These companies are both investing billions in AI, but one is a safer bet over the long term.

Tech stocks have been on fire over the last year thanks to a rally in the artificial intelligence (AI) market. The Nasdaq Composite index, which includes many of the world’s leading tech companies, has popped 21% year to date (outperforming the S&P 500‘s 16% rise). The launch of OpenAI’s ChatGPT toward the end of 2022 brought renewed interest in AI and illustrated its potential to boost countless industries.

As a result, the companies behind the hardware and software that makes AI possible have enjoyed significant stock gains. Two companies on Wall Street’s radar are Advanced Micro Devices (AMD 4.88%) and Microsoft (MSFT 1.47%), with one a leader in chip design and the other delivering innovative ways to get AI into the hands of millions of consumers.

These companies could have bright futures in AI, a market projected to hit close to $2 trillion in spending by 2030. So, let’s take a closer look at these tech giants and determine whether AMD or Microsoft is the better stock to invest in AI.

Advanced Micro Devices

Shares in AMD have spiked 153% since the start of 2023. The company has gone full force into AI, motivated by its rival Nvidia‘s immense success in the industry. Nvidia’s earnings and stock price have hit record heights as its AI graphics processing units (GPUs) have become the go-to for developers worldwide.

AMD has responded by launching competing chips and has made promising progress, attracting customers like Microsoft and Meta Platforms. Meanwhile, the company is taking its cues from Nvidia, shifting to an annual chip release schedule rather than the two-year cycle it was previously on. So, after announcing its MI300X AI accelerator last year, the company followed that by unveiling its MI325X this June.

However, AMD has its work cut out, with Nvidia responsible for between 70% and 95% of the AI chip market. These companies are by no means new competitors. AMD has played second fiddle to Nvidia in the desktop GPU market for at least the last decade. Since 2014, AMD’s share of the sector has fallen from 35% to 12%, while Nvidia’s has soared from 65% to 88%.

AMD’s performance in the desktop GPU market doesn’t inspire much confidence yet in how it will do against Nvidia in AI. However, the rapid growth of the industry and soaring chip demand could play in AMD’s favor, with room for Nvidia to retain its dominance and for AMD to find a lucrative role in meeting supply demands that its rival can’t.

Microsoft

While AMD faces the repercussions of a delayed start in AI, it’s almost the opposite for Microsoft. The software king was an early investor in the industry, partnering with ChatGPT developer OpenAI in 2019. Microsoft has invested about $13 billion in the start-up over the years, making it OpenAI’s biggest backer.

The partnership has made Microsoft a major threat in AI, allowing it to get a head start over competitors Amazon and Alphabet. Access to some of the most powerful AI models in the industry has enabled Microsoft to enhance multiple areas of its business. The company has integrated aspects of ChatGPT into its search engine, Bing, monetized new AI features on its Office productivity software, and brought generative tools to its cloud platform, Azure.

Meanwhile, Microsoft’s AI efforts showed signs of paying off in its third quarter of 2024 (which ended in March). Revenue increased by 17% year over year to $62 billion, beating forecasts by more than $1 billion. AI appeared to boost multiple parts of its business, with revenue in its productivity and intelligent cloud segments increasing by 12% and 21%, respectively.

Microsoft’s recent success saw it surpass Apple as the world’s most valuable company this year. Yet, its dominance in tech and vast financial resources indicate it’s nowhere near hitting its ceiling.

Is AMD or Microsoft the better AI stock?

AMD and Microsoft are at vastly different stages in their AI journeys, with one still figuring out where it stands among its competitors and the other enjoying success with increasingly established services.

As a result, the question of which of these companies is the better AI stock lies in their reliability. AMD’s long-term position in AI is more uncertain than Microsoft’s. Meanwhile, the chipmaker has significantly less cash reserves than the Windows company, which only creates more doubt about its future.

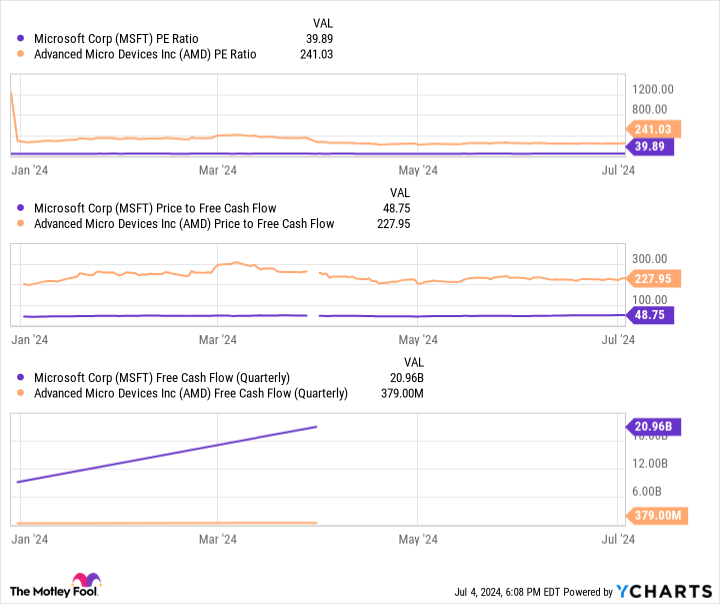

Data by YCharts

Moreover, this chart shows that AMD’s stock offers significantly less value than Microsoft’s, illustrated by its far higher price-to-earnings ratio and price-to-free cash flow. AMD’s earnings growth has yet to align with its share price, making it overvalued for now. Microsoft isn’t exactly a bargain buy, but these valuation metrics show it’s a more reasonably priced option.

Meanwhile, Microsoft’s considerably higher free cash flow indicates it’s better equipped to continue expanding in AI and keep up with its rivals. As a result, Microsoft is the better AI stock and an attractive long-term buy right now.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.