As the parent of a high school junior, I feel like the unluckiest college saver. I’m close to tuition bills coming, which is not a good time for our portfolio balance to be down 17.5% since last year — even in an age-based investment fund that’s pretty conservative by now. To boot, this is something of a double-whammy, because I started saving in 2007 and the account took a beating right off the bat with the 2008-2009 financial crisis.

Early losses and late losses are hard on investment accounts, but with college on a fixed timeline, it’s hard to get around when the bills are due. We’re starting college visits and I’m just a year or so away from having to put down a deposit. In the meantime, both U.S. stocks DJIA, +1.12% and bonds TMUBMUSD10Y, 4.030% are down, and there’s no known timeline for economic recovery.

So what is the best way to maximize my savings, starting now? I talked to some experts to see what parents like me should do.

Get more conservative

While families saving for high school juniors don’t have college bills just yet, it’s time to start the goal-line offense, especially if your funds are in equities. Things could get better before that first tuition bill is due, or by the time today’s high schoolers graduate from college — or not.

Your instincts might tell you to leave the money in the market in case it bounces back, but this isn’t what experts advise for the portion of the money you need soonest. Your best strategy could be to lock in some losses, especially if you currently have a high school senior at home.

“For August tuition next year, I say let’s get that into cash and set it aside,” says Kyle McBrien, a financial planner at Betterment.

If you don’t like the idea of a big chunk of money — we could be talking about $80,000 for one year of private university at full cost — sitting in cash and losing to inflation, you can look at a high-yield savings account, short-term CDs or Treasury bills, but it’s best not to take any risk with money that’s needed soon.

But this applies only to the first bill due. “If you can stomach it, you might want to continue with age-based funds for the later years of college,” says Rita Assaf, vice president of retirement and college products at Fidelity Investments. “If you feel a little more scared, it’s ok to go into stable-value funds. It’s a safer option, kind of an in-between.”

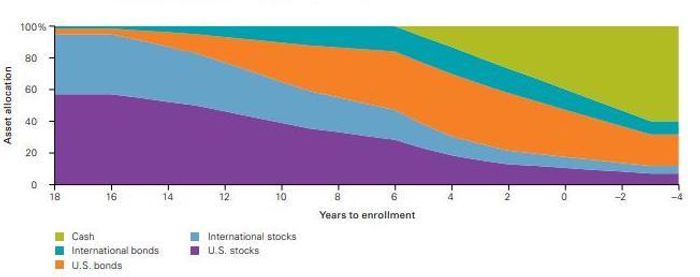

Many age-based portfolios in a 529 savings plan will automatically adjust to become more conservative over time, so you don’t have to worry about cashing out that money now, says Nathan Zahm, head of goal-based investing research in Vanguard’s Investment Strategy Group. For instance, a Vanguard age-based fund is typically more than 20% in cash at two years out from the target enrollment date, and around 40% in stocks. Fidelity’s 2024 fund typically has less than 40% in stocks and just over 50% in bonds.

The age-based funds are linked to a high school graduation date, but assume you’ll stay invested for at least four more years as you pay for college.

A sample Vanguard age-based fund

Keep saving

My parents didn’t have the opportunity to save much for me to go to college, and certainly didn’t think about the investing options available back then. But I’m part of the generation of parents since 1996 with access to Section 529 college savings plans. These are state-sponsored investment accounts for educational use that grow tax-free, and in some states offer a tax break for contributions. So I joined with more than 15 million families that have opened these accounts over the years. The plans had amassed more than $450 billion in assets by the end of 2021, according to the Investment Company Institute, a mutual-fund industry trade group.

Other families choose to save for college in custodial accounts for minors, or in commingled accounts with other savings. Others might have prepaid tuition plans. It’s all good, considering how the price of college has consistently increased more than inflation. “As we say, every dollar saved is one less borrowed,” Assaf says.

College-savings growth will be slower in the next two years if you keep your savings and ongoing contributions in cash, but whatever you can accumulate will make it easier when the time comes for the bills.

Spend in the right order

I have a younger child whose college fund escaped the Great Recession and has caught mostly upswing in the market. I put in the same lump sum amount for each child, two years apart, and made the same recurring contributions as time went along.

Right now, the younger child has a higher balance than the older one, basically because of the market fluctuations the older one faced at the beginning. The annualized return of the S&P 500 SPX, +1.14% during the investing time period for my older child was 6% through Sept. 30 of this year, but it was 7.7% for the younger one, according to FactSet data. If I had started investing in 2009, it would have been 10%.

You might say, tough luck for the older kid. But that’s not the way it needs to go for us. Since I’m the owner of the 529 accounts, I can move money between the two children easily. I can even shift more to the older child, spending down our savings in the first few years of college.

“My recommendation is to always use 529 first,” says Robert Farrington, founder of The College Investor. “It might be down, but your tax advantage expires if you don’t use it for college.”

That’ll give the rest of the investments more time to recover, for one thing, and also gives me more time to save, if I can. By the time my younger child heads off to college, maybe I’ll even be making more. Or, if not, maybe I’ll qualify for more financial aid because I’ll have depleted our savings.

More from MarketWatch

If the FAFSA makes you look too rich, here are 4 steps to boost college financial aid

Here’s the information you’ll need to apply for student debt forgiveness under Biden’s plan

Why some student-loan balances grow — even if you’re making diligent payments