If ever there was a year when you’d hope an “all weather” investment portfolio would live up to its name, 2020 was that year.

Oops.

A review of many “all-weather” strategies — as outlined by market guru Meb Faber in his (free) book Global Asset Management—shows that very few sidestepped March’s maelstrom, most of them suffering sharp falls in value.

Meanwhile they are all ending the year behind a simple S&P 500 SPX, -0.74% stock index fund such as the SPDR S&P 500 ETF SPY, -0.69%.

On the plus side: A couple performed well, causing few, if any, sleepless nights during the depths of the crisis and ending the year nearly behind the S&P 500.

I ran models of the main “all-weather” strategies, using the portfolio tools offered by YCharts.com, a financial website. I constructed the portfolios using exchange-traded funds available to any average Joe or Joanna saving for their retirement.

The thing about so-called “all weather” strategies is that they tend to look very different from the conventional long-term portfolio. Typically Wall Street tells us Main Street investors to hold a simple mix of stocks and bonds. The classic is the so-called “60/40” portfolio, which is 60% stocks (mostly U.S.) and 40% bonds (all U.S.). That’s the makeup of the Vanguard Balanced Index Fund VBINX, -0.16%, for example. The theory is that the bonds, which offer lower returns but more stability, will smooth out the bumps on the road of the stock market.

There are a number of problems with this theory, even though it has worked well since the early 1980s. The biggest is that during that time we’ve been a massive bull market for bonds, caused by collapsing interest rates and collapsing inflation. So that distorts all the numbers. Bonds have been atypically terrific over this period. But long-term rates can’t fall from 15% to 2% again. And if inflation and interest rates rise again, we could see stocks and bonds plunge together. That’s what happened, for example, in the 1970s.

The other big problem is that most “balanced” or conventional U.S. portfolios are heavily weighted towards U.S. stocks. These have had a terrific decade, so they look great. But these things go in cycles. For most of the previous decade, for example, U.S. stocks were a dog. You wanted to be in things like European stocks and emerging markets. There’s no particular reason U.S. stocks should do better than other markets regardless of valuations.

“All-weather” portfolios are supposed to work in any environment—rising inflation, falling inflation, growth, recession and so on. They typically include alternative assets such as gold, other commodities, and real-estate investment trusts. These are not fringe ideas, either. Champions include some of the most respected people on Wall Street, such as Ray Dalio, the billionaire founder of hedge fund behemoth Bridgewater, Research Affiliates Chairman Rob Arnott, David Swensen, who ran the Yale University endowment for decades, and Mohamed El-Erian, the former CEO of investment giant Pimco.

How did they do?

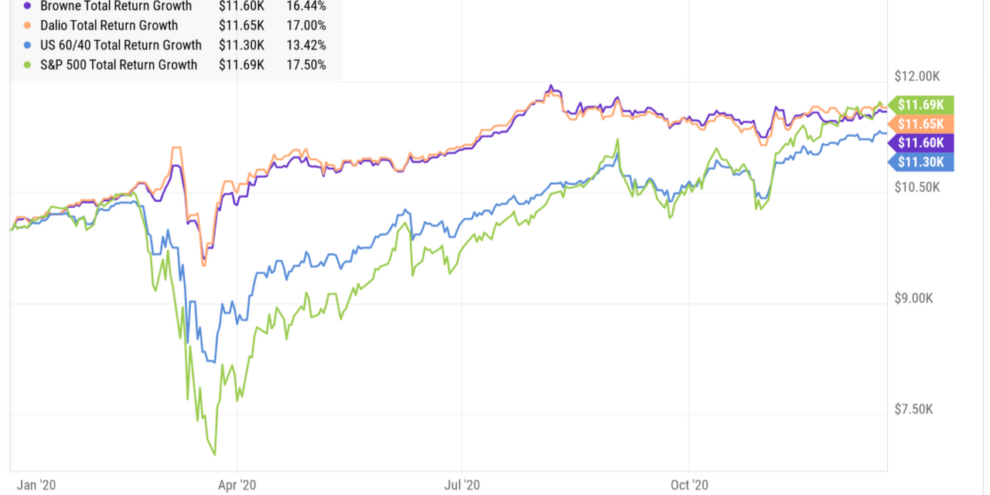

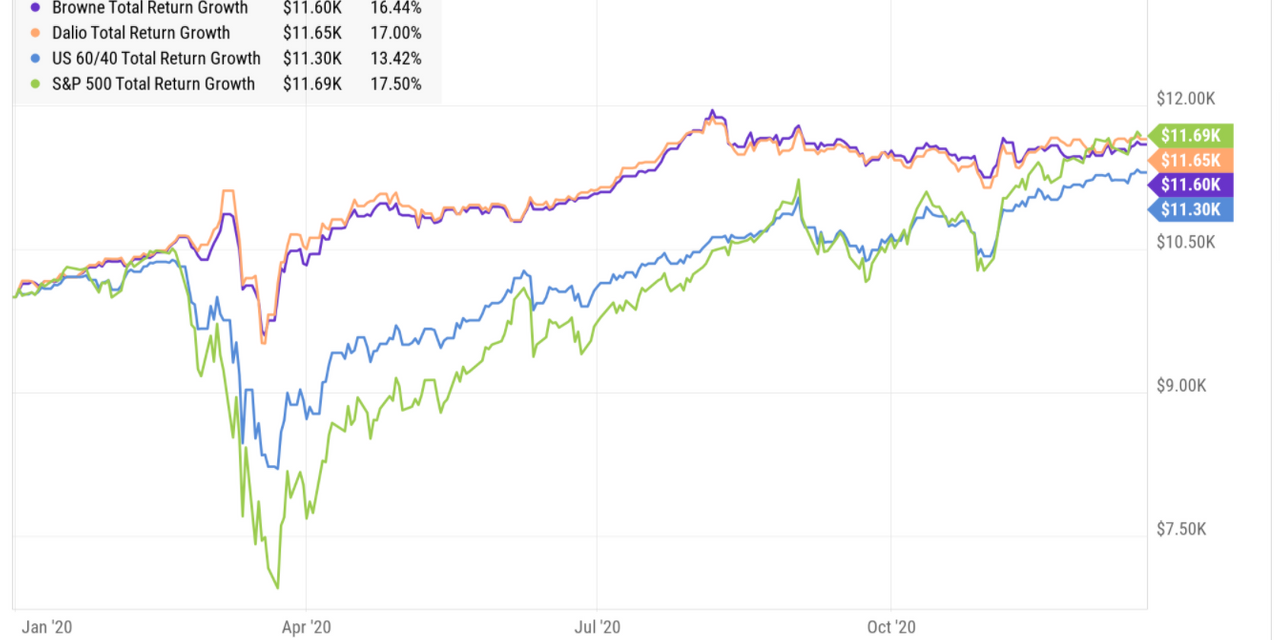

The two standouts for 2020 were the Ray Dalio and Harry Browne portfolios.

The first is ending the year up nearly 17%, about level with the S&P 500, the second, 16%. But, critically, they rode through March pretty smoothly. At their lowest points, the Dalio portfolio was down just 4% on the year and the Browne portfolio 5%. Compare that to the S&P 500 index, which at one point was down 30% for the year, and even the balanced portfolio of U.S. stocks and bonds, which was down 18%.

The reasons for their stability aren’t hard to find: The portfolios that sidestepped the worst of the turmoil held large amounts of cash GBIL, +0.01%, U.S. bonds BND, +0.04%, international bonds BNDX, +0.06%, gold GLD, -0.12%, and Treasury inflation-protected securities SCHP, or TIPS. These all went down much less than the market overall.

Curiously, the liquidation panic in March was so bad that even long-term U.S. bonds TLT, +0.49%, arguably the safest of safe havens, fell at one point as people rushed to get their hands on ready money. (Similar dislocations happened at points early in the 2008 crisis as well.) Only cash was king.

The Ray Dalio All-Weather Portfolio holds 40% of its money in 30-year Treasury bonds and 15% in 10-year Treasurys. Another 30% is in U.S. and overseas stocks, and 15% split between gold and other commodities.

The Harry Browne portfolio is remarkable in its simplicity: 25% each in U.S. stocks, 30-year U.S. bonds, gold, and cash (Treasury bills).

I’ve assumed for these calculations that you didn’t take an active role and rebalance the portfolios more than once a year.

None of this is a fundamental criticism of the all-weather portfolios in theory or practice (nor of the various gurus who’ve suggested them in the past). They are supposed to work long-term, not just during individual crises. They are all based on analysis of what has worked, and not worked, over decades in the past. And their goal is not simply to maximize long-term returns, but to reduce the risk of disaster. Holding lots of gold and cash has lowered your returns dramatically during most recent decades, but they kept you afloat in the 1970s.

U.S. stocks, bonds, TIPS and gold have been very good performers this year. But to assume that they will therefore be good performers next year is to engage in double counting. All are now more expensive than they were in January. TIPS now sport negative “real yields,” meaning if you buy them and hold them until maturity you are actually guaranteed to lose purchasing power. Based on a long-term measure known as Tobin’s Q, which compares stock prices with the replacement cost of company assets, U.S. stocks are “overvalued by…278%” compared to history, reports London-based financial consultant Andrew Smithers.

Frankly, keeping all my money in those would give me some pretty sleepless nights. But investors who want to play it safe have even fewer options now than they did a year ago.