These companies stocks dipped in July, presenting compelling investment opportunities.

Tech stocks have been battered and beaten over the last month, with the Nasdaq-100 Technology Sector down 13%. There’s not one specific reason for the sell-off, but rather several different ones. Better-than-expected inflation reports at the start of July triggered a slight reshuffle on Wall Street, allowing investors to pull back from the reliability of tech and look into less stable investments.

Then, midway through the month, the Biden administration proposed more stringent sanctions on chip exports to China. Combined with the start of earnings season at the end of July, many tech stocks slid in recent weeks.

While a market dip can be worrying, it also presents many buying opportunities. The tech industry remains one of the best places to invest for the long term, fueled by innovative companies that never cease to push the envelope. Meanwhile, a sell-off generally means better-priced stocks.

Two attractive long-term options are Nvidia (NVDA -1.78%) and Alphabet (GOOGL -2.40%) (GOOG -2.35%), with one leading the artificial intelligence (AI) chip market and the other home to a booming cloud business. Either of these companies’ stocks would likely be real assets for any portfolio over the long term.

So, let’s compare these tech giants and determine whether Nvidia or Alphabet is the better stock this year.

Nvidia

Nvidia’s stock took a hard tumble over the last 30 days, falling 12%. The dip hasn’t been great for current stockholders, but it has made the shares more accessible to new ones thanks to an improved valuation.

The price-to-earnings (P/E) ratio is at one of its lowest levels in months, at about 62. That’s high for a P/E and doesn’t usually represent a bargain, but it’s significantly lower than Nvidia’s five-year average P/E of 80.

That average saw Nvidia’s stock rise more than 2,500% since 2019, suggesting its current position is unlikely to stop it from delivering major gains in the coming years.

Meanwhile, the company maintains a solid long-term outlook. Nvidia will post its 2025 second-quarter earnings on Aug. 28, an even that will likely boosting its share price. It beat Wall Street estimates for four consecutive quarters, and this quarter will likely follow suit.

Nvidia’s chip rival Advanced Micro Devices reported second-quarter 2024 earnings this week. Revenue outperformed forecasts by $12 million as sales in its AI-focused data center segment surged 115% year over year. Considering Nvidia dominates the AI chip industry with an estimated 70% to 95% market share, it could be in for another quarter of beating expectations based on AMD’s performance.

A recent stock slump and an upcoming earnings release could be an excellent time to buy Nvidia before it’s too late.

Alphabet

Alphabet is another exciting way to invest in tech. While Nvidia dominates hardware, Alphabet has reached historic heights with the popularity of its software. Its Android, Chrome, YouTube, and Google have made the company a household name and a thoroughly reliable growth stock.

Alphabet’s shares have risen 178% over the last five years, beating the S&P 500‘s 82% rise. The company won over investors with consistent reinvestment in itself and financial growth.

The tech giant reported its second-quarter earnings last week, beating expectations in multiple areas. Earnings per share came in at $1.89 versus the $1.84 forecast. Net sales rose 14% year over year, landing $450 million above estimates. The quarter was the first time Google Cloud surpassed $10 billion in quarterly revenue and delivered over $1 billion in operating profit.

The company slightly missed on YouTube ad revenue, posting $8.7 billion against expectations of $8.9 billion. But sales in the segment still rose 13% year over year, rounding out an overall positive quarter for Alphabet.

The second quarter illustrated that Alphabet’s advertising division remains a highly profitable business, alongside solid prospects in AI.

Is Nvidia or Alphabet the better tech stock in 2024?

Both companies are among the most prominent names in tech, but Nvidia and Alphabet are otherwise challenging to compare. Their businesses operate in vastly different areas of the industry. Nvidia predominantly sells its chips to businesses, with part of its sales tied to the consumer market. Meanwhile, Alphabet’s core business is digital advertising, and it is making impressive headway in cloud computing.

However, these companies do complement each other. Alphabet requires graphics processing units (GPUs) like Nvidia’s to run and expand its cloud services. And Nvidia’s business is thriving by selling its chips to companies like Alphabet.

As a result, it’s worth comparing their valuations to determine which is the better buy.

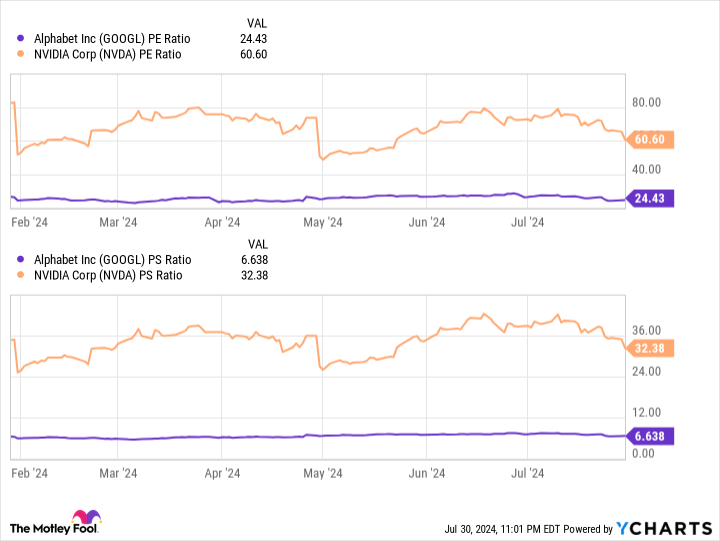

Data by YCharts; PS = price to sales.

Alphabet’s stock is currently a far better value than Nvidia’s, with a significantly lower P/E and price-to-sales (P/S) ratio. These metrics help determine a stock’s value, and the lower the figure, the bigger the bargain.

As a result, Alphabet’s stock is likely a lower-risk investment for now. With a lucrative ad business and expanding role in AI, it’s worth picking up over Nvidia right now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, and Nvidia. The Motley Fool has a disclosure policy.