This undervalued stock has a big opportunity in front of it with AI.

Taking profits in chip giant Nvidia (NVDA 2.57%) was a popular move among billionaire hedge fund managers in the first quarter, with a number of notable ones reducing their stakes in the company. Given the run the stock has had, it perhaps should be of little surprise that some big-name investors were taking some profits.

Among the billionaires reducing their stakes in Nvidia were Stanley Druckenmiller of Duquesne Capital Management, David Tepper of Appaloosa Management, Paul Tudor Jones of Tudor Investments, and Philippe Laffont of Coatue Management.

Druckenmiller talked about his reason for reducing his stake in Nvidia, saying in a CNBC interview that he still liked Nvidia but that artificial intelligence (AI) might be overhyped in the near term. However, he said the big payoff could be big in four to five years and that AI may be underhyped in the long term.

While it’s common to see billionaire hedge fund managers taking some profits in a stock like Nvidia, several top hedge fund managers are also piling into Alphabet (GOOG 0.72%) (GOOGL 0.83%). Among the investors aggressively buying the stock in Q1 were Chase Coleman of Tiger Global, Glen Kacher of Light Street Capital, Gavin Baker of Atreides Management, and Foxhaven Asset Management’s Michael Pausic and Nick Lawler.

Let’s look at why these investors might think Alphabet is an attractive investment.

Alphabet is drawing investor interest

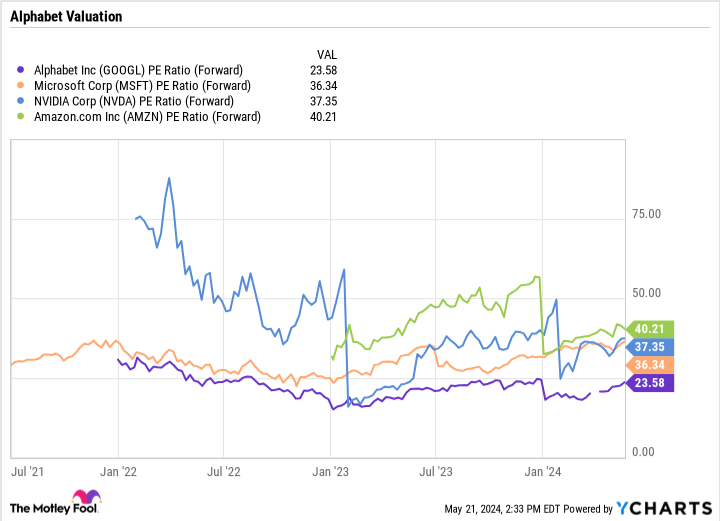

One of the first things that tends to grab hedge fund managers’ attention is valuation. Alphabet trades at a pretty large discount compared to many other AI-related stocks with a forward price-to-earnings (P/E) ratio of only 23.6 times. A number of rivals are trading at over 35 times.

GOOGL PE Ratio (Forward) data by YCharts

In addition, that is below the multiple where Alphabet has traded historically before the pandemic when it would often trade above a 30 times P/E ratio.

GOOGL PE Ratio data by YCharts

That gives Alphabet stock room to run higher, but valuation alone is not a reason that well-regarded hedge fund managers would buy the stock.

An investment in Alphabet is an investment in a company that has two dominant businesses with Google search and video platform YouTube. Google is nearly a monopoly with about an estimated 90% share in global search. While there have been some fears of AI impacting its search business, the company is embracing the technology, rolling out AI overlays at the top of page results to answer more complex questions.

Alphabet will look toward new ad formats to help monetize its latest AI efforts to drive growth. With only about 20% of its search results including ads, this is actually a pretty large opportunity for Google search to become even more profitable in the future by monetizing the search results it doesn’t make money from currently.

Alphabet’s YouTube platform should also not be overlooked. While many streaming services outside of Netflix have struggled with profitably due to content costs, the revenue-sharing model that Alphabet uses with creators has long alleviated these issues. Meanwhile, the company has a strong opportunity to profit from short-form videos that compete with TikTok, which it has just started to monetize. If its competitor gets banned in the U.S., this could be a big opportunity for the company.

In addition, Alphabet’s cloud computing business is still in the early days of ramping up profitability. Given the high fixed costs of the business, profitability should now grow much faster than revenue, which will be driven by AI adoption.

Image source: Getty Images.

Should retail investors follow suit and buy Alphabet?

Alphabet is a relatively inexpensive stock with a dominant position in search and a big opportunity ahead of it with AI. While the stock has had a strong year, up about 27% year to date, it is not too late to follow hedge fund billionaires into the stock.

The company has a long runway of growth ahead and multiple expansion potential (which is an increase in its valuation multiples, such as P/E). Together that is a powerful combination and makes the stock a buy.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Netflix, and Nvidia. The Motley Fool has a disclosure policy.