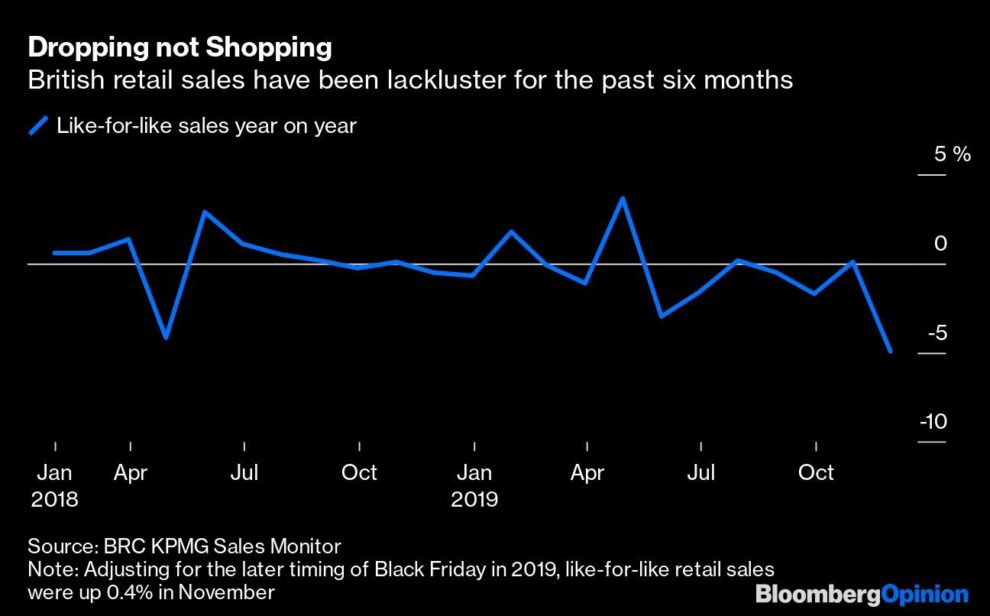

(Bloomberg Opinion) — Brits haven’t felt very much like shopping this year, and understandably so. There’s been political gridlock and upheaval, the repeated threat of a hard Brexit and an election in December for the first time since 1923. No wonder despite strong employment, and wage growth outpacing inflation, U.K. consumers have been acting as if they’re in a recession.

As a result, Britain’s army of shoppers have been choosing more classic colors such as black, navy, gray and camel rather than trendy shades at high-street stalwart Marks & Spencer Group Plc. Families have put off buying new fridges and dishwashers until their old appliances broke down. And they’ve turned to discounters Aldi and Lidl when, in spite of it all, they wanted to start preparing for Christmas by filling their shopping carts with panettone and children’s toys.

Even with a lift from the Black Friday frenzy, this has all added up to weak non-food sales, and sluggish demand at the big supermarkets.

Against this background, the general election result can only be reassuring: a hard Brexit has likely been shelved and affluent shoppers can breathe a sigh of relief that they won’t face a Labour government led by Jeremy Corbyn.

This should all bode well for trading over the coming weeks, the conclusion of the so-called Golden Quarter that captures the run up to the holidays and the merrymaking as well. There is now only one weekend left before Christmas. Last week was likely a slow one in malls and on high streets with the pending election and heavy rain. If the weather is good — cold crisp conditions are best — then shoppers could come out in force for last minute gifts.

This upswing may come too late for some store groups. Black Friday sucked spending into November, so that may mean there is less pent-up demand to be released in December. Many consumers bought Christmas gifts when they were on special offer. Unless those deals generated sales that wouldn’t have happened anyway, the mark downs mean margins will have suffered.

It’s a different story for supermarkets. Their peak period kicks off around now, and the days immediately before the holiday will be the biggest for food shopping. With Brits feeling slightly less nervous, they may be prepared to buy a nicer bottle of wine, or a pricey free-range turkey — or a vegan Wellington.

The recovery in the pound should be helpful too. Retailers selling clothing, toys and electronics buy well over half of the stock they sell from suppliers in Asia, and pay for them in dollars. When sterling weakens, their input costs rise. As stores struggle to pass higher prices onto consumers, their margins get squeezed. A stronger pound should ease the pressure on profitability.

What’s more, a large amount of capacity is coming out of the market, with the likes of M&S, Debenhams Plc and Philip Green’s Arcadia Group closing stores. Chains that have survived the tumultuous conditions should benefit.

But even if shoppers do party like its 1999 — and that’s still debatable — retailers may not escape a New Year hangover.

If Prime Minister Boris Johnson forces through his Brexit deal — which now looks increasingly likely — it is only the starting point for Britain’s withdrawal from the European Union, and negotiations for a comprehensive agreement with its largest trading partner.

There’s also the toll that the uncertainty of the past three years has taken on an already fragile British economy. Businesses may have held back from investing, potentially storing up trouble for the future. And despite overall strong employment, there have been job losses. Consumers make the most drastic changes to their purchasing habits when they are made redundant or see their friends losing their jobs.

So even a late surge won’t change the winners and losers this Christmas. Discount players such as Aldi and Lidl and Associated British Foods Plc’s Primark are still likely to be standout performers. Next Plc is doubling down on its strong online presence by selling other retailers’ brands, which should pay off. Bricks and mortar clothing retailers and department stores will be under pressure from both Amazon.com Inc. and specialist-fashion brands such as Boohoo Group Plc. Meanwhile, a revival over the next two weeks may not be enough to compensate for lackluster sales so far at Britain’s big supermarkets.

The general election result should make this Christmas a little less dismal. But it won’t transform it from turkey into a cracker.

To contact the author of this story: Andrea Felsted at [email protected]

To contact the editor responsible for this story: Melissa Pozsgay at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”67″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.