The federal government will allow you to save nearly 10% more for retirement in 2023. But it’s not likely that many will take advantage of the tax break. The simple reason: Most people don’t make enough money to save more from their paychecks.

The average amount that participants contribute is 7.3% of their salary, according to Vanguard’s How America Saves 2022 report. At that rate, you’d have to make more than $300,000 to hit the $22,500 maximum amount an employee can save in a workplace plan for 2023, up from $20,500 in 2022. To put it another way, to save the max, you’d have to put aside $1,875 per month, or $865 per paycheck if you’re paid biweekly.

Only 14% of participants saved the maximum amount in 2020.

Few people will also likely take advantage of the increase in the catch-up contribution limit, which will allow those 50 and older to contribute an extra $7,500, up by $1,000 from 2022, for a total of $30,000. Vanguard’s report found that only 16% of those eligible participate, even though 98% of plans allow for catch-up contributions.

“The max numbers are very high. A lot of people don’t make that kind of money,” says Anqi Chen, assistant director of savings research at the Center for Retirement Research at Boston College.

You might not need to max out

Not everyone needs that kind of money put away for retirement. The key is to save over time to eventually be able to replace your current income in the future, supplemented by Social Security. If you’re making $60,000 now, it wouldn’t make sense to try to save more than a third of your yearly income just because the government says you can.

“You don’t want to deprive yourself today or later on. You want to balance that over time, to be able to maintain the same standard of living in retirement,” says Chen.

The tried-and-true method to get people to contribute to retirement savings is a monetary incentive: matching funds. That “free money” on the table is at the base of every recommendation for how much workers should contribute. Give at least up to the match, everyone says. But almost all company retirement plans offer matching funds, and it hasn’t yet solved the retirement crisis facing most Americans who haven’t saved enough.

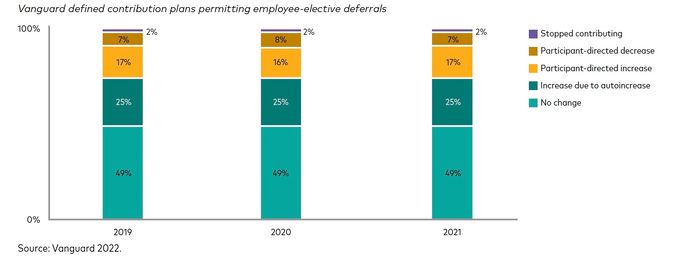

Trend in deferral rate changes

If there’s a takeaway from the new IRS limits, it’s that pushing up the limits every year does help. Retirement contributions have been indexed for inflation since 2001 for good reason, because legislators recognized that the amount you need in the future is constantly going up.

Ten years ago, the maximum for 401(k) contributions was $17,000 and going back 30 years to 1992, it was $8,728. In today’s dollars, that certainly wouldn’t be enough.

At the same time, the government has to cap it somewhere to put a limit on tax deferral, so you can’t just shelter all your income from the IRS.

“These annual step-ups matter over time, because saving for retirement is a multidecade thing,” says David Stinnett, head of strategic retirement consulting for Vanguard.

His advice for those who can’t max out, particularly younger workers, is to at least contribute up to the company match and then automatically escalate your savings rate over time to something in the rage of 12% to 15%.

It can be helpful to think of the amounts in dollar terms, rather than percentages.

“By starting small and thinking of it as just ‘3 pennies per dollar’ earned and then adding ‘2 pennies per dollar’ each year going forward, you’ll get on track to those recommended savings rates in no time,” says Tom Armstrong, vice president of customer analytics and insight at Voya Financial.

Escalating over time does seem to move the needle, according to Vanguard’s study, at least if you look at the rate of people coming to the table. The voluntary participation rate was only 66%, but the participation rate for automatic enrollment was 93%.

“What that does is make it easy to save more,” says Stinnett.

Related: This easy, free iPhone hack could be the most important estate planning move you make