Is Donald Trump playing chess while his critics play checkers? One economist begrudgingly seems to suggest that might be the case.

Gluskin Sheff’s David Rosenberg, who just last month asked if Trump was trying to lose the 2020 election with his tariffs, says the president’s recent moves might all be part of his grand plan to extend his stay in the White House.

His tweet gained plenty of attention across Finance Twitter.

Michael Lebowitz of 720 Global says Trump’s “playing the Fed like a fiddle.”

And options trader Damian Pulcini put it like this: “Absolutely his plan… Trump’s style to create problems, profit from them and then champion himself as the savior of the problem he created.”

Trump has long pressured the Federal Reserve to slash rates, tweeting earlier this year that the market, which Trump has hailed as a report card on his performance, could “go up like a rocket ship” if Jay Powell would just cooperate.

Trump’s critics have slammed his efforts, saying that he’s wrongly attempting to influence the Fed in order to burnish his case for re-election.

Former Treasury Secretary Larry Summer has been one of the notable voices throwing water on lowering rates.

“It would be premature to cut interest rates by 50 basis points,” he previously told CNBC. “You don’t cut interest rates from 2.5 [percent fed funds rate] with urgency because you’re feeling great about the economic future of a country.”

Two months later and Summers is singing a different tune.

“The best way to take out recession or slowdown insurance would be for the @federalreserve to cut interest rates by 50 basis points over the summer and by more, if necessary, in the fall,” Summers tweeted this week.

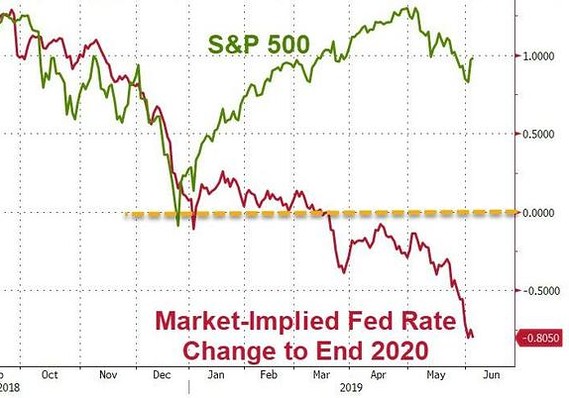

The Zero Hedge blog highlighted the Rosenberg tweet in a post on Wednesday and used this chart to show that bull market dream is alive and well with the expectation of three rate-cuts on the way by the end of next year:

Zero Hedge

Zero Hedge

On the other hand, the next rate cut could be a “sell the news” event that confirms the Fed is worried about where this is all headed, Zero Hedge wrote, adding that “Trump’s 2020 run depends on it.”

Genius or not, if the stock market is, indeed, a report card on this administration, Trump’s received high marks over the past two sessions. At last check, the Dow Jones Industrial Average DJIA, +0.82% was up almost 200 points.