A congressional panel tasked with overseeing coronavirus stimulus funds sent letters Friday afternoon to five public companies that took out Paycheck Protection Program loans, demanding they return the money on the grounds that businesses like theirs have access to other forms of funding so their seeking and acceptance of the funds deprives truly needy small businesses.

“Since your company is a public entity with a substantial investor base and access to capital markets, we ask that you return these funds immediately,” a panel of seven Democratic members of the Select Subcommittee on the Coronavirus Crisis wrote to each of the five firms.

“Returning these funds would allow truly small businesses — which do not have access to alternative sources of capital — to obtain the emergency loans they need to avoid layoffs, stay in business, and weather the economic disruption caused by the coronavirus crisis.”

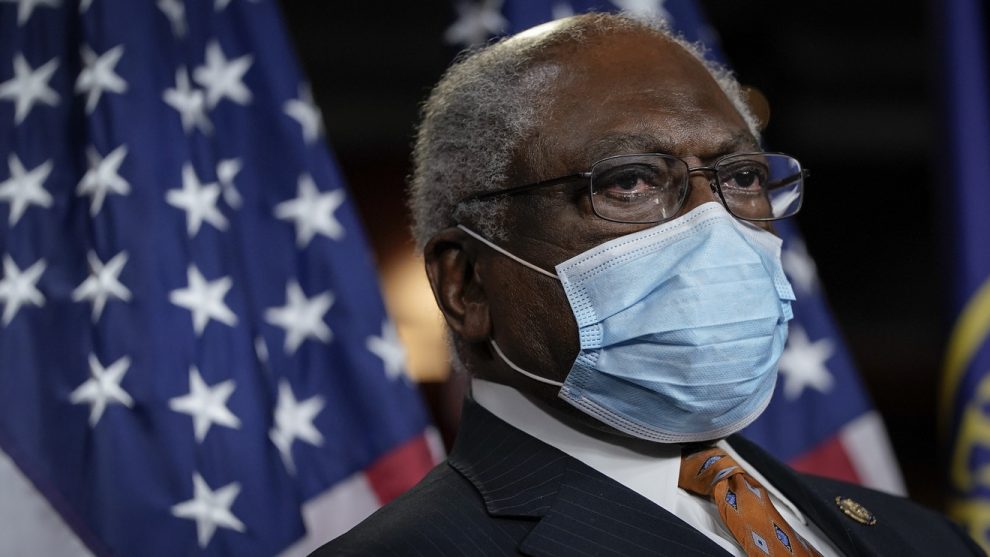

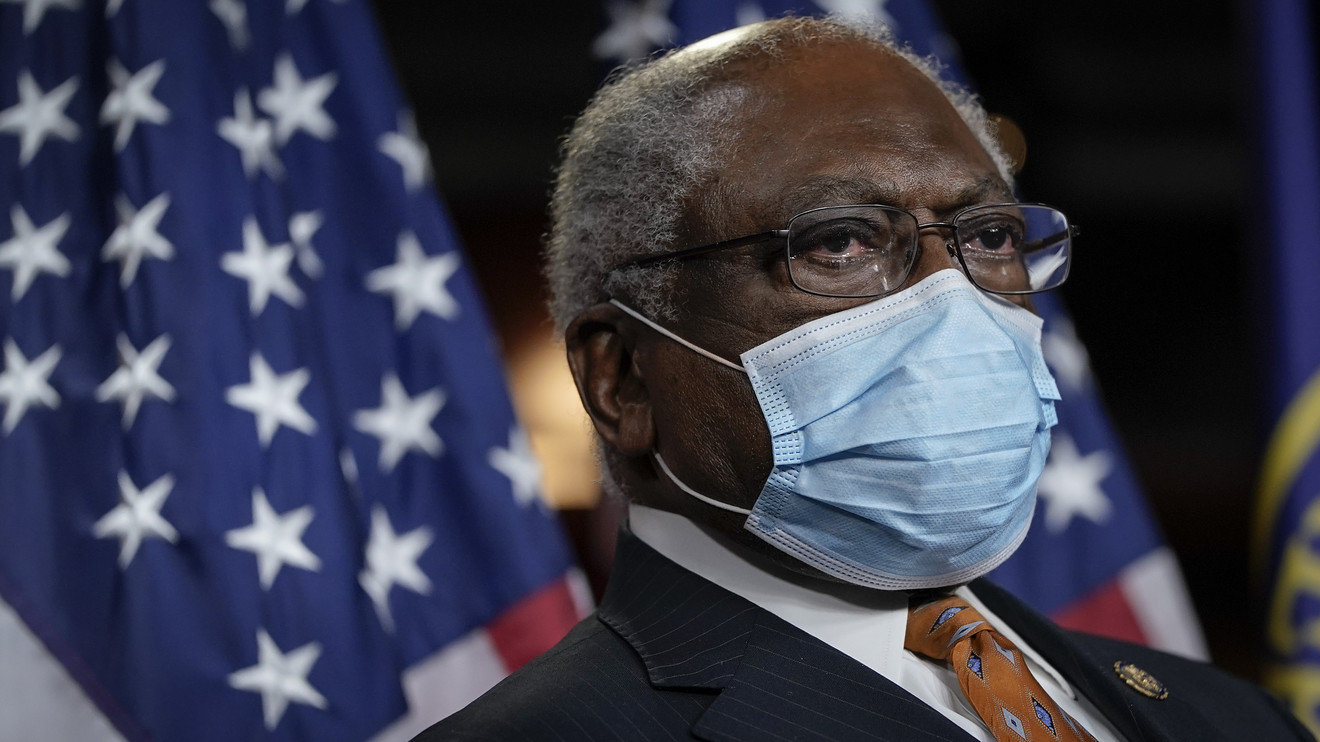

The committee, chaired by South Carolina Democrat Rep. James Clyburn, issued these demands to public firms with a market capitalization of more than $25 million, more than 600 employees and which received PPP loans of at least $10 million.

The companies include Evo Transportation & Energy Services Inc. EVOA, +1.90%, Gulf Island Fabrication Inc. GIFI, -0.65%, MiMedx Group Inc. MDXG, , Quantum Corp. QMCO, +11.28% and Universal Stainless & Alloy Product, Inc. USAP, +11.77%. None of the companies immediately replied to requests for comment.

The Paycheck Protection Program was created by Congress to make available loans to small businesses to cover two months of payroll and other expenses, with the loans forgivable if the companies maintain pre-pandemic levels of employment. The initial $350 billion appropriated to the program ran out in a matter of weeks, forcing Congress to replenish the fund with another $320 billion, more than half of which has already been spoken for.

The Small Business Administration, which is administering the program, typically defines a small business as one with 500 employees or fewer, though companies in certain industries see higher employee caps.

Public pressure has grown on larger businesses to return funds as reports have proliferated that loans were going to the largest of small businesses, many of which had access to other sources of capital, such as public equity markets. Banks originate these loans on behalf of the government, and many businesses complained that the banks were favoring existing customers and leaving very small businesses out in the cold. At least 40 public companies have returned PPP loans so far.

The Trump administration has also pressured companies with access to public markets or other forms of capital to return funds. Treasury Secretary Steven Mnuchin called it “outrageous” that the Los Angeles Lakers took a $4.6 million loan, which the NBA team later returned. He also said the administration will audit all loans above $2 million, in part to confirm the companies receiving funds actually needed the loans.