(Bloomberg) — If FTI Consulting Inc. suffers from a lack of name recognition, its clients don’t.

The firm, staffed with former FBI, MI-6 and Mossad agents, has advised everyone from Jeff Bezos in the alleged Saudi phone hack case that United Nations experts got involved with last month, to George W. Bush and O.J. Simpson’s defense team — not to mention helping recover billions stolen by Bernie Madoff.

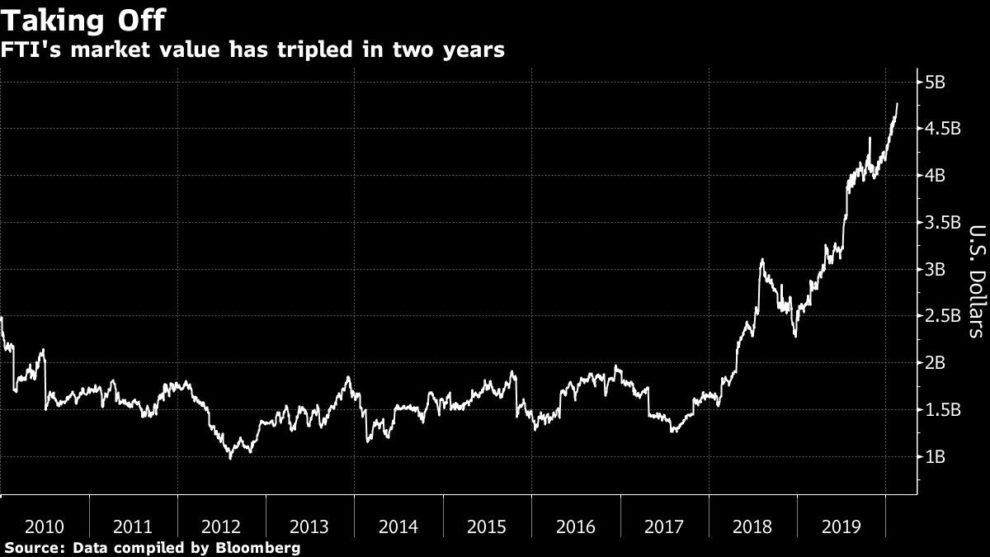

It’s paid off for investors, at least recently. After going nowhere since the 2008 recession, FTI’s market value has almost tripled, rising 191% to $4.7 billion, after beating Wall Street projections in the last two years. The Washington, D.C.-based company is expecting 2019 results, to be released on Feb. 25, to show a second-straight year in which profit increased by more than 40%.

The question now is how long FTI’s recent growth will last. In years past, it relied in part on numerous mergers and acquisitions. FTI’s restructuring business also did well during the recession, working on the bankruptcies of Lehman Brothers, General Motors and CIT Group.

Under Chief Executive Officer Steven Gunby, who started in 2014, FTI has focused more on organic growth, expanding into areas such as cybersecurity and lobbying. But wary investors now want to see another couple of years of growth, said Tobey Sommer, a longtime FTI analyst for SunTrust Robinson Humphrey Inc.

“There’s a lot of skepticism” among investors that FTI can keep growing organically, he said. The shares fell 2.6% on Thursday, the most since November, closing at $125.89.

Even so, the stock should climb to $155 in a year, he projects, or a 20% increase from Wednesday’s closing price. The bullishness was echoed by Joe Kunkle, head of research at Relativity Capital Advisors, which has owned FTI shares. He said the stock’s valuation remains fairly cheap and Wall Street profit expectations are too pessimistic. FTI shares trade at about 22 times earnings, roughly the same as the S&P 500 Index.

FTI declined to comment. In a presentation in November, it said it’s on a path of “sustained double-digit” growth in adjusted earnings-per-share. It expects to post annual profit, excluding some items, of as much as $6 a share on annual revenue of $2.25 billion to $2.3 billion, both records.

Founded in a warehouse in Annapolis, Maryland, in 1982, Forensic Technologies International initially assisted lawyers in finding expert witnesses and then went on to help bring computer modeling and animation to courtrooms. For Simpson’s defense, it built an illustrated timeline. In 1996, the company went public at $8.50 a share.

Over the next decade the company changed its name and bought rivals to expand into restructuring, bankruptcy, accounting, risk advisory and public relations. It helped Bush with trial graphics in the Florida presidential voter case. It worked on the bankruptcy cases of Enron and WorldCom, and snapped up operations of the Big Four accounting firms when they were forced to sell in the aftermath of those scandals.

Gunby is now working to instill “a culture of organic growth” while pushing the company into adjacent services, according to Sommer. He has hired more employees, increasing so-called billable headcount during his tenure by 34% to 4,334 as of September.

One of those hires was the former FBI official Anthony J. Ferrante, whose report on the Bezos case was published by Vice last month.

FTI’s analysis traced the hack on the Amazon.com founder’s phone to a WhatsApp message allegedly sent from the account of Saudi Arabia’s crown prince, Mohammed bin Salman. The Saudi Embassy has denied involvement in the hack, calling the claims “absurd.”

Landing high-profile clients like Bezos for the firm’s relatively new cybersecurity unit could lead to even more business, Sommer said.

(Updates share performance starting in headline)

To contact the reporter on this story: Vivek Shankar in Washington at [email protected]

To contact the editors responsible for this story: Kasia Klimasinska at [email protected], Larry Reibstein, Richard Richtmyer

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”61″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”62″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.