Billionaire hedge fund manager Israel Englander co-founded Millennium Management in 1989 with $35 million. Today, Millennium has over $70 billion in assets under management and is one of the world’s largest hedge funds. Englander has done well and has one of the best investing minds in the game. That’s why investors anxiously await Millennium’s quarterly 13F filing, a form required by the Securities and Exchange Commission (SEC) disclosing a fund’s holdings.

Investors should understand that Millennium is a “pod shop,” which means it allocates capital to different teams (or “pods”) that all have their own strategies and a lot of autonomy. So, an investment at Millennium may not have come directly at Englander’s order. However, as the CEO, Englander likely still has a certain amount of control and a hand in big hiring decisions, so he certainly has faith in his portfolio managers. So don’t follow these managers blindly — but they can serve as sources for picking up new ideas and checking investment theses.

In the third quarter, Millennium sold large portions of its stakes in artificial intelligence (AI) companies Nvidia (NVDA -3.22%) and Palantir (PLTR 4.87%) and bought a new stock that Wall Street thinks can soar.

Selling the AI darlings

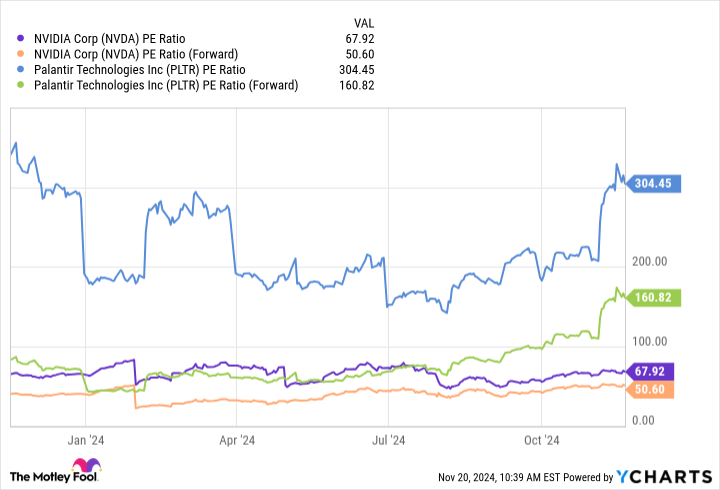

Millennium is not the only big fund selling the chipmaker Nvidia and analytics platform Palantir — it’s definitely been a trend in the third quarter. Millennium sold 13% of its stake in Nvidia in the third quarter, although it still owns 11.15 million shares and put and call options. Millennium sold 90% of its shares in Palantir but increased the company’s call and put options on the stock, which could be a straddle options strategy. The sales appear to be more of a valuation call in a market many view as overbought and frothy. The market has ripped higher for the last two-plus years, spurred mainly by themes like tech, growth, and AI.

NVDA PE Ratio data by YCharts

As you can see above, these are astronomical valuations, despite AI’s ability to disrupt life as we know it. I don’t think institutional fund managers doubt the potential of AI, but an important yet difficult lesson for investors is that valuation does matter. The best businesses with unlimited potential can be bad purchases if bought at extremely high valuations. On the other hand, bad businesses with high debt loads can make great investments if bought at low enough valuations.

It’s difficult to abandon businesses that you have conviction in, but it may be the right call sometimes. When stocks trade at high values, even if the business performs well, there is a smaller margin for error. For instance, Nvidia’s third-quarter earnings report saw sales nearly double year over year but the stock fell the next day after guidance didn’t impress.

A new exciting EV play

During the third quarter, Millennium purchased more than 3.2 million shares in electric aircraft maker Archer Aviation (ACHR 4.50%) for a total value of about $9.8 million, making Millennium the 11th-largest holder of the stock.

Archer is one of two companies trying to launch air taxis for commercial use in select U.S. cities to help ease traffic congestion. The company’s Midnight electric aircraft can carry out consecutive 20- to 50-mile flights with minimal charge time and transport up to four passengers in addition to the pilot. They also supposedly make minimal noise.

Archer has already achieved some key regulatory milestones including receiving the final airworthiness criteria from the Federal Aviation Administration (FAA) and conducting 400 test flights ahead of schedule. In August, Archer also announced a planned air taxi network in Los Angeles that could replace one- or two- hour drives with 10- and 20-minute flights. The company has also forged deals to develop a network with Southwest Airlines. Timing is going to be uncertain, but the launch of commercial flights and networks in select cities is not out of the question in 2025.

Wall Street seems to like the company’s plan, with an average price target of $9.38 among four analysts covering the stock, which implies 88% upside from current levels. The most bullish analyst has a $12.50 price target, implying upside of 151%. Understand that investing in a stock like Archer Aviation is equivalent to investing in a late-stage start-up. The company is not profitable yet. However, the risk-reward proposition is favorable, so investors could see substantial gains if things go well. If Archer can get off the ground, it could gain significant share in a potentially lucrative market.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.