BOSTON — Stockholders in Kellogg have been crying into their Corn Flakes for years.

Their investments have lost more than a third of their value in the last three years, while the rest of the stock market has boomed. Kellogg stock K, +6.30% which peaked at $87 in July 2016, is down to under $54 and recently touched a seven-year low after falling 6.4% just since the start of this year through Monday.

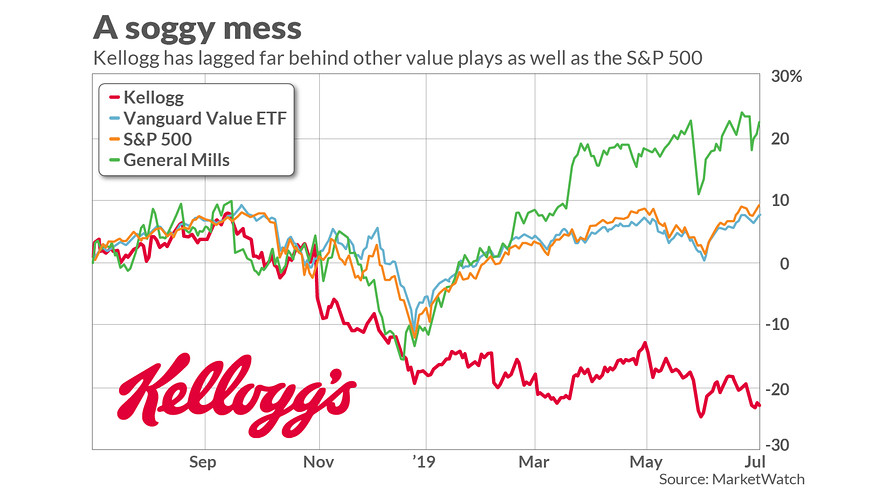

This is a dismal performance, even for a stock in the unfavored “value” half of the market. Kellogg is underperforming comparable staples like McDonald’s MCD, +1.54% General Mills GIS, +1.48% Campbell Soup CPB, +2.53% Procter & Gamble PG, +2.33% and Johnson & Johnson JNJ, +1.51%

And while Kellogg has slumped 23% in the past year through Monday, the Vanguard Value exchange-traded fund VTV, +0.79% has risen 7.4%. The S&P 500 SPX, +0.77% is up 8.7%

Given all these stock-market losses, why is the management letting free money go by?

I spoke to them and couldn’t get a straight answer. I also asked analysts, but they declined to comment, saying they haven’t written on the topic.

Anyone watching the stock market, reading the financial news, or even watching consumer news knows that there’s a sudden Wall Street mania for so-called “fake meat” burgers. Beyond Meat BYND, +1.20% has skyrocketed sixfold since its IPO two months ago, and its bigger rival Impossible Burger is rumored to be heading for its own listing sometime soon.

Yet Kellogg already owns the largest single “fake meat” operation in the country in MorningStar Farms, a brand that has been around since the 1970s. Where’s its IPO?

I asked Sara Young, one of the Kellogg executives running MorningStar Farms, if an IPO was on the cards. She laughed. “Not that I’m aware of,” she said.

Why not? She couldn’t comment further.

I tried MorningStar’s “Grillers” vegetarian burgers not long ago, on the recommendation of some friends. Frankly, I found them way better than Beyond Meat’s “Beyond Burgers” and not obviously worse than the so-called “Impossible Burger” that people are raving about. Everyone has their own preferences and I’m sure others will disagree. But they’re an excellent product. Broil them, stick them in a bun with ketchup and the other fixings, and you’re basically eating a burger that isn’t made out of dead animal. (The MorningStar Grillers are mainly made of soy.)

Young wouldn’t share any results of blind taste tests, but she said: “We’re the largest brand in the category, (and) we have the highest repeat rate in the category.”

I tried to get data on sales or market share, but Kellogg doesn’t break it out, Young wouldn’t disclose it, and market research people Nielsen wouldn’t hand it over.

However, Young admitted “we serve over 90 million pounds of food to consumers annually,” and added that about a third of sales were fake burgers, a third were fake chicken products, and a third were others, such as fake breakfast sausage.

From this, it’s possible to start sketching out some rough numbers. MorningStar Grillers sell for about $6.50 a pound at Walmart WMT, +0.65% where gross margins average about 25%. That suggests the wholesale price is about $5.20 a pound. Grillers sell for about $5.76 a pound in at privately owned BJ’s Wholesale Club. Based on numbers from publicly traded rival Costco COST, +1.38% the gross margins in wholesale clubs are around 10%. So these numbers, too, suggest a wholesale cost of $5.20 a pound.

If Morningstar is getting just over $5 a pound for its products, and is selling 90 million pounds of food, it would be generating sales of $450 million a year.

Forecast annual sales for Beyond Meat for 2019: $210 million.

OK, this is a back-of-the-envelope guess. Maybe MorningStar Farms’ sales are only $400 million, or $350 million. Directionally, it doesn’t matter that much.

What matters is that Wall Street in its insanity has slapped a $10 billion market valuation on Beyond Meat, or about 50 times annualized sales. If MorningStar got half the rating of Beyond Meat, and sold for a “mere” 30 times sales, we’re looking at a spinoff valued at more than $10 billion. Be even more conservative: halve the figure, and you’re still looking at $5 billion.

Dress up the MorningStar Farms operation for “growth,” do some repackaging and rebranding, make it trendier, then launch an IPO and raise a ton of money.

This is how it works. Stocks, as the old saying goes on Wall Street, “are created to be sold.”

How big a deal is a value of $5 billion or $10 billion? Kellogg’s market value is now $18 billion. Throw in debt and the total enterprise value is $28 billion, says FactSet.

Kellogg directors are paid $250,000 a year and the CEO, Steve Cahillane, collected $10 million last year, even as the stock plunged. Perhaps they might like to cash this blank check on behalf of the stockholders at some point. If, you know, it’s not too much trouble.

If they don’t, someone else will. I’d wager cash to Corn Pops that a private-equity behemoth or a competitor is already running the numbers on taking over the entire company and breaking it up.

Brett Arends is a MarketWatch columnist. He doesn’t own any of the individual stocks mentioned in this article.