Shares of Chesapeake Energy Corp. nearly tripled in very volatile trading Monday, as growing expectations of a quick rebound in the economy and an agreement among major oil producers to extend production cuts fueled hopes of a continued rally in crude-oil prices.

The oil and natural gas exploration and production company’s stock CHK, +181.93% shot up 181.9% to close at $69.92 on volume of 19.3 million shares, which was more than seven times the full-day average of 2.6 million shares. After rallying 76.5% on Friday, the stock has rocketed 397.7% in two days, and more than about eightfold since closing at a record low of $8.71 on May 14.

Also read: Chesapeake Energy’s stock drops after ‘going concern’ warning, less than 3 months after warning was removed.

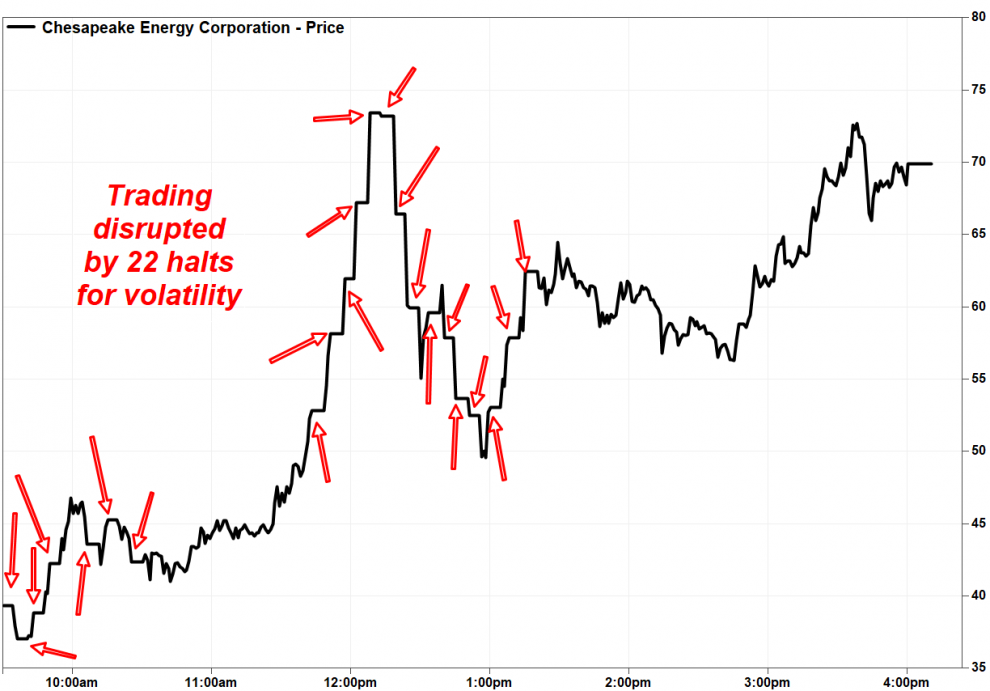

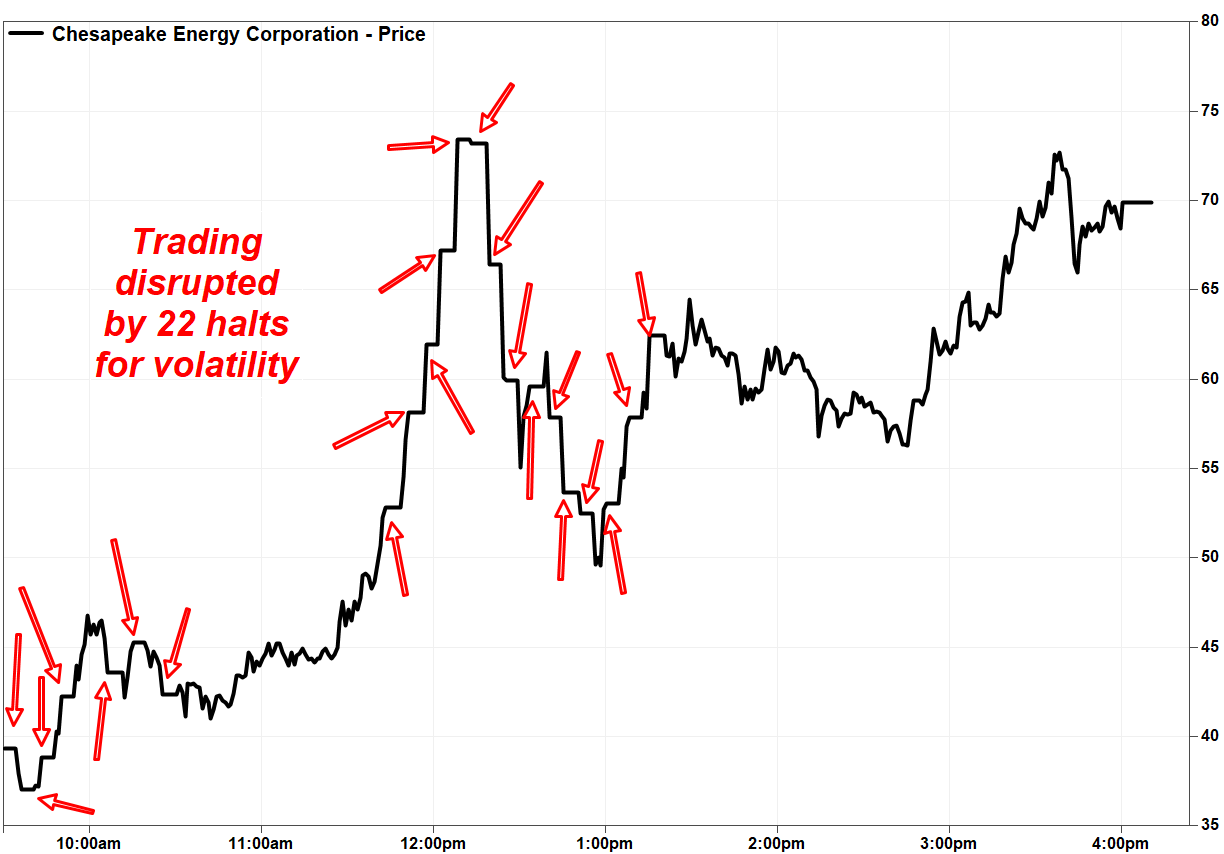

The stock’s rally Monday wasn’t a smooth one by any means, as investors had to endure 22 trading halts for volatility, with each halt lasting for five minutes.

Under the “limit up-limit down” rule approved by the Securities and Exchange Commission in 2012, stocks that are usually less liquid, such as those not in the S&P 500 index or the Russell 2000 index, like Chesapeake, will be halted for five minutes if it moves 10% or more from the average price over the preceding five-minute period.

For example, the first halt for volatility of Cheseapake’s stock was seconds after the at 9:30 a.m. Eastern opening bell, after the stock opened at $40.26 according to FactSet, or 62% above Friday’s closing price of $24.80.

There were four volatility halts in the first half-hour of trading, the second halt coming at 9:36 a.m. after a sharp but brief dip to an intraday low of $36.24, and the others coming after a the stock resumed its rally.

Most of the halts were clustered around midday, when the stock took off to an intraday gain of as much as 212.5% before pulling back to a gain of just 95.4% a little before 1 p.m., before rallying again.

The company hasn’t responded to a request for information or comment on the stock’s volatile trading.

Helping give the stock a boost that past two days, the shockingly strong May jobs report released Friday provided hopes for a quicker-than-expected bounce in the economy, which would lead to increased demand for crude oil. As a result, continuous crude oil futures CL00, -3.36% surged 5.7% on Friday to close at a three-month high.

Then over the weekend, the Organization of the Petroleum Exporting Countries, Russia and other oil producing allies agreed to extend oil production cuts in an effort to support prices by reducing supply. Meanwhile, crude-oil prices pulled back 3.7% on Monday, after more than doubling (up 110%) from the end of April through Friday. See Futures Movers.

Chesapeake Energy’s stock has now risen 326.9% since April 15, when a 1-for-200 reverse stock split went into effect. Still, the stock has tumbled 57.7% year to date, while crude-oil futures have shed 37.7%, the SPDR Energy Select Sector exchange-traded fund XLE, +4.50% has dropped 22.0% and the S&P 500 index SPX, +1.20% has inched up 0.1%.