The tremendous growth of the AI chip market has been a big tailwind for both companies.

Semiconductor giants Nvidia (NVDA 0.94%) and Taiwan Semiconductor Manufacturing (TSM 1.76%) have delivered stellar gains so far in 2024 as both companies benefit from the growing demand for artificial intelligence (AI) chips that both companies specialize in.

Nvidia’s stock is up 115% this year, while TSMC’s gains are just under 55%. The interesting thing to note here is that Nvidia is a fabless semiconductor company, which means that it only designs its chips. It outsources the manufacturing of its chips to foundries such as TSMC.

While Nvidia is considered the top player in the AI chip market, it utilizes TSMC’s foundries for its chip manufacturing. Nvidia was TSMC’s second-largest customer last year, accounting for 11% of the Taiwan-based foundry giant’s revenue. This may lead investors to believe that TSMC’s fortunes are dependent on Nvidia’s.

Does that mean Nvidia is the better AI stock of the two? Let’s find out.

The case for Nvidia

Nvidia’s financial metrics for the second quarter of fiscal 2025 (the three months ended July 28) make it clear that it is the dominant player in the AI chip market. The company’s quarterly revenue jumped 122% year over year to a record $30 billion. Its data center segment produced a record $26.3 billion in revenue for the company, an increase of 154% from the same quarter last year.

Growth like this puts the company way ahead of rivals such as Advanced Micro Devices, which reported $2.8 billion in data center revenue in its latest quarter, a jump of 115% year over year. Nvidia’s data center business is leagues ahead of AMD’s and it is growing at a faster pace despite having a larger revenue base. A key reason Nvidia is able to generate that level of growth is because of TSMC.

The Taiwanese foundry expects to increase its chip-on-wafer-on-substrate (CoWoS) advanced packaging capacity by 150% in 2024 to satisfy the growing demand for Nvidia’s chips. What’s more, TSMC is reportedly going to double its CoWoS capacity once again next year. As it turns out, Nvidia is among the companies that have fully booked TSMC’s advanced packaging lines until 2025. More importantly, its data center revenue indicates that TSMC is probably allocating a lion’s share of its AI chip manufacturing capacity to Nvidia.

So, the improvement in TSMC’s output should directly translate into strong growth for Nvidia, especially considering that the demand for its upcoming Blackwell chips exceeds supply. It is also worth noting that the supply of Nvidia’s current generation Hopper chips has improved. Even better, the company expects shipments of AI chips based on the Hopper architecture to increase in the second half of fiscal 2025 even though it is set to begin the production of its next-generation Blackwell chips in fiscal Q4.

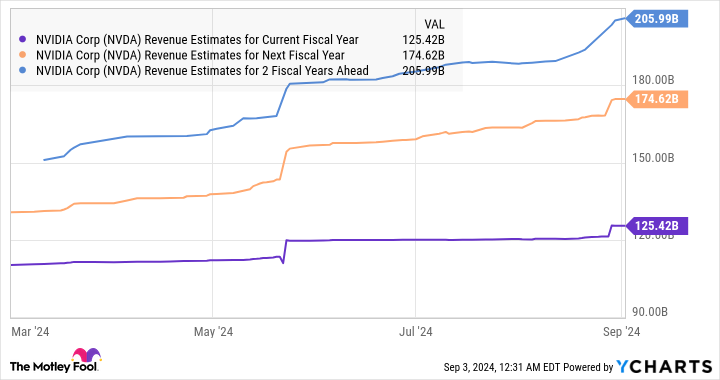

All this indicates that Nvidia’s AI chips enjoy solid pull among customers, leaving very little for rivals such as AMD. Not surprisingly, Nvidia expects another round of solid growth in the current quarter with an estimated revenue of $32.5 billion, which would be an increase of 80% from the same quarter last year. Analysts have also increased their growth expectations from Nvidia for the current fiscal year and the next one following its results.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

The company’s revenue is on track to more than double in fiscal 2025 from the previous fiscal year’s level of $60.9 billion. The fiscal 2026 estimate suggests that its top line could jump another 40%. So, Nvidia has the potential to remain a top AI stock going forward thanks to its robust share of the lucrative AI semiconductor space.

The case for TSMC

We have already seen how TSMC is playing a central role in helping Nvidia remain the dominant player in the AI chip market. However, a closer look will tell us that it is probably a more influential player in AI chips than its illustrious client.

That’s because Nvidia is just one of the companies for whom TSMC is manufacturing AI chips. The likes of Broadcom, Intel, AMD, and Marvell Technology also rely on TSMC’s facilities to manufacture their chips. So, it doesn’t matter for TSMC who the bigger player in the AI chip space is, as almost all the names mentioned above are fabless semiconductor companies (except Intel), which means that they will have to utilize the services of a foundry to make their chips.

However, this is not the only way TSMC can capitalize on the AI market. Qualcomm and Apple also get their chips manufactured through TSMC, which puts the latter in a strong position to benefit from the secular growth in the smartphone and personal computer (PC) markets. So, TSMC gives investors a more diversified way to play the AI opportunity.

Investors should also note that TSMC’s growth aggressively accelerated in 2024 because of AI. The company’s revenue in the first seven months of 2024 increased by 30.5% from the same period in 2023. That’s a strong comeback from 2023 when its top line fell almost 9% year over year to $69.3 billion.

The company is expected to finish 2023 with a 27% increase in revenue to $88.6 billion, followed by healthy increases over the next couple of years as well.

TSM Revenue Estimates for Current Fiscal Year data by YCharts

So, TSMC has the potential to remain a top AI stock going forward, just like Nvidia. But is it a better buy right now?

The verdict

There is no doubt that Nvidia is growing at a much faster pace than TSMC. However, investors will have to pay a significant premium to buy shares of Nvidia right now. This is evident from the chart below.

NVDA PE Ratio data by YCharts

TSMC stock is cheaper than Nvidia, and we have already seen why it looks like the more diversified AI stock of the two. That’s why long-term investors looking for a mix of growth and value should consider buying TSMC over Nvidia. But those with a higher appetite for risk can still consider going long on Nvidia stock as its AI chip dominance is likely to translate into more upside going forward.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom, Intel, and Marvell Technology and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.