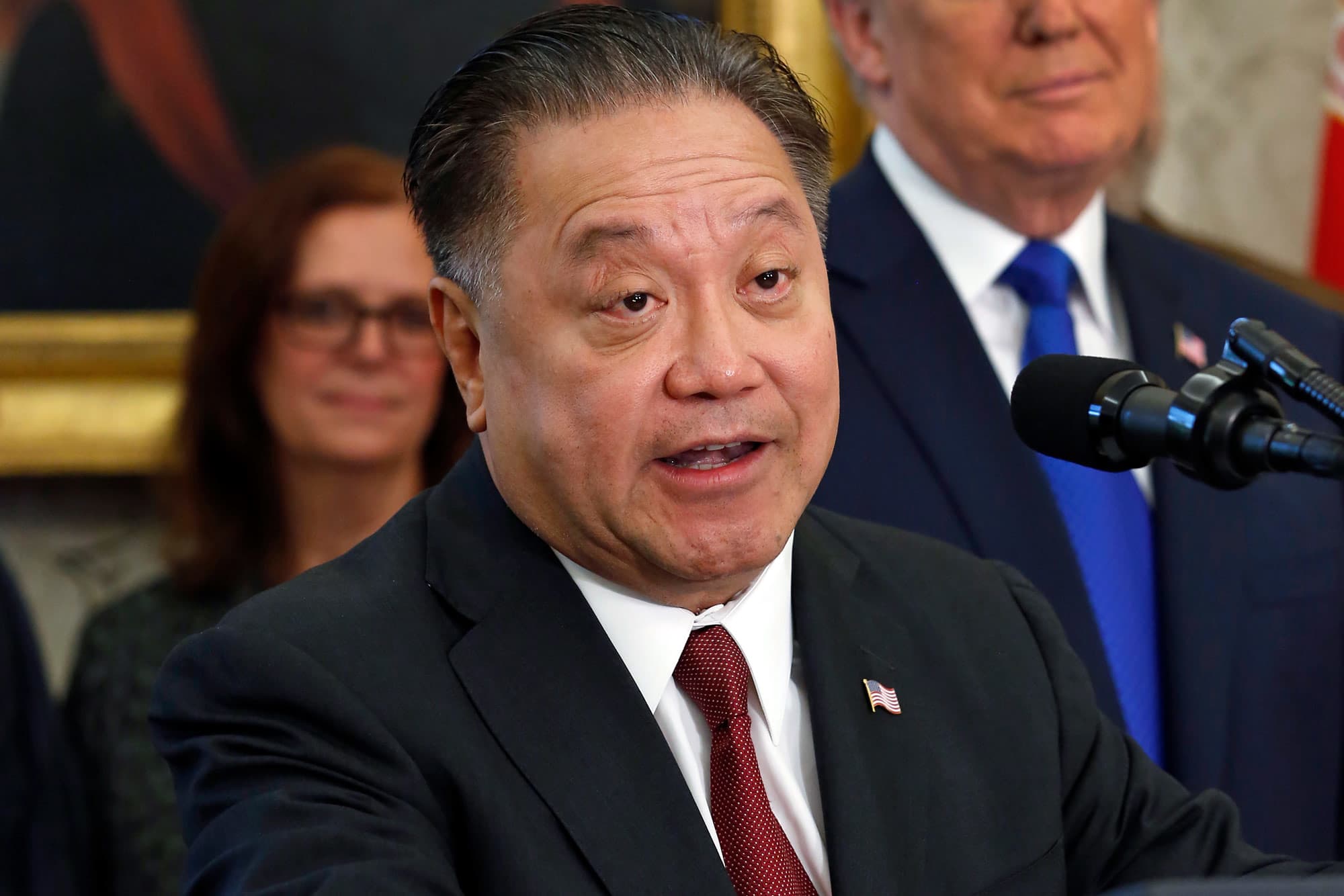

Hock Tan, chief executive officer of Broadcom

Martin H. Simon | Bloomberg | Getty Images

Shares of chipmaker Broadcom fell more than 8% on Thursday after the company reported lower-than-expected revenue for the second quarter of its 2019 fiscal year, which ended on May 5, and cut its revenue guidance.

Here are the key numbers for the quarter:

- Earnings: $5.21 per share, excluding certain items, vs. $5.16 per share as expected by analysts, according to Refinitiv.

- Revenue: $5.52 billion, vs. $5.68 billion as expected by analysts, according to Refinitiv.

Broadcom’s revenue grew 10% year over year in the quarter, according to a statement.

Broadcom’s biggest business segment, semiconductor solutions, produced $4.09 billion in revenue, below the $4.18 billion FactSet consensus estimate. The infrastructure software segment, including contributions from the CA business Broadcom acquired in 2018, had revenue of $1.41 billion, below the $1.37 billion FactSet estimate.

In recent weeks other semiconductor companies have lowered their forecasts following the U.S. government’s efforts to limit Huawei’s ability to purchase products from U.S. companies. Piper Jaffray analysts Harsh Kumar and Matthew Farrell estimated that Huawei represents 3% of Broadcom’s revenue at about $150 million per quarter in a note distributed to clients on May 24. The analysts lowered their full-year earnings and revenue estimates for Broadcom in light of the blacklisting, which was announced in mid-May.

Broadcom lowered its guidance for the full 2019 fiscal year, saying it now expects to achieve $22.50 billion in revenue in that period. The consensus among analysts polled by Refinitiv was $24.31 billion in revenue for the 2019 fiscal year. In the previous quarter Broadcom had guided $24.50 billion in full-year revenue.

“We currently see a broad-based slowdown in the demand environment, which we believe is driven by continued geopolitical uncertainties, as well as the effects of export restrictions on one of our largest customers. As a result, our customers are actively reducing their inventory levels, and we are taking a conservative stance for the rest of the year,” Broadcom CEO Hock Tan was quoted as saying in Thursday’s statement.

Tan elaborated on the situation on Thursday’s conference call with analysts, noting that while last year Broadcom received about $900 million in revenue from Huawei, the issues go beyond the dependency on that one company.

“Compression of supply chain is what’s driving this reduction more than anything else, and it’s broad-based,” he said.

At the same time, Tan said the company expects a decline in orders from global device makers, which are working to lower their own inventory levels in the midst of the ongoing U.S.-China trade war.

“The environment is very, very nervous,” he said.

Broadcom stock has risen 10% since the beginning of 2019.

WATCH: Chips rebound after trade restrictions temporarily lifted