It’s the fifth-largest company today by market cap.

Microsoft regained the title of most valuable company in the world after briefly falling behind Nvidia with the latter’s recent stock split. However, it’s been playing second fiddle to Apple for years and only recently slid into first place since Apple has been under some pressure.

Amazon (AMZN -1.21%) is only in fifth place on the list of U.S. companies with the highest market caps, also behind Alphabet. It has extraordinary growth opportunities in several of its businesses, and the second-highest sales of any U.S. company behind Walmart. Can it become the most valuable company in the world?

What is market cap and why does it matter?

Market cap is simply the price per share multiplied by the outstanding share count. In other words, it’s the total dollar value of all of a company’s stock. Amazon stock trades at $193 per share, and there are 10.4 billion shares outstanding, so the market cap is over $2 trillion. That makes it the fifth most-valuable company on the stock market.

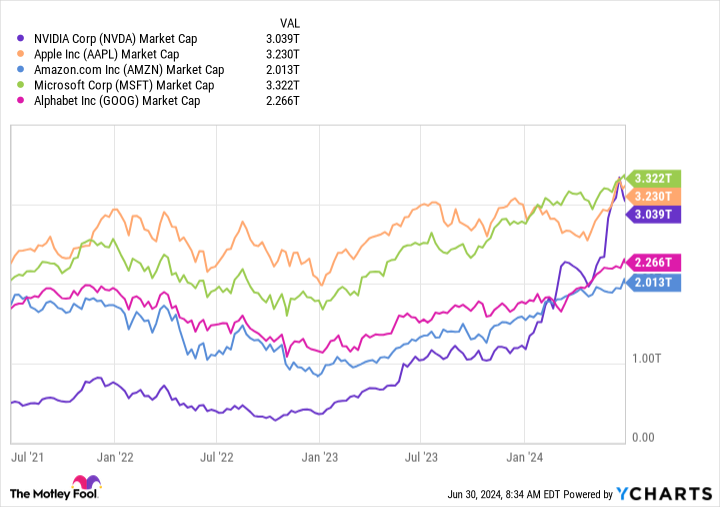

NVDA market cap data by YCharts.

As you can see in the chart above, Apple had been the most valuable company until recently, when Microsoft took over and Nvidia briefly topped it.

Market cap tells investors a few things. Highly valued companies are best in class, and they have proved that over time. Investors have piled in because these companies perform, quarter after quarter, and they’re large businesses that drive the economy. In general, you can count on them to deliver, and they’re low risk.

But highly valued companies might offer less growth for investors, since they’re already so valuable. For the top three stocks here to even double at this point, they would be worth more than $6 trillion.

Is it possible? Yes. But that comes with its own risk, since they would need to sustain their high value. It’s easier to see Amazon or Alphabet doubling from where they are today.

In terms of valuation, none of these stocks are cheap. They all get a premium valuation for their reliable track records and incredible businesses. Nvidia tops them, trading at 73 times trailing-12-month earnings, and Amazon comes in second at 55.

Why Amazon stock can reach the top

Amazon struggled a bit, like many companies, when inflation started soaring in 2022. It rebounded already last year, but the stock only surpassed its previous highs a few weeks ago, and it could be in its best position in a long time.

One reason is generative artificial intelligence (AI). It’s today’s hot topic, but it might have more staying power than other recent trends like cryptocurrency and the metaverse, and Amazon is a major player.

It has launched a powerful set of AI tools for its Amazon Web Services (AWS) clients, and as the leading worldwide cloud computing company, it stands to benefit in a big way from adoption of these tools. According to consulting company McKinsey, as much as 30% of workplace hours could be automated through generative AI, and it could add $4.4 trillion to the economy.

Amazon is at the forefront of these endeavors, and CEO Andy Jassy recently said, “I don’t know if any of us have seen a possibility like this in technology in a really long time.”

But it’s not just AI, with Jassy adding, “We have a lot of growth in front of us, and that’s before the generative AI opportunity.” He said that AWS is already a $100 billion run-rate business, and that 85% of global spending on information technology is still on-premises, meaning not in the cloud. That leaves a massive opportunity for further spending in AWS.

And AWS isn’t even its biggest business, which is still e-commerce. Amazon has an unbeatable lead in that category globally and accounts for nearly 38% of all U.S. e-commerce. It has made strides in improving logistics to get more deliveries out faster, and as it speeds up shipments, more shoppers rely on it for even more of their daily essentials, leading to a positive growth cycle.

The company’s fastest-growing business these days is advertising, which increased 24% year over year in the 2024 first quarter. It’s a high-margin business, and with its new ad-supported streaming tier for Prime Video, Amazon is finding more ways to monetize its advertising capabilities.

It has an edge in this business because when customers see advertisements on the company’s platform, they’re already looking to buy, and that can lead to incredible conversion rates.

Amazon can certainly muscle its way to the top of the market-value chain, just as it’s pushing ahead and getting closer to becoming the largest U.S. company by sales. Regardless, it has tremendous opportunities in many ways, and its stock is a no-brainer buy.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.