NYSE:VMW) for nearly $61 billion in cash and stock. This is one of the largest technology transactions in history and further blosters Broadcoms software product lineup. This follows multiple transactions, including CA Technologies in 2018 and Symantec in 2019, over the past few years that were completed to improve the company’s software business.

VMware had been switching to more of a subscription model itself, something that Broadcom has been fairly successful at doing. The deal, if completed, will mean that recurring software sales will contribute nearly half of annual sales. These sales are much more predictable even if they grow at slightly lower rates.

The most recent quarterly report coupled with the acquisition of VMware should enable Broadcom to continue to grow its dividend at a high rate.

Dividend analysis

Broadcom has raised its dividend for 11 consecutive years. Growth has been very robust as the company has a five- and 10-year compound annual growth rate of 31.5% and 142%. This occurred even as the share count nearly doubled over the past decade.

Important for investors, dividend growth looks likely to continue as well. Broadcom distributed $14.40 of dividends per share in 2021 while generating earnings per share of $28. This equates to a payout ratio of 51%.

The company is projected to distribute dividends per share of $16.40 for 2022, implying an expected payout ratio of 46%. This compares to the 41% payout ratio that Broadcom has averaged since 2016.

Free cash flow also shows a similar picture of safety. The company has paid out $1.75 billion worth of dividends over the last 12 months. At the same time, Broadcom produced free cash flow of $4.2 billion, resulting in a payout ratio of 42%. This is very close to the three-year average of 44%.

Turning to debt obligations, Broadcom had interest expense of $1.77 billion over the last year. The company had total debt of $39.2 billion at the end of the second quarter, resulting in a weighted average interest rate of 4.5%.

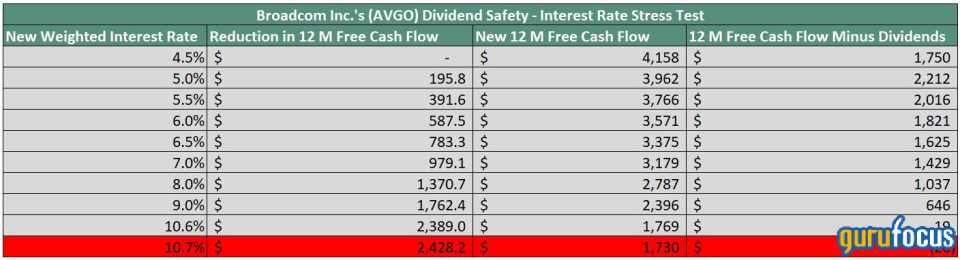

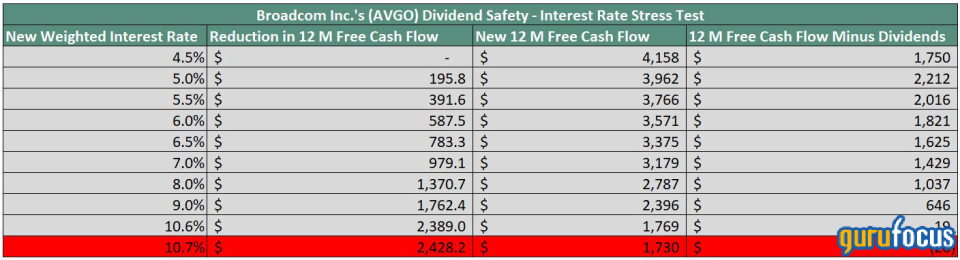

The table below illustrates where Broadcoms weighted average interest rate would need to reach before dividends were not covered by the companys free cash flow.

Source: Authors calculations.

Broadcoms weighted average interest rate would need to rise above 10.6% before dividends were not sufficiently covered by free cash flow. As such, debt does not appear to be a major factor in future dividend payments.

Shares yield just over 3% today, very close to the five-year average yield of 3.2% and double the average of the S&P 500 Index.

Valuation

Broadcom currently trades near $541, implying a forward price-earnings ratio of 14.7. The stock has a 10-year average price-earnings ratio of close to 14, so shares are currently slightly ahead of its long-term average.

The GF Value chart shows that Broadcom is fairly valued on an intrinsic basis.

With a GF Value of $523.41, Broadcom has a price-to-GF Value of 1.03, earning the stock a rating of fairly valued from GuruFocus.

Final thoughts

Broadcoms second quarter outperformed the average analysts estimate both on the top and bottom lines. The company experienced growth in key areas, with the expectation that growth would continue and, in some cases, accelerate in the current quarter.

The companys record-setting purchase of VMware will be a major addition and should strength Broadcoms software business even further.

This likely means that Broadcoms dividend will continue to see high rates of growth amid very reasonable payout ratios.

Despite a strong quarter and future outlook, shares are trading very close to both the historical multiple and its intrinsic value. Broadcoms business model and dividend make the name an ideal pick for those looking for technology exposure.

This article first appeared on GuruFocus.

Add Comment