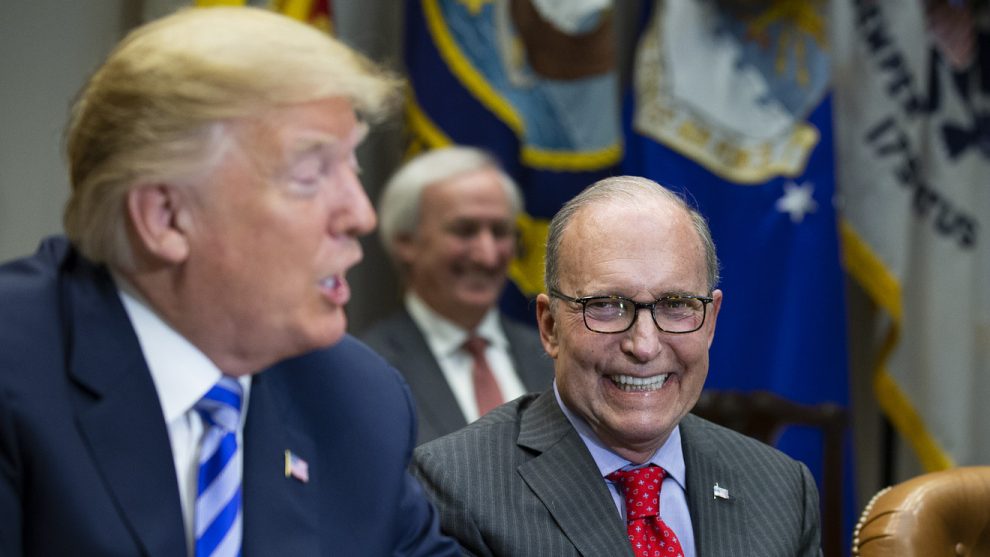

Larry Kudlow may be the only thing standing between us and the next leg of a currency war.

The president’s chief economic adviser is a “strong dollar” man.

“A great country needs a strong currency,” he told CNBC soon after he was tapped last year to join the administration. “I have no reason to believe [President Trump] doesn’t favor a sound and strong and steady dollar.”

View him as a tool of the “Deep State.” Or view him as Sparta’s King Leonidas, holding the pass for civilization. It’s up to you.

But Kudlow isn’t the president, Donald Trump is. And after recent events, the markets are now drastically raising the odds that the federal government will intervene to drive down the dollar BUXX, -0.03% .

Analyst Chris Turner at investment bank ING says the options markets are giving a remarkable 23% probability that the dollar will slump as much as 3% against the Japanese yen USDJPY, -0.15% within the next month. And a 13% chance it will do the same against the euro EURUSD, +0.0714% .

(It also gives a 9% chance of such a move against the Chinese yuan USDCNY, -0.0014% , but that’s a stickier subject because the Chinese are likely to manipulate their currency right back). Turner himself thinks the chance of a Federal intervention to drive down the dollar is 25%.

To cut to the chase: If you think this is going to happen you’d probably want to own some gold GC00, -0.10% GLD, -0.33% , Swiss francs CHFUSD, +0.0411% FXF, +0.16% , or yen FXY, +0.40% .

You might also want to consider the risk that a currency war could spook the stock market SPX, -0.66% .

Options markets are reacting to the growing war of words between the world’s two most powerful countries. China has let its currency drop against the dollar in retaliation for the latest round of Trump tariffs. The Trump administration has officially labelled China a “currency manipulator.”

The U.S. dollar, on a broad measure DXY, +0.02% , is now higher against other currencies than it was when Trump took office.

“As your president, one would think that I would be thrilled with our very strong dollar,” Trump said Thursday via the Stupid Website That Shall Not Be Named. “I am not! The Fed’s high interest rate level, in comparison to other countries, is keeping the dollar high, making it more difficult for our great manufacturers like Caterpillar, Boeing… John Deere, our car companies, & others, to compete on a level playing field.”

If the Fed cut rates, he added, “the dollar will make it possible for our companies to win against any competition.”

By that he means: A falling dollar.

This is not the first time he’s made this point. As far back as early 2016 he was warning that a high dollar was hurting U.S. companies by making their products too expensive overseas.

And hedge-fund manager Matthew Klody was arguing shortly after Trump took office that, sooner or later, he’d go after the dollar. He argued that over many decades, the soaring dollar had gone hand in hand with the collapse in manufacturing jobs.

It started to happen in 2017. The dollar tumbled as much as 8% in 2017. But rising U.S. economic growth and interest rates, coupled with lower rates in many places overseas, turned that around.

Trump is currently trying to tackle the trade imbalance using tariffs. But if he means his recent comments, that may soon change.

There are several ways the administration could intervene to drive down the dollar. It doesn’t have to involve the Federal Reserve cutting interest rates. Ultimately, the Treasury could just sell dollars on the international markets in exchange for yen, euros, and so on.

It sets up a potential conflict with the president’s chief economic adviser.

Kudlow subscribes to the theory that a strong currency is no impediment to strong exports. He notes that the soaring Japanese yen didn’t stop Japan’s exports booming in the 1970s and 1980s. Ditto the Deutsche mark and Germany.

Make of it what you will.

But he’s passionate. I know and like Kudlow, even though we disagree about many things. He used to invite me onto his television and radio shows, and he was always singing the praises of “King Dollar.”

Whenever I’d written an article that might be bearish about the greenback he’d invite me on so he could (nicely) give me a hard time. He’s a very persuasive arguer. He is presumably working hard on his current, mercurial charge.

What will happen next? Stay tuned.