Both companies benefit from the adoption of AI in the cloud, but one of them stepped up its game recently.

The cloud infrastructure market got a nice boost over the past two years thanks to the growing adoption of artificial intelligence (AI). Companies across the globe have been using cloud services to train AI models for their specific purposes.

The massive demand for AI in the cloud is the reason Goldman Sachs expects the global cloud infrastructure market to clock $2 trillion in revenue in 2030 as compared to $496 billion last year. The investment bank forecasts that generative AI alone could drive $200 billion to $300 billion in annual cloud spending by the end of the decade.

Microsoft (MSFT -0.76%) and Oracle (ORCL 0.38%) are two companies trying to make the most of this huge cloud infrastructure opportunity. But which one of these two cloud-focused AI stocks should you consider buying right now? Let’s find out.

The case for Microsoft

Microsoft was one of the early movers in the AI market thanks to its partnership with OpenAI, the developer of ChatGPT. That partnership helped the company quickly integrate AI-focused tools into several of its products such as the Azure Cloud, the Windows operating system, and the Microsoft 365 office productivity and collaboration tools.

The company’s AI-specific services gained impressive traction. For example, its generative AI assistant, Microsoft Copilot, saw healthy demand growth in multiple areas. On the July earnings conference call, CEO Satya Nadella said that its Copilot for the developer platform GitHub is being widely deployed by enterprise customers, with more than 77,000 having chosen it, up 180% year over year. Nadella added that Copilot accounted for more than 40% of GitHub’s revenue growth in fiscal 2024 (which ended June 30). Microsoft’s Power Platform, which allows customers to build apps embedded with AI, had 45% sequential growth in the previous quarter. Copilot for Microsoft 365, which is the company’s cloud-based suite of productivity and collaboration tools, saw a 60% sequential increase in its customer base last quarter.

Investment banking firm Piper Sandler estimates that Microsoft 365 Copilot alone could generate $10 billion in annual revenue for the company by 2026. More importantly, Copilot could unlock a terrific long-term opportunity as the market for intelligent virtual assistants is expected to grow 27% annually through 2032, generating almost $100 billion in revenue that year as compared to last year’s $10 billion.

AI also boosted Microsoft’s cloud computing business. The company reported 60,000 customers using its Azure AI cloud service last quarter, up 60% from the prior-year period, with the average spending per customer increasing.

As a result, Azure revenue increased 30% year over year last quarter (in constant-currency terms), and 8 percentage points of that growth was attributable to AI services. Microsoft is the second-largest provider of cloud infrastructure services with a market share of 20%, so its cloud business should benefit from the adoption of AI services.

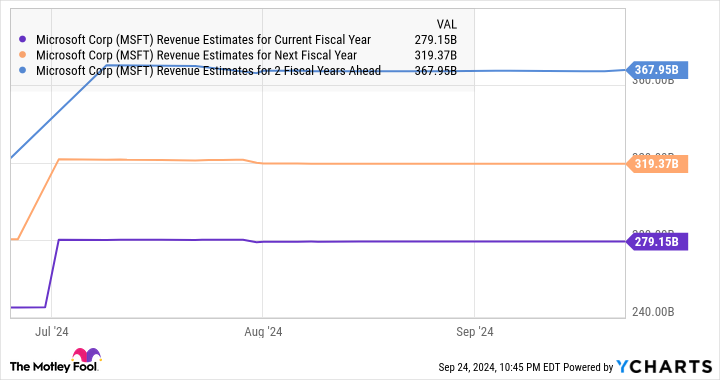

MSFT revenue estimates for current fiscal year; data by YCharts.

Microsoft is making the most of the lucrative cloud AI market thanks to its presence in multiple applications. Analysts expect revenue growth to remain solid over the next three fiscal years following a 16% jump in fiscal 2024 to $245 billion.

But is it a better investment than Oracle?

The case for Oracle

Oracle has burst onto the AI scene of late, with customers using its cloud infrastructure to train AI models. Cloud infrastructure revenue shot up 45% year over year in the first quarter of fiscal 2025 (ended Aug. 31, 2024) to $2.2 billion, outpacing the 7% growth in the company’s overall revenue to $13.3 billion.

Oracle’s cloud infrastructure-as-a-service business expects impressive and prolonged growth for two reasons. First, the infrastructure-as-a-service market is forecast to hit $580 billion by 2030, accounting for a major chunk of overall cloud spending. Second, Oracle is going all out to increase its capacity as the demand for its cloud infrastructure is outpacing supply.

The remaining performance obligations (RPO) of its cloud business shot up 80% year over year last quarter. RPO is the total value of a company’s contracts that are yet to be fulfilled, and overall RPO jumped 52% year over year in the fiscal 2025 first quarter to $99 billion.

Oracle is on track to double its capital expenditures in fiscal 2025 to $15 billion. The aim is to allow the company to serve the additional AI-related demand. Management expects revenue to grow by 10% in fiscal 2025 to $58 billion. Prior projections had growth pegged at 7%.

Management believes the company could achieve 12% revenue growth in fiscal 2026 to $65 billion as it converts more of its RPO into revenue. It has also updated its long-term forecasts and expects its top line to grow to at least $104 billion in fiscal 2029, along with annual earnings growth of over 20% over the next five years.

This is where the company enjoys an advantage over Microsoft, whose earnings are forecast to increase at an annual rate of just under 15% for the next five years.

The verdict

Microsoft and Oracle are top cloud computing stocks that benefit from the proliferation of AI services in the cloud. Microsoft is growing faster than Oracle right now. At the same time, Oracle’s solid revenue pipeline is why its pace of growth is expected to top Microsoft’s in the future.

As such, it boils down to the valuation of the two companies to determine which is a better AI play right now. The following chart tells us that Microsoft is the cheaper of the two stocks when we compare their trailing price-to-earnings ratios (P/E). However, Oracle’s forward earnings multiple is much lower than Microsoft’s and points toward a stronger jump in earnings.

MSFT PE ratio data by YCharts.

Also, Oracle is undervalued looking at the price/earnings-to-growth ratio (PEG) of the two companies.

MSFT PEG ratio (forward) data by YCharts.

The PEG ratio is a forward-looking valuation metric that considers the potential earnings growth that a company is likely to deliver. A reading of less than 1 indicates that a stock is undervalued with respect to its growth forecast, which is the reason investors looking to add an AI stock that could capitalize on the lucrative cloud computing market might be tempted to buy Oracle over Microsoft.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.