(Bloomberg) — The Bank of Korea left its key interest rate unchanged despite mounting evidence of an economic hit from the coronavirus, and said it will raise the cap for cheap loans available to companies affected by the epidemic.

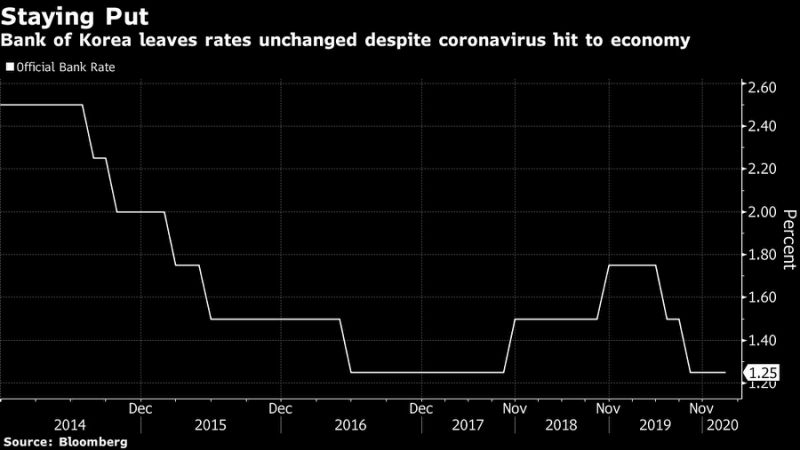

The decision to keep the seven-day repurchase rate at 1.25% was forecast by 10 of 28 analysts surveyed by Bloomberg. The majority had projected a 25 basis point cut to a fresh record low. The bank will later update its economic projections, with analysts expecting a downgrade to its 2.3% growth forecast for this year.

The BOK’s decision to stand pat contrasts with the approach taken by Asian central banks from Indonesia to Thailand that have stepped up support. South Korea’s latest data shows the economy under pressure, as trade with China shrinks, sentiment plunges and the tourism industry reels. The government is working on an extra budget to beef up record spending plans for the year.

The onus is on the government to front load fiscal stimulus into the first half, Rory Green, an economist at TS Lombard, said before the decision. “As Governor Lee Ju-yeol said, they will use ad-hoc measures to maintain liquidity and support firms most exposed to the virus.”

The decision shows Governor Lee is more worried about the financial risks of low rates at the moment, and is waiting for clarity on data and the extent of fiscal stimulus before acting.

Economists who projected a rate hold pointed to concerns about an overheated property market and high household debt, alongside a weakening currency. The BOK may have also wanted to preserve its limited policy room, having cut rates twice in 2019.

Next Step

Governor Lee’s assessment of the epidemic’s impact and the size of any outlook downgrades will offer clues about whether the BOK is likely to cut at its next meeting in April.

The number of South Korea’s infections has spiked from just dozens to over 1,000 in the past week. Both exports and imports to China fell in the first 20 days of February despite the benefit of more work days, signaling that the virus is disrupting supply chains between South Korea and its biggest trading partner.

BOK watchers will also be watching Governor Lee’s post-decision press conference Thursday to see if he has other measures up his sleeve. In October, he said the bank was studying unconventional policy tools, but offered no details. Instead of addressing the media live, Lee will speak over YouTube to minimize the risk of contagion.

(Updates to add additional detail.)

To contact the reporter on this story: Sam Kim in Seoul at [email protected]

To contact the editors responsible for this story: Paul Jackson at [email protected], Jiyeun Lee

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”31″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”32″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.