Nvidia must continue to increase revenue and maintain its record profit levels to justify its valuation.

Only three companies have ever eclipsed the $3 trillion market value threshold: Microsoft, Apple, and Nvidia (NVDA -1.31%). Although Microsoft and Apple are incredibly large businesses that can justify this valuation, Nvidia has attained its price tag due to its future growth prospects.

As a result, the pedestal it’s standing on isn’t nearly as stable as those other companies. So, can Nvidia maintain this valuation? Or is it primed to tumble?

Nvidia’s market dominance has allowed it to excel

Nvidia has reached this point on the back of strong artificial intelligence (AI) demand. Its graphics processing units (GPUs) are essential to developing and maintaining these AI business models.

GPUs are the hardware of choice for AI because they can run so many calculations in parallel. Additionally, GPUs can be connected in clusters to multiply this effect. This allows for huge AI systems to be trained efficiently and effectively, and is the driver behind Nvidia’s incredible rise during the past year and a half.

Furthermore, Nvidia is also the top dog in its industry by a wide margin. Second-place Advanced Micro Devices is also in the AI market but doesn’t offer technology that matches Nvidia’s.

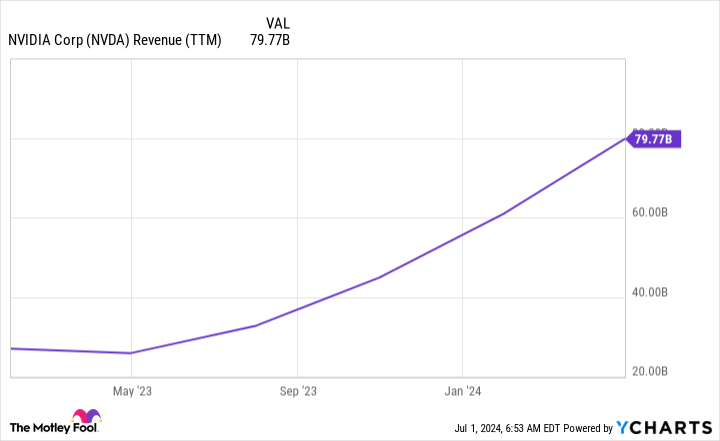

Due to the high demand for its primary product, Nvidia’s trailing-12-month revenue increased from about $30 billion to $80 billion in just over a year.

NVDA Revenue (TTM) data by YCharts

For its fiscal 2025 year (ending January 2025), Wall Street analysts on average expect Nvidia to do $120 billion in sales, rising to $161 billion in FY 2026. That’s still a huge increase, and many investors would be elated by that rise.

The stock has a lot of growth baked into it

However, much of that growth is already baked into the stock price.

Although sales growth drives a company’s future, investors care about earnings. As a result, metrics like the price-to-earnings (P/E) ratio or the forward P/E ratio are quite popular for valuing stocks.

For Nvidia, these two metrics are in stark contrast to each other.

NVDA PE Ratio data by YCharts

With Nvidia trading at 72 times trailing earnings and 46 times forward earnings, it’s easy to calculate that investors have baked in 59% earnings growth into the share price. While that’s a huge figure, Nvidia has far exceeded that in recent reports. In Q1 FY 2025 (ended April 28), Nvidia’s earnings per share (EPS) rose 629% year over year.

However, investors shouldn’t expect these jaw-dropping figures to continue. The year-over-year comparison quarters are about to become more difficult as we’re starting to overlap the initial GPU rush that started in Q2 last year.

However, the question remains: Can Nvidia maintain its $3 trillion valuation?

The profit and revenue growth to sustain its valuation are lofty

The other two members of the $3 trillion club, Microsoft and Apple, have traded at about 30 times trailing earnings during the past five years. Although that is historically expensive relative to the rest of the market, both are outstanding companies. Nvidia also is a unique business with incredible profit margins and a clear market lead. As a result, I’ll use 30 times earnings as my base case for Nvidia.

For a company to be worth $3 trillion and trade at 30 times earnings, it must generate $100 billion in profit annually. During the past 12 months, Nvidia has generated $42.6 billion. This shows that it has a long way to go before attaining the profit levels needed that we calculated.

Another factor investors must consider is Nvidia’s history. Nvidia has never been as profitable as it is now, and its market leadership position is a huge factor in that.

NVDA Gross Profit Margin data by YCharts

When you have a product everyone wants, with few viable alternatives, you can charge whatever you want, and the customer will pay it. However, these high prices will spur innovation, which is exactly what is happening. Many of the largest tech companies in the world (which also happen to be Nvidia’s largest customers) have started to design their own chips to replace Nvidia GPUs. Although this may not be a big deal right now, it could become a problem for Nvidia when a refresh or upgrade cycle occurs.

If we factor in a profit margin drop and reduce the levels to 30%, where Nvidia was before the AI boom, Nvidia would need to generate $333 billion in sales to maintain its valuation. Although Nvidia’s profit margins may never revert to historical levels, it’s unlikely the company will be able to maintain its current levels as rising competition will begin to erode its margins.

For Nvidia to stay above (or around) a $3 trillion market cap, it must maintain its revenue and profit margins. That’s no easy task, considering many are coming after the company. While I don’t think Nvidia’s business will collapse, the stock may see pressure as investors recognize the lofty expectations that already are reflected in the stock price.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.