U.S. Treasury yields extended their decline on Thursday as the whole U.S. government bond yield curve slipped below the 2% level, suggesting investors expect gloomy prospects for the U.S. economy.

What are Treasurys doing?

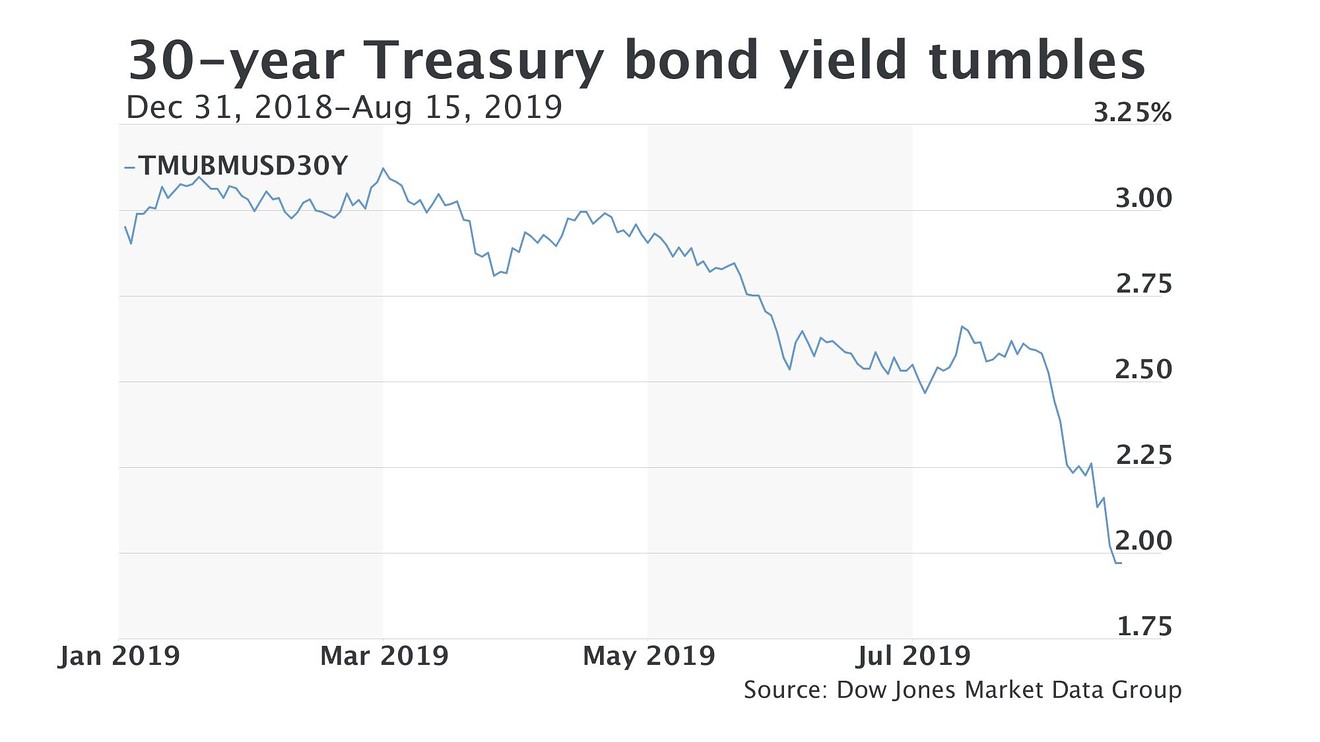

The 10-year Treasury note yield TMUBMUSD10Y, -2.35% fell 5.4 basis points to 1.527%, its lowest since September 2016. The 2-year note yield TMUBMUSD02Y, -2.84% slipped 6.5 basis points to 1.512%, while the 30-year bond rate TMUBMUSD30Y, -2.23% tumbled 6.5 basis points to 1.963%, a new all-time low.

See: The 30-year Treasury bond yield plunges to an all-time low

What’s driving Treasurys?

Investors scooped up government bonds after China pledged to launch countermeasures if the White House carries out its recent plan to impose 10% tariffs on an additional $300 billion of Chinese imports.

Only a few days after the U.S. winnowed down the list of goods included in the latest levies, the development highlighted how the two largest economies in the world have fanned tensions over trade policy and undermined global economic growth.

Read: China threatens countermeasures if U.S. tariff hikes go ahead

Traders will also face a rush of U.S. economic data early Wednesday, amid questions whether the sharp slide in Treasury yields is justified by the U.S. growth environment. Retail sales data for July, weekly jobless claims, and second-quarter productivity data will all be published at 8:30 a.m. Eastern, followed by industrial production numbers for July at 9:15 a.m.

The Treasury International Capitol Report will offer a snapshot of foreign purchases of U.S. government debt at 4 p.m.

Check out: Stock futures erase gains after China vows retaliation for U.S. tariffs

What else is on investors’ radar?

“The bond market rally is as much a global story as a U.S. one and yesterday it was weak data in Asia and Europe that dragged U.S. yields down. But at some point, U.S. data need to justify the fall in U.S. yields, or at least a bigger part of them than recent data have. So today’s numbers ought to matter. One of the things that’s clear in this move, is that U.S. yields have fallen a good bit further than those elsewhere by and large,” wrote Kit Juckes, macro strategist at Société Générale.