Salesforce.com CRM made headlines today after the company announced it was buying big data firm Tableau Software DATA for $15.3 billion. This purchase marks the biggest acquisition in company history, and it comes as Salesforce is attempting to provide its clients with more data insights; Salesforce previously acquired application integration provider Mulesoft for $6.5 billion in 2018, as well as Demandware and Heroku, before scooping up Tableau.

Tableau is a leading analytics platform that can help Salesforce expand its product offerings. Tableau focuses on big data analytics, which is a complex process that unveils hidden patterns and tendencies. After these correlations or trends are discovered, they then can be utilized to help companies make better business decisions. Tableau has over 86,000 customers, including some notable tech giants such as Verizon Communications VZ and Netflix NFLX.

With Tableau’s technology, Salesforce would be able to offer new services to its clients, such as marketing and innovative tools that would help companies with their sales efforts. However, the acquisition is expected to decrease fiscal year 2020’s non-GAAP EPS by 37-39 cents a share, though the deal could generate $400 million in revenue in that same year. Marc Benioff, Salesforce’s CEO, stated “Tableau helps people see and understand data, and Salesforce helps people engage and understand customers,” demonstrating his optimistic approach to the acquisition.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Should Investors Buy CRM?” data-reactid=”25″>Should Investors Buy CRM?

CRM took a sharp hit today on the news; shares fell as much as 8% earlier, but pared back a little, closing down over 5%.

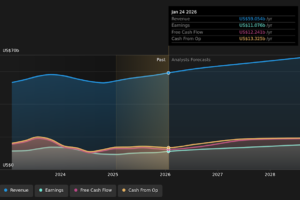

Right now, Salesforce has a Zacks Rank #3 (Hold) and a Zacks Style Score of a D in Value. The stock has a forward P/E ratio of 59.8X compared to the industry’s P/E of 29.6X, showing just how high this SaaS stock is trading. The company’s PEG ratio of 2.76 also signals just how overly priced the stock is. Despite its high value, CRM has a Style Score of A in Growth. Salesforce has an expected long-term EPS growth rate of 21.70% (3-5 years), as well as a historical EPS growth rate of 165.85%. Compared to last year, Salesforce also has an earnings growth rate of 11.54% and a sales growth rate of 24.32%.

Salesforce reported strong earnings results last week, and estimates have been inching upwards for the current fiscal year; the company’s top line should also continue to expand for this year and next. With Salesforce’s high multiples in mind, investors are definitely paying for the growth right now, but the software stock is growing, with revenues and its Other Bets division leading the way.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

” data-reactid=”29″>Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Tableau Software, Inc. (DATA) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research” data-reactid=”30″>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Tableau Software, Inc. (DATA) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research