(Bloomberg) — Bitcoin traders appear to be heeding a warning of a demand slowdown ahead of China’s lunar New Year.

The largest cryptocurrency slumped as much as 4% to $8,281, while altcoins such as Ethereum Classic tumbled more than 11% to $8.18 in New York trading.

Arthur Hayes, co-founder and chief executive officer of BitMex, a cryptocurrency exchange, predicted in a post on Twitter late Wednesday that it’s time for “volatility and volumes to nose dive.”

Cryptocurrencies have been under pressure this week. The price of Bitcoin has dropped more than 6% since Friday, while the Bloomberg Galaxy Crypto Index — which tracks some of the major digital currencies — has slumped about 5.7%.

“Bitcoin and the entire crypto space are under pressure as uncertainty over regulatory scrutiny is expected to intensify and investor skepticism grows for the short-term outlook for risky assets,” said Ed Moya, a market analyst with OANDA. Investors “saw central banks unite and begin a review on digital currencies, fading optimism that a Bitcoin ETF will occur, and amid the China coronavirus worries, a flight-to-safety to the bond markets and not cryptocurrencies.”

Twenty of the top 50 crypto exchanges are based in the Asia-Pacific region and accounted for about 40% of Bitcoin transactions in the first half of last year, according to data from Chainalysis. Within the region, the most exchanges are in China, the research firm found.

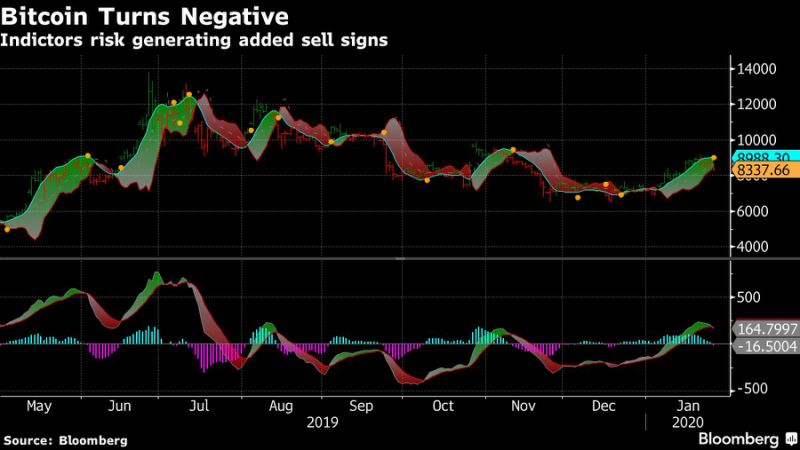

A number of technical indicators are flashing sell signals. Earlier this week, for instance, a measure of upward and downward movements of successive closing prices flashed a sell signal, the first such sign since Bitcoin’s peak in June of last year. Should Bitcoin’s price drop further, the GTI Vera Convergence-Divergence indicator could also generate such a signal.

(Updates prices)

–With assistance from Kenneth Sexton.

To contact Bloomberg News staff for this story: Vildana Hajric in New York at [email protected];Claire Ballentine in New York at [email protected]

To contact the editors responsible for this story: Jeremy Herron at [email protected], Dave Liedtka, Randall Jensen

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”51″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”52″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment