:

He replaces outgoing boss Paul Eagland, who is stepping down after eight years in charge.

Mr Shaw, who has been a BDO partner since 2006, is currently the firm’s business restructuring head.

He was elected following an equity partner vote and will take charge of BDO at the start of October, with Mr Eagland remaining in his post until the end of September to oversee the transition.

BDO, the UK’s fifth largest accounting firm, nearly doubled its partner headcount from 244 to 441 since Mr Eagland’s appointment in 2016.

The company, which employs 7,500 people across the UK, increased revenue 16pc to £925m last year.

05:40 PM BST

Worries about new Chinese tariffs push down European shares

European stocks closed at a one-week low today, hurt by a sell-off in carmakers following a report about possible Chinese tariffs on imported cars, while tech stocks ticked higher ahead of US-based Nvidia’s results.

European automakers fell 1.4pc to a more than three-month low, with shares of Mercedes-Benz, BMW and Volkswagen falling between 0.7pc and 1.7pc.

China should raise its import tariffs on large gasoline-powered cars to 25pc, a car research body affiliated with the Chinese government told the Asian giant’s Global Times newspaper, as the country faces sharply higher US car import duties and possibly additional duties to enter the European Union.

The European Commission launched an investigation in October into whether fully-electric cars manufactured in China were receiving unfair subsidies and warranted extra tariffs. The EU could impose provisional duties in July.

The Europe-wide STOXX 600 index dipped 0.3pc, also pressured by a tick up in sovereign bond yields after data showed UK inflation eased less than expected in April.

Tech stocks were a bright spot, up 0.6pc as investors awaited quarterly results from AI darling Nvidia this evening to gauge if the recent market rally could continue.

05:35 PM BST

Younger women buying knickers helped fuel a £1bn sales boost at M&S

Demand for Marks & Spencer knickers among younger women has helped fuel a £1bn sales boost at the retailer, propelling it to its strongest performance since 1997. Hannah Boland reports:

M&S said more people than ever were buying lingerie in its stores, with one in two women purchasing bras from the retailer. In total, it sold 20 million bras last year and 60 million pairs of knickers.

Demand was particularly strong among Millennials and Gen Z customers, M&S said, with shoppers under the age of 30 accounting for a third of underwear sales – double the level a year ago.

M&S said the popularity of its lingerie among younger shoppers was boosted by its “B by Boutique” range which is known for bolder and brighter styles. Sales of the range, which launched in 2022, jumped 16pc over the year.

M&S’s success in appealing to younger shoppers will be seen as an indication that chief executive Stuart Machin’s turnaround efforts are bearing fruit. Bosses had been battling to revive the clothing division, with previous executives saying the company had been chasing older customers.

05:25 PM BST

Wall Street struggles for direction as it awaits Nvidia results

Wall Street’s main indexes struggled for direction this afternoon as investors kept to the sidelines ahead of AI chip leader Nvidia’s quarterly results and minutes of the Federal Reserve’s policy meeting, both due this evening.

Eyes will be on whether semiconductor bellwether Nvidia’s first-quarter results, due after markets close, can meet sky-high expectations and sustain the bumper gains the company’s shares and other AI-related stocks recorded.

Nvidia has emerged as the third-largest US company by market value after a more-than 92pc surge in its shares this year after a large jump in 2023.

The company’s shares were down 0.5pc today, after hitting a nearly two-month high on Tuesday.

Art Hogan, chief market strategist at B. Riley Wealth, said:

The most important piece of the puzzle is whether Nvidia meets and beats expectations on the revenue line … investors have certainly ramped up their expectations of a beat quarter.

Wall Street’s recent bull run has carried all three major indexes to record highs this month, driven by a strong earnings season as well as renewed hopes for interest-rate cuts and a so-called soft landing for the US economy.

05:10 PM BST

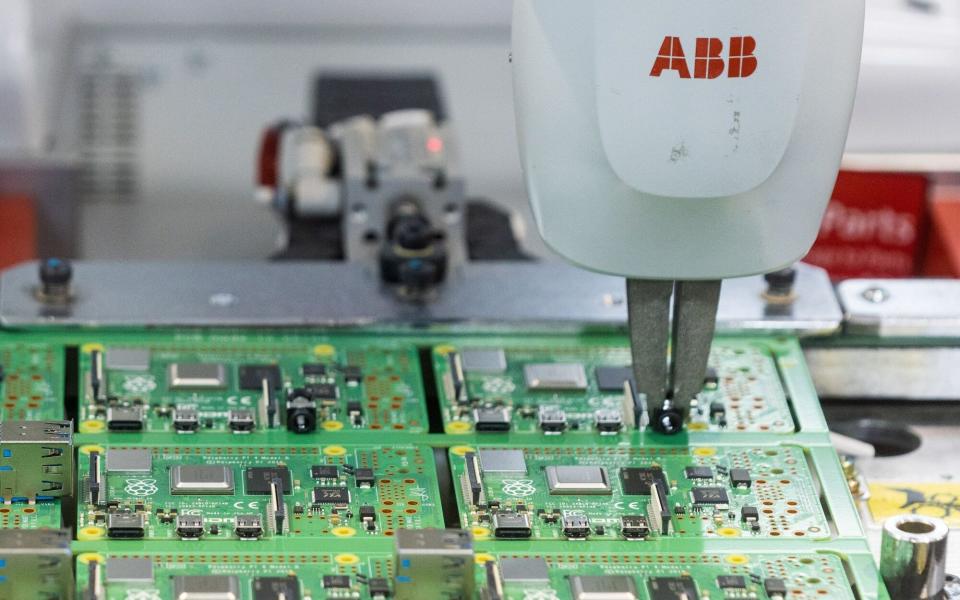

Raspberry Pi confirms London float will take place next month

Raspberry Pi has confirmed aims to list in London next month in a boost to the capital’s flagging stock market.

The Cambridge-based firm – known for affordable credit card-sized computers designed to boost coding skills among children – has revealed plans to raise $40m (£31.4m) in new money as part of the initial public offering (IPO) on London’s main market.

The IPO is a welcome victory for the London market, which has been hit by a swathe of UK-listed firms being bought out or defecting abroad.

Arm and fellow Raspberry Pi investor Lansdowne Partners have agreed to also buy $35m (£27.5 million) and $20m (£15.7 million) worth of shares respectively as part of the plans.

Raspberry Pi was founded by computer scientist Eben Upton in 2008, before releasing its first product in 2012.

It has since sold more than 60m of its single board computers alone.

It is a subsidiary of the Raspberry Pi Foundation – a UK charity founded when the company was set up in 2008, with the goal of promoting interest in computer science among young people.

As a major shareholder in Raspberry Pi, the foundation has received around $50m (£39.7 million) in dividends since 2013, which has been used to advance its educational mission globally, according to the group.

04:55 PM BST

Footsie closes down

The FTSE 100 lost 0.6pc today. The top riser was M&S, up 5.2pc, followed by packaging group DS Smith, up 2.6pc. The biggest faller was miner Antofagasta, down 6.4pc, followed by fellow miner Glencore, down 3.4pc.

Meanwhile, the FTSE 250 dipped 0.3pc. The biggest riser was investment platform group IntegraFin, up 11pc, followed by pub operator Mitchells & Butler, up 10pc. The biggest faller was City firm Close Brothers, down 6.7pc, followed by Pets and Home, down 5.9pc.

04:45 PM BST

US says new tariffs on Chinese goods start in August

Some of the steep US tariff increases on an array of Chinese imports, including electric vehicles and their batteries, computer chips and medical products, will take effect on August 1, US officials said on Wednesday.

President Joe Biden will keep tariffs put in place by his Republican predecessor Donald Trump while ratcheting up others, including a quadrupling of import duties on Chinese EVs to 100pc and a doubling of semiconductor duties to 50pc.

The Office of the United States Trade Representative, which advises the president on trade policy and conducts trade negotiations, is seeking comments on the effects of the proposed tariff increases on the US economy, including consumers, and on whether a proposed 25pc duty on medical masks, gloves and a planned 50pc tariff on syringes should be higher.

The United States imported nearly $640m (£503m) of gloves, masks and syringes last year from China that will be affected by the new measures.

The proposed Chinese tariff increases include “products targeted by China for dominance, or are products in sectors where the United States has recently made significant investments.”

Washington is investing hundreds of billions of dollars in clean energy tax subsidies to develop American EV, solar and other new industries, and has said China’s state-driven excess production capacity in these sectors threatens the viability of US companies. The tariffs are meant to protect American jobs from a feared flood of cheap Chinese imports.

04:24 PM BST

Disney to sell stake in Indian pay-TV service

Disney is selling its stake in an Indian pay-TV business to Tata, according to a report.

Bloomberg said the transaction valued the service, Tata Play, at about $1bn (£785m), according to stakes. Disney owns 29.8pc of the business.

It comes Disney pushes through a programme of cost cutting under chief executive Bob Iger, who has cut thousands of jobs as part of a plan to strip out $7.5bn of costs.

Disney and Tata have been approached for comment.

04:16 PM BST

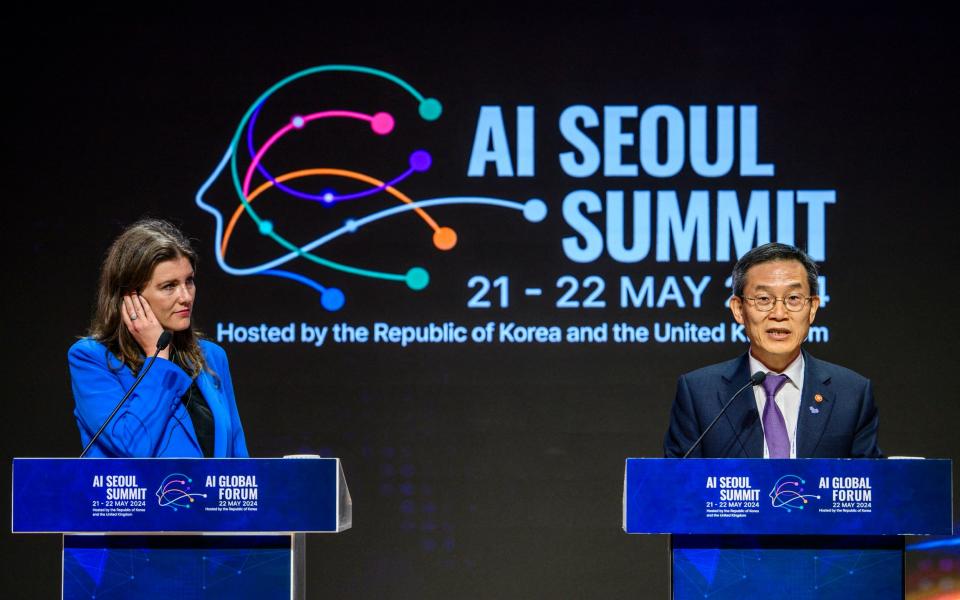

Goverments vow to cooperate against AI risks at Seoul summit

More than a dozen countries and some of the world’s biggest tech firms pledged today to cooperate against the potential dangers of artificial intelligence, including its ability to dodge human control, as they wrapped up a global summit in Seoul.

AI safety was front and centre of the agenda at the two-day gathering. In the latest declaration, more than two dozen countries including the Britain, the United States and France agreed to work together against threats from cutting-edge AI, including “severe risks”.

Such risks could include an AI system helping “non-state actors in advancing the development, production, acquisition or use of chemical or biological weapons”, said a joint statement from the nations.

These dangers also include an AI model that could potentially “evade human oversight, including through safeguard circumvention, manipulation and deception, or autonomous replication and adaptation”, they added.

The ministers’ statement followed a commitment on Tuesday by some of the biggest AI companies, including ChatGPT maker OpenAI and Google DeepMind, to share how they assess the risks of their tech, including what is considered “intolerable”.

The 16 tech firms also committed to not deploying a system where they cannot keep risks under those limits.

The Seoul summit, co-hosted by South Korea and Britain, was organised to build on the consensus reached at the inaugural AI safety summit last year.

04:09 PM BST

Vue cinema chain rejigs top team after Hollywood strikes hit sales

Vue has appointed an industry veteran to its top team as it seeks to move on from losses caused by Hollywood strikes.

Matt Eyre has joined as chief operating officer, having worked previously held similar jobs at Cineworld and in cinema chains in the US.

The company said that it had now received approval from its lenders and shareholders for a “deleveraging of the balance sheet and £50m of cash injected into the business.” It added:

This around as a consequnce of the unforeseen and unprecendented six months of strike action by Hollywood writers and actors in 2023 which pushed back the release of anticipated movies and delayed the pipeline of new content.

03:49 PM BST

US stocks hover around record levels

US stock indexes are drifting around their records this afternoon, continuing a run of quiet trading.

The S&P 500 is virtually unchanged a day after setting its latest all-time high.

The Dow Jones Industrial Average and Nasdaq Composite indexes are also practically unchanged compared with yesterday’s close.

03:47 PM BST

Airbus to hire 400 British engineers in race against crisis-hit Boeing

Airbus is to hire 400 engineers at its wing manufacturing plant in Wales as the company races to extend its lead over crisis-hit Boeing in the market for single-aisle jets. Christopher Jasper reports:

Additional staff will be required at the plant in Broughton, near Chester, as Airbus transforms a building that made wings for the A380 superjumbo into a production line for the best-selling A320neo model.

Covering an area larger than 10 football pitches, the West Factory site is key to plans to lift monthly A320 output from an average of 48 last year to 75 by the end of 2026.

Airbus is also adding staff at its existing A320 facility at the Broughton complex, which makes 90pc of the European company’s wings.

03:42 PM BST

Yogawear maker Lululemon drops 7pc after key manager departs

Shares in clothing brand Lululemon took a hit this afternoon after it told investors that a key executive had resigned.

The maker of yoga pants told investors that it was “implementing an updated and more integrated organisational structure, in conjunction with the departure of Sun Choe, chief product officer, who has resigned and will leave the company later this month to pursue another opportunity.”

Bloomberg reported that Ms Choe’s departure adds to the “wall of worry” in the company’s near term, according to a note by Raymond James analyst Rick Patel.

The Nasdaq-listed company’s shares are down over 7pc today and have fallen 41pc since the start of the year.

03:33 PM BST

Handing over

I will sign off for the day at this point and leave you in the hands of Alex Singleton, who will keep you up to speed with the latest updates.

As traders fret over UK inflation falling less than expected from 3.2pc to 2.3pc, take a look at Lebanon’s latest data, where the increase in consumer prices slowed from 70.357pc to 59.67pc in April.

03:15 PM BST

US home sales drop amid rising mortgage costs

Sales of previously occupied US homes sank last month, pushed down by high mortgage rates and rising prices.

Existing home sales fell 1.9pc to a seasonally adjusted annual rate of 4.14m from a revised 4.2m in March, the National Association of Realtors said.

The average price of previously occupied homes rose 5.7pc to $407,600 — the tenth straight increase and a record for April.

Lawrence Yun, the association’s chief economist, called the sales drop “a little frustrating.’’ Economists had expected sales to come in at 4.2m.

The rate on the benchmark 30-year, fixed-rate loan has risen five of the last six weeks and stands at 7.02pc, up from 6.39pc a year ago.

Would-be homebuyers are also deterred by the high prices, caused partly by a tight inventory of available homes.

03:03 PM BST

Bank of England will cut interest rates in August, says Goldman Sachs

Interest rates will be cut in August, according to major investment banks, even after inflation came in higher than expected last month.

Wall Street giant Goldman Sachs and Paris-based BNP Paribas both said the Bank of England will still begin cutting borrowing costs this summer.

It comes after the consumer prices index tumbled from 3.2pc to 2.3pc in April, its lowest level in nearly three years, after a record decline in energy prices.

However, money markets were spooked by strong services inflation, which is closely watched by the Bank of England and fell less than expected from 6pc to 5.9pc.

As a result, traders have pushed back their expectations for interest rate cuts from as early as June to as late as November – and are only pricing in one reduction this year.

Goldman Sachs and BNP Paribas had both predicted a first cut in borrowing costs in June but said this would now come in August.

Goldman analyst Sven Jari Stehn said this would “provide two more rounds of

inflation and labour market data, which we expect to show renewed inflation progress”.

02:37 PM BST

US markets muted ahead of Nvidia results

Wall Street’s main stock indexes were subdued at the opening bell ahead of AI chip leader Nvidia’s quarterly results and the Federal Reserve’s policy meeting minutes, released later in the day.

The Dow Jones Industrial Average was flat at the open to 39,863.33.

The S&P 500 was also little changed at 5,319.28, while the Nasdaq Composite gained a fractional amount to 16,839.02.

02:34 PM BST

Anglo American rejects ‘final’ £38.6bn offer from BHP

Anglo American has rejected a “final” offer from Australian rival BHP which valued the miner at £38.6bn.

The board of the London-listed miner, which owns the De Beers diamond empire, said it was confident in the company’s “standalone future prospects” as it shunned a third bid worth £29.34 per share.

BHP chief executive Mike Henry said the merger offered a “compelling opportunity”, which would have given would Anglo American shareholders 17.8pc of a new combined venture.

Anglo American chairman Stuart Chambers said:

The board is confident in Anglo American’s standalone future prospects and believes that Anglo American has set out a clear pathway and timeframe to deliver the acceleration of its strategy to unlock significant and undiluted value for Anglo American’s shareholders.

The board considered BHP’s latest proposal carefully, concluded it does not meet expectations of value delivered to Anglo American’s shareholders, and has unanimously rejected it.

02:24 PM BST

Falling inflation is ‘unalloyed good news,’ says former minister

Conservative former Treasury minister Sir Robert Syms said the inflation statistics were “unalloyed good news” for the country.

He said: “I think that should be rejoiced by everybody in this House, including people on the other side, who might actually end up in Government, inherit the benefit of some of the things that this government is doing. In truth I’m always a little surprised by, when good news comes along, how miserable the opposition gets.”

Treasury Minister Bim Afolami replied: “I do disagree with him on one key measure, I must admit, which is the idea that they might inherit this because of course, we are not complete yet.

“We know that the economy still needs to continue to turn. We know that inflation needs to come down. We hope that that will lead in due course to falling interest rates as well, and for the measures that we put in place to come to fruition over the next parliament.”

Conservative former Treasury minister Richard Fuller said Mr Afolami was “right to make the point that people are continuing to find economic difficulties at this time and that we need to stick with the Prime Minister’s plan.

“Right to point out the terrible risks to the economy that the Labour Party’s policies on labour markets and on taxes will do, and right to say that there have been external factors and that is different when you tackle external factors that are one offs from what your policies are, looking forward.”

02:15 PM BST

Nasa delays crewed Boeing Starliner launch for third time

The first crewed launch of Boeing’s Starliner spacecraft to the International Space Station has again been delayed, according to Nasa, with no new date immediately set.

The US space agency said: “The next possible launch opportunity is still being discussed.”

The postponement of the launch, which had been set for Saturday, marks the third delay this month for the highly anticipated mission.

It would allow Nasa to certify a second commercial vehicle to carry crews to the ISS, beyond Elon Musk’s SpaceX.

Earlier this month, the Starliner launch was postponed just hours before liftoff, with the astronauts already strapped in, due to a separate technical issue.

01:59 PM BST

Ozempic maker hit by second fire in a week

Europe’s most valuable company has been hit by its second fire in a week, this time at its headquarters in Denmark.

Novo Nordisk said production of its Ozempic and Wegovy durgs had not been affected by the blaze outside a building at its site in Bagsvaerd, which then spread to an adjacent office.

A spokesman said that extinguishing the fire “is expected to last some hours”, with about 100 firefighters at the site.

It comes a week after a fire on the roof of a factory construction site in Kalundborg, where the company is spending more than $8bn (£6.3bn) to boost production.

01:45 PM BST

Inflation is nothing to do with Sunak – Telegraph readers

The decline in inflation has nothing to do with the Government, Telegraph readers have said, after the consumer prices index dropped to its lowest level in nearly three years.

Here is a selection on some of our readers’ views on falling inflation and pressure from former Tory ministers for interest rate cuts.

You can join in the conversation in our comments section below.

01:28 PM BST

Gas prices hit four-month high after warning over Gazprom supply

Wholesale gas prices have jumped to their highest level in four months after a warning about possible disruption of suppky from Russia’s Gazprom.

Dutch front-month futures, the continent’s benchmark, rose as much as 4.4pc to more than €34 per megawatt hour.

The UK equivalent rose by as much as 4.5pc to more than 83p per therm.

It came as Austrian energy supplier OMV said an unidentified European company had won a court decision to obstruct its payments to Gazprom, potentially halting supplies.

Austrian regulators said it could lead to a “short-term” increase in prices.

01:07 PM BST

Citi fined £62m after ‘fat finger’ trade triggered £1.1bn share sale

Citi has been fined £62m by UK regulators after a “fat finger” trade triggered a flash crash on the European stock market.

Our reporter Michael Bow has the details:

The Wall Street bank’s controls were “deficient” and monitoring of the incident had been “ineffective” after it occurred in May 2022, the Financial Conduct Authority (FCA) said.

The Citi trader, who was working on a UK bank holiday, had meant to sell a basket of stocks worth $58m (£45.6m) early in the morning but mistakenly typed the wrong numbers into the computer, triggering a sale of hundreds of stocks worth $444bn, according to the FCA.

Although Citi’s internal risk control systems stopped the bulk of the order, around $1.4bn (£1.1bn) crept through in the 14-minute period after the sell order was created before the trader realised the error and hit stop on the sale.

Read how it created turmoil in financial markets.

12:56 PM BST

German economy forecast to grow ‘slightly’

The German economy is expected to have grown gently in the second quarter after a positive first three months of the year, the Bundesbank said.

The German central bank said in its monthly report that economic output “is likely to increase slightly again” during the period.

Europe’s largest economy exceeded expectations in the first quarter, when it posted growth of 0.2pc.

The positive figures came as a relief after German output shrunk by 0.5pc in the last quarter of 2023 at the end of a difficult period of high inflation.

An improvement in the services sector was behind much of the rising German growth figures.

Businesses in the sector could see their “recovery continue”, the Bundesbank said.

12:30 PM BST

Oil slumps amid rising stockpiles

Oil prices have slumped towards their lowest level in three months amid signs of rising stockpiles in the US.

Brent crude, the international benchmark, has fallen 0.7pc towards $82 a barrel, while West Texas Intermediate has dropped 0.7pc to near $78.

The American Petroleum Institute reported crude stockpiles rose by 2.5m barrels last week, according to Bloomberg.

Brent is around 7pc higher so far this year amid cuts to supply by the Opec+ cartel, but prices have cooled since mid-April.

12:00 PM BST

Wall Street edges down ahead of Nvidia results

US stock markets are on track to begin the day lower ahead of AI chip maker Nvidia’s quarterly results and the Federal Reserve’s policy meeting minutes due later in the day.

All eyes will be on semiconductor bellwether Nvidia’s first-quarter results, due after market close. Analysts are keen to see if it can meet the market’s sky-high expectations.

Nvidia has emerged as the third-largest US company by market value after a more than 92pc surge in its shares this year and an over three-fold jump in 2023.

The company’s shares were down 0.5pc in premarket trading, after rising over 3pc over the past two days.

Market participants are also keenly awaiting minutes from the US central bank’s latest policy meeting for more clarity on the timing of rate cuts.

In premarket trading, the Dow Jones Industrial Average was down 0.1pc, the S&P 500 was down 0.2pc, and the Nasdaq 100 had fallen 0.2pc.

11:14 AM BST

Why a summer rate cut is still in play despite inflation ‘shocker’

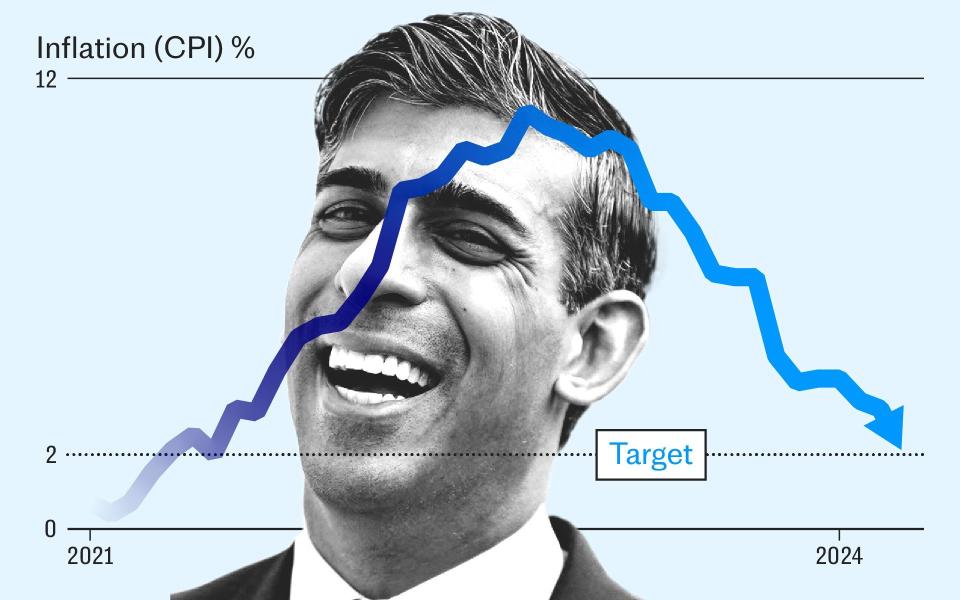

This is what Rishi Sunak has been waiting for. Not since July 2021 has Britain’s inflation rate started with the number “2”.

Our economics editor Szu Ping Chan analyses what happens next:

The Prime Minister hailed the fall in the consumer prices index, to 2.3pc, as a “major moment for the economy, with inflation back to normal”.

Surely, Downing Street must have been hoping, the narrative would now shift to economic stability – and imminent interest rate cuts by the Bank of England ahead of a looming general election.

Unfortunately, the markets were less impressed.

Wednesday’s inflation data sparked a frenzy among traders who pushed back their prediction for the first reduction in interest rates from 5.25pc from June to November, in large part because of stubborn prices in the crucial services sector.

Previously, they had been predicting a cut as soon as June.

Read why the Bank of England could yet defy market gloom to slash borrowing costs.

11:03 AM BST

US fund takes control of Inter Milan

Inter Milan have been taken over by US fund Oaktree after the Serie A champions’ outgoing owners Suning missed a deadline to repay a €395m (£336.5m) debt.

Chinese conglomerate Suning have relinquished control of Inter to Oaktree three days after the team were officially crowned Italian champions for the 20th time.

10:55 AM BST

Culture Secretary backs Ofcom over GB News impartiality ruling

The Culture Secretary has backed Ofcom after the regulator warned GB News that it could consider fining it or revoking its licence over recent impartiality breaches.

Lucy Frazer was grilled by MPs at the Culture, Media and Sport Committe about a recent finding by the broadcasting regulator, which found that the People’s Forum: The Prime Minister broke impartiality rules.

The watchdog said it was starting the “process for consideration of a statutory sanction against GB News” following a “serious and repeated breach” of the rules and the hour-long programme where Rishi Sunak took questions from the audience.

Ms Frazer said: “I think that Ofcom is doing its job in terms of making sure that the Broadcasting Code is complied with.”

When asked if the media regulator had been “tolerant” of GB News, Ms Frazer appeared to defend Ofcom saying that it has “found various breaches” of the channel.

“I would say Ofcom is doing its job,” she added.

Ms Frazer also said the BBC “has more work to do” on impartiality.

She added: “I do think the BBC has more work to do on impartiality and I think the BBC absolutely accepts that.”

10:42 AM BST

Inflation analysis ‘depends on whether you’re glass half full’

James Smith, research director at the Resolution Foundation think tank, said:

Consumers are still living with far higher prices and how you take today’s inflation data will depend on whether your glass is half full or half empty.

While it’s clearly good news headline inflation is back to normal levels, it is disappointing that price pressures haven’t fallen further and that measures of services inflation are proving more stubborn that expected.

And second, core inflation – which strips out erratic food and energy contributions – was higher than expected at 3.9% (the market had 3.6%). Disappointing services and core inflation point to some extra stickiness this month. pic.twitter.com/VaG4AxJF0J

— JamesSmithRF (@JamesSmithRF) May 22, 2024

And this chart just reminds you that while headline *inflation* is back to normal, prices of essentials are still way up with energy prices up 67% and food prices 32% since March 2021. That compares to 22% for all consumer prices. pic.twitter.com/YuaDHpNNar

— JamesSmithRF (@JamesSmithRF) May 22, 2024

And this chart just reminds you that while headline *inflation* is back to normal, prices of essentials are still way up with energy prices up 67% and food prices 32% since March 2021. That compares to 22% for all consumer prices. pic.twitter.com/YuaDHpNNar

— JamesSmithRF (@JamesSmithRF) May 22, 2024

10:30 AM BST

Tesla sales drop by quarter in Britain, official figures show

In corporate news, Tesla sales slumped across Europe last month as governments reduced the subsidies offered to buyers of electric cars.

Tesla registrations in Britain fell by a quarter in April and have slumped 14pc in the first four months of the year.

The carmaker registered just 13,951 vehicles in April, the European Automobile Manufacturers’ Association said, which was down by 2.3pc from last year and its worst total since January 2023.

It comes despite chief executive Elon Musk previously insisting that he expected the car maker’s second quarter results would be “a lot better”.

Germany and Sweden have been among the major economies to have ceased or reduced subsidies for electric vehicles in recent months, which has put a damper on Europe’s sales growth.

10:16 AM BST

Bonds slump as interest rates expected to remain higher

Bond markets slumped after the latest official figures showed inflation remained higher than expected in Britian.

The yield on 10-year UK gilts – which moves inversely to its price – rose by more than nine basis points to 4.22pc, which was its highest level this month.

The coupon on two-year gilts, which are more sensitive to changes in interest rates – has jumped nearly 12 basis points to 4.4pc.

The pound has hit its highest level in two months against both the dollar and the euro as money markets indicated the first interest rate cut by the Bank of England could come as late as November.

Prior to the latest official figures, which showed persistent services inflation, traders had been betting on a 50pc chance of a rate cut in June.

10:08 AM BST

Vennells apologies to subpostmasters over Horizon scandal

Former Post Office boss Paula Vennells has apologised to subpostmasters and their families as she began giving evidence to the Horizon IT inquiry.

She told the inquiry:

I would just like to say, and I’m grateful for the opportunity to do this, how sorry I am for all that subpostmasters and their families and others have suffered as a result of all of the matters that the inquiry is looking into.

I followed and listened to all of the human impact statements and I was very affected by them.

Follow the latest in our live blog.

09:56 AM BST

Reeves: It’s not the time for a victory lap on inflation

As inflation fell to 2.3pc, shadow chancellor Rachel Reeves said:

Inflation has fallen but now is not the time for Conservative ministers to be popping champagne corks and taking a victory lap.

After 14 years of Conservative chaos, families are worse off. Prices in the shops have soared, mortgage bills have risen and taxes are at a 70-year high.

Inflation has fallen but now is not the time for Conservative ministers to be popping champagne corks.

Prices have soared, mortgages bills have risen and taxes are at a seventy year high.

Only Labour can be trusted to protect and improve family finances.

— Rachel Reeves (@RachelReevesMP) May 22, 2024

09:50 AM BST

House prices rose 1.8pc in March, official figures show

Average UK house prices increased by 1.8pc in the 12 months to March, according to official figures.

The Office for National Statistics (ONS) said it lifted the average house price across the UK to £283,000.

It represented a recovery in pricing after house prices had fallen by 0.2pc in the 12 months to February.

Meanwhile, the ONS also revealed that UK private rents increased by 8.9pc in the 12 months to April, as house price inflation slowed slightly from 9.2pc growth in the year to March.

Average UK house prices increased by 1.8% in the year to March 2024, the first annual increase since June 2023.

Average UK private rents rose by 8.9% in the 12 months to April 2024 (provisional estimate), down from 9.2% in the 12 months to March 2024.

➡️ https://t.co/7NllekCjf8 pic.twitter.com/JZ9Z3MvC4t

— Office for National Statistics (ONS) (@ONS) May 22, 2024

09:41 AM BST

BT fined £2.8m for failing to provide contract information to customers

Away from today’s inflation news, BT has been fined £2.8m by the industry watchdog after EE and Plusnet failed to provide clear and simple contract information to more than a million customers before they signed up.

Ofcom said that since June 2022, BT’s EE and Plusnet businesses made more than 1.3m sales without providing customers with a contract summary and information documents, which affected at least 1.1m customers.

This meant that BT broke the regulator’s consumer protection rules, which came into effect in 2022 and are designed to ensure customers get clear, comparable information about the services they are considering buying.

Ofcom said the fine “reflects the seriousness of this breach”.

Ofcom brought in the rules in June 2022 and said BT had assured it that the group was confident the deadline would be met.

But the watchdog said its investigation found that, from January 2022, BT was aware that some of its sales would not meet the deadline. Ofcom said:

In some cases, BT deliberately chose not to comply with the rules on time.

Other providers dedicated the resource required to meet the implementation deadline for these new rules, and BT is likely to have saved costs by not doing so.

A BT spokesman said: “We’re sorry that some of our pre-contract information and contract summary documents were not available to some of our customers in a timely manner. We apologise for any inconvenience caused and have taken steps to proactively contact affected customers and arrange for them to receive the information and be refunded where applicable.”

09:29 AM BST

People feel worse off, admits Hunt

People do still feel worse off than a few years ago, Jeremy Hunt has acknowledged.

Speaking to ITV’s Good Morning Britain, the Chancellor said:

Do people feel better off now than a few years ago? No, because we have had something that you and I have never had in our lifetimes.

We have had two massive economic shocks in quick succession so no, they don’t feel better than they felt a few years ago.

The numbers show very clearly that since 2010 over a longer period of time living standards have improved, we have got four million more jobs, we have attracted more investment than anywhere in the world apart from China and the United States.

The reason I am saying that is because this is an election year, people are going to make a choice about the future.

When it comes to the important things that make a difference, the difficult decisions on having a flexible labour market, on getting taxes down so that we attract investment from overseas, a Conservative Government will continue to take those difficult decisions.

Today is an important day for the economy, with inflation now back within normal range.

The last few years have been difficult, but the IMF say the economy is approaching a soft landing – and our long term prospects are better than any other major European economy. pic.twitter.com/AvF7tx9cAu

— Jeremy Hunt (@Jeremy_Hunt) May 22, 2024

09:16 AM BST

Ministers call for interest rate cuts

Ministers have called for the Bank of England to cut interest rates as inflation fell to its lowest level in nearly three years.

Sir Jacob Rees-Mogg, the former Tory business secretary, said the Bank of England should have already cut interest rates, which stand at 16-year highs of 5.25pc.

Sir Jacob said: “Interest rates ought to have been cut already as inflation is a lagging indicator.”

Mark Francois, a Tory former minister, said the Bank of England should now “actively consider” cutting the interest rate.

09:07 AM BST

Hunt: Living standards have gone up since Sunak became PM

Jeremy Hunt said it was “nothing to do with me” when asked if he personally felt wealthier following the cost-of-living crisis.

Asked by BBC Radio 4’s Today programme if he felt wealthier, the Chancellor said:

It is nothing to do with me. It is to do with my responsibilities as Chancellor.

What I know when I became Chancellor is we had the Office for Budget Responsibility saying we were going to have the biggest fall in living standards ever.

We had the Bank of England saying that we were going to have the deepest, the longest recession for a hundred years.

He pointed to cost-of-living support the Government had offered, adding: “The result of those difficult decisions, and they were difficult because in the end we had to put up taxes for those decisions, but the result is living standards have gone up since Rishi Sunak became Prime Minister.”

In a testy exchange, Mr Hunt could earlier be heard to insist “me too” when host Emma Barnett said she was interested in people’s household finances.

08:54 AM BST

Summer rate cuts not ruled out, say economists

Although traders have reacted strongly to the latest inflation figures, many economists still think summer interest rate cuts remain a possibility.

Suren Thiru, ICAEW economics director, said: “Lingering concerns over underlying inflationary pressures mean a June rate cut is unlikely.

“However, these figures may convince more rate setters to vote to ease policy, providing a signal that a summer rate cut is still possible.”

Julian Jessop, economics fellow at the Institute of Economic Affairs think tank, said he believed a rate cut in June is “still in play”.

FWIW I think a June rate cut is still in play, even though the stickiness of services #inflation makes this a close call.

Remember that the MPC will have another set of inflation and labour data by then, and more evidence on the latest pay settlements.

If not June, it’s August.

— Julian Jessop FRSA (@julianHjessop) May 22, 2024

08:44 AM BST

Marks & Spencer profits surge by 58pc

Stepping away from inflation for a moment, Marks & Spencer has revealed a better-than-expected surge in annual profits as its turnaround pays off.

The retail bellwether reported a 58pc rise in underlying pre-tax profits to £716.4m for the year to March 30.

It notched up an 11.3pc jump in like-for-like food sales over the year, with growth of 5.2pc across its clothing and home arm.

The group said it was upping its cost-cutting target by another £100m to £500m by 2027-28 as it looks to offset rising staff wages.

The company said: “With continuing cost headwinds, notably from investment in colleague pay, the structural cost programme is critical to our profit progression.”

It said it was in the “strongest financial health since 1997” and was confident of making “further progress” over the financial year ahead.

Its shares were last up 8.7pc – leading gains on the FTSE 100.

08:39 AM BST

FTSE 100 slumps as interest rate cuts expected to be delayed

Stock markets have slipped after inflation fell by less than expected, delivering a blow to hopes of a June interest rate cut.

The benchmark FTSE 100 index fell 0.6pc, while the pound strengthened against the dollar and touched a two-month high at $1.275.

The mid-cap FTSE 250 dropped 0.4pc.

It comes as markets are now pegging a mere 16pc chance of a June rate cut by the Bank of England, a dip from the nearly 60pc that was priced in last week.

Despite UK inflation edging closer to the Bank of England’s target, its slowdown fell short of expectations, with services inflation proving to be persistent.

Markets also have Nvidia’s quarterly results on the radar that is due later in the day, and could spark a $200bn swing in the AI-darling’s shares.

In corporate news, Marks & Spencer jumped 8.7pc to the top of the FTSE 100 after the retailer reported a 58pc rise in annual profit, which was ahead of market expectations.

SSE fell 2.3pc after the power generator and network operator posted a lower annual adjusted operating profit.

08:23 AM BST

Sunak: We have reached a major milestone

Responding to the inflation figures, Rishi Sunak told reporters:

The economy grew in the first quarter of this year, faster than France, Germany and America.

Wages have been rising faster than prices for almost a year now, energy bills are down hundreds of pounds now from where they were, mortgage rates are down from the peak and today’s news on inflation being back to normal is very welcome.

If you put all of that together it shows we have got momentum, it shows that the plan is working but of course there is more work to do for people to really feel the benefits of all these things.

That is why it is important that we stick to the plan. As I have said, these things don’t happen by accident.

Thanks to everyone’s hard work and resilience, today we have reached a major milestone and inflation is back to normal.

That is an important moment for our country, for the economy, and shows that our plan is working.

Whilst I know people are only just starting to feel the benefits and there is more work to do, I hope this gives people confidence that if we stick to the plan there are brighter days ahead.

08:21 AM BST

Much more to be done on inflation, says Labour

There is still “much more to be done” to drive down inflation, Labour’s Darren Jones has said, pointing to energy measures which could prevent inflationary spikes in the UK in future.

The shadow Treasury minister acknowledged inflation had “come down a bit” when speaking to Sky News, but said this was “largely driven by a drop in the energy price cap”.

He added: “Core inflation is still around 3.6pc to 3.9pc, which is hotter than the markets were expecting it to be. This is not out of the woods yet. It is in the right direction but there is still much more to be done.”

Mr Jones pointed to Labour’s “securonomics” agenda, which includes measures to build “homegrown, secure, renewable energy”.

The shadow minister said:

The one reason that the headline rate of inflation has come down closer to 2% today even though the cost of other things are remaining a bit too high is because of the energy bills.

The problem there is if something happens in the world and gas prices rocket again, we are going to be back into that inflationary environment with very high bills.

08:17 AM BST

FTSE 100 drops sharply as inflation disappoints

UK stock markets declined at the open as inflation fell by less than expected at the start of the year.

The FTSE 100 began the day by falling 0.6pc to 8,363.02 while the midcap FTSE 250 was down 0.4pc to 20,701.53.

08:05 AM BST

First interest rate cut not expected until November despite fall in inflation

Hopes of a summer interest rate cut have been dashed for mortgage holders after inflation fell less than expected last month.

The consumer prices index tumbled from 3.2pc to 2.3pc in April – its lowest level in nearly three years – after a record decline in energy prices.

Prime Minister Rishi Sunak said the sharp decline indicated that “brighter days are ahead” but economists had expected inflation to drop to 2.1pc.

As a result, traders have pushed back their expectations for interest rate cuts from as early as June to as late as November.

They are also only pricing in one interest rate cut this year, compared to two before the latest inflation figures were published.

07:49 AM BST

Services sector points to ‘difficult last mile’ on inflation, say analysts

Services inflation, a critical indicator for Bank of England policymakers, dipped slightly from 6pc in March to 5.9pc in April in a blow to hopes for early rate cuts.

The figure was higher than forecasts of a drop to 5.4pc, driven by more volatile aspects of the sector, such as hotels and live music.

Core inflation, which strips out volatile food and energy prices, fell from 4.2pc to 3.9pc, which was higher than predictions of a drop to 3.6pc.

The weaker than expected decline in inflation was another example of inflation figures “developing a nasty habit of coming in hot”, according to analysts.

Rob Morgan, chief investment analyst at Charles Stanley, said

There are some economic trends that point to a difficult last mile to sustainably keep inflation to its 2pc target.

“For starters, economic growth – at 0.6pc in the first quarter despite a slowdown in construction – has surprised on the upside.

This is good news, but it does make the Bank of England’s decision making harder. Cutting rates would add fuel to the inflationary embers, which is intuitively the right course of action if the economy is in recession but a far more difficult call if it is expanding at a decent clip.

“Of greater concern to the Bank of England is wage growth, which has remained remarkably firm despite other employment trends such as unemployment weaking. As a key input into services inflation, this is a critical component of the Bank of England’s thinking and a nut it is yet to crack.

07:37 AM BST

Britain’s deficit balloons to £20.5bn in setback for Hunt’s tax cut plans

Public borrowing has overshot forecasts in April, leaving Jeremy Hunt with less room to cut taxes this year in a pre-election giveaway.

The deficit stood at £20.5bn in April, according to the Office for National Statistics (ONS).

This is £1.2bn more than the £19.3bn forecast just two months ago by the Office for Budget Responsibility (OBR), the government’s tax and spending watchdog.

Public borrowing in the tax year ending in March has also been revised higher by £0.8bn to £121.4bn, outpacing forecasts by the Government’s spending watchdog by £7.3bn.

The figures are a blow to Conservative Party’s prospects of narrowing a 27-point poll gap with Labour by wooing voters with further reductions in national insurance.

While public sector receipts from income like taxation was £1.6bn higher in April than a year earlier, spending has grown at nearly twice the pace at £3.1bn.

Alex Kerr at Capital Economics said: “The Chancellor will be disappointed that April’s figures do not provide more scope for tax cuts at a fiscal event later this year.

“Moreover, we expect slower wage growth to dampen tax receipts growth later this year. And the rise in market interest rates since March’s Budget alone suggests he may have even less fiscal headroom (perhaps about £6.5bn) for tax cuts than the £8.9bn left over in March.”

Rob Wood, chief UK economist at Pantheon Macroeconomics, added: “The headroom to cut taxes doesn’t exist, but Chancellor Hunt seems likely to go ahead anyway.”

It comes after inflation figures for April were higher than expected, pushing back market expectations of the first interest rate cut.

07:34 AM BST

Falling inflation may not be enough for early rate cut, warn economists

The sharp decline in inflation takes the consumer prices index closer to the Bank of England’s 2pc target but may not be enough to trigger an early interest rate cut by its Monetary Policy Committee (MPC), according to economists.

Yael Selfin, chief economist at KPMG UK, said:

This may still not be enough to convince more cautious MPC members to commit to a rate cut in June, especially while wage growth remains elevated and economic growth momentum is strong.

The fall in inflation was relatively broad-based with declines in annual core, food, and energy inflation.

However, of the three components, the key metric of core inflation remained relatively high, at 3.9pc compared to a year ago, while service sector inflation was still at 5.9pc, pointing to lingering price pressures in the UK economy.

Our forecast sees further declines in headline inflation, which could for a time bring the annual rate below 2pc, potentially picking up slightly early in 2025.

That could leave enough margin for the MPC to start easing rates in August while keeping the overall monetary policy stance tight for at least another year.

Other economists also signalled their disappointment with the figures:

Not quite as far as I had hoped, but still a big fall in UK #inflation – from 3.2% in March to 2.3% in April.

Led as expected by lower household #energy bills and another drop in #food price inflation, but ‘core’ rate slowed too.

Services inflation still high, but ticked down. pic.twitter.com/1dHJ71mcND

— Julian Jessop FRSA (@julianHjessop) May 22, 2024

The headline CPI fall in April is the biggest in 45 years – driven by falling energy prices. But it isn’t quite as big as hoped – (@bankofengland forecast 2.1%) – with core and services inflation both more stubborn than hoped

— Torsten Bell (@TorstenBell) May 22, 2024

07:25 AM BST

Pound jumps to two-month high as inflation higher than expected

The pound has risen after the sharp decline in inflation was still higher than analysts had expected.

Sterling rose 0.3pc against the dollar to $1.275 – its highest level since March – after the consumer prices index dropped to 2.3pc in April, which was higher than forecasts of a fall to 2.1pc.

The pound was up 0.2pc against the euro, which is worth a little over 85p.

07:18 AM BST

Sunak: Brighter days are ahead

Inflation is “back to normal” and “brighter days are ahead”, Rishi Sunak has said in response to the latest figures.

The Prime Minister said:

Today marks a major moment for the economy, with inflation back to normal.

This is proof that the plan is working and that the difficult decisions we have taken are paying off.

Brighter days are ahead, but only if we stick to the plan to improve economic security and opportunity for everyone.

07:17 AM BST

The economy is turning a corner, insists Treasury

The Office for National Statistics has also published borrowing figures this morning, showing that the Government borrowed £20.5bn last month, which was higher than official forecasts.

A Treasury spokesman said:

We rightly protected millions of jobs during Covid and paid half of people’s energy bills after Putin’s invasion of Ukraine sent bills skyrocketing – but it wouldn’t be fair to leave future generations to pick up the tab.

That’s why we must stick to the plan to get debt falling.

The economy is turning a corner, with strong growth this quarter and inflation close to target, allowing us to cut taxes for the average worker by £900 a year.

07:16 AM BST

Energy, tobacco and food prices help lower inflation, says ONS

ONS chief economist Grant Fitzner said:

There was another large fall in annual inflation led by lower electricity and gas prices, due to the reduction in the Ofgem energy price cap.

Tobacco prices also helped pull down the rate, with no duty changes announced in the Budget.

Meanwhile food price inflation saw further falls over the year.

These falls were partially offset by a small uptick in petrol prices.

07:10 AM BST

Energy bills fall by largest amount on record

The dramatic fall in inflation was mainly driven by the lowering of the Ofgem price cap in April, according to the Office for National Statistics (ONS).

It meant that average household energy bills fell by £238 a year to £1,690 following the shock caused by Vladimir Putin’s decision to invade Ukraine.

The ONS said prices of electricity, gas and other fuels fell by 27.1pc in the year to April, the largest fall on record.

Gas prices fell by 37.5pc on the year, compared with a fall of 26.5pc in the year to March 2024, while electricity prices fell by 21pc, compared with 13pc in March.

07:05 AM BST

Inflation falls to 2.3pc

Inflation has fallen less than expected, official figures show, in a blow for the Prime Minister and mortgage holders.

The consumer prices index dropped in April from 3.2pc to 2.3pc following a record decline in typical energy bills last month, according to the Office for National Statistics.

The drop takes the pace of price growth to its lowest level since July 2021 but it was far short of analyst expectations of a plunge to 2.1pc.

The higher-than-expected reading could derail hopes for a summer cut to interest rates, which would provide relief to mortgage holders grappling with the highest borrowing costs in 16 years.

It is also a blow to Rishi Sunak, who has said he only wants to call a general election when people “feel that things are improving”.

Derivatives trades on money markets had indicated the Bank of England would reduce borrowing costs twice by the end of the year from 16-year highs of 5.25pc to 4.75pc.

Traders had priced in a first cut by August and more than a 50pc chance of a first cut in June.

In the 12 months to April 2024:

Consumer Prices Index (CPI) rose by 2.3%, down from 3.2% in the 12 months to March.

Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.0%, down from 3.8% in the 12 months to March.

➡️ https://t.co/MgOQsgwOkV pic.twitter.com/8Oof8bpYua

— Office for National Statistics (ONS) (@ONS) May 22, 2024

07:00 AM BST

Good morning

Thanks for joining me. We begin the day with the economic news that has been keenly anticipated by mortgage holders and the Prime Minister.

Inflation fell to 2.3pc in April, according to the Office for National Statistics, raising hopes that interest rate cuts will not be far away.

5 things to start your day

1) Britain’s third new nuclear power station to be built in Anglesey | New North Wales site expected to generate 7pc of the UK’s electricity

2) Sunak and Hunt to press ahead with tax cuts in defiance of IMF warnings | IMF warns next PM faces ‘tough choices’ despite upgrading UK’s growth forecast

3) Tories accused of abandoning Port Talbot steelworkers | Labour and union bosses launch withering attack after failure to spend £100m rescue fund

4) Bank boss on £3m a year: I only took the job because I can work from home | Santander’s Mike Regnier says there’s no need to spend all five days a week in the office

5) Ambrose Evans-Pritchard: Europe must defend itself or be crushed by China’s export tsunami | Other world power are protecting their industrial cores – the Continent is a sitting duck

What happened overnight

Asian shares edged higher as anxious investors dared to hope that Nvidia, the chip maker at the centre of the AI boom, could meet sky-high expectations.

New Zealand’s central bank offered a sobering assessment of its inflation problems, warning that rates would have to be higher for longer to bring them to heel in a shock to local markets.

That saw the kiwi dollar jump 0.9pc to a one-month high of $0.6151 as bond yields spiked, while it surged to 17-year peaks on the relatively low-yielding yen.

MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.4pc, having already climbed for four straight weeks to reach a two-year top.

Chinese blue chips were little changed, just below a seven-month top hit at the start of the week.

Japan’s Nikkei eased 0.8pc as data showed a weak yen was boosting exports but also stoking imported inflation and weighing on business sentiment.

In America, stock indexes edged up to set more records. The S&P 500 rose 0.3pc, to 5,321.41 and surpassed its record set last week.

The Nasdaq Composite added 0.2pc, to 16,832.62, a day after setting another all-time high. The Dow Jones Industrial Average rose 0.2pc, to 39,872.99, and is sitting just below its high set last week.

The yield on benchmark 10-year US Treasury bonds slipped to 4.41pc from 4.48pc late on Monday.