Shares of Nvidia (NVDA) closed down 2% on Sept. 27 after media reports surfaced that China’s government is discouraging domestic companies from buying Nvidia’s microchips and processors.

Bloomberg News, and other media outlets, are reporting that government officials in Beijing are calling on Chinese businesses to source artificial intelligence (AI) microchips produced within China, and to avoid Nvidia’s chips, which are among the most powerful in the world.

The pressure to buy local comes as the Chinese government tries to bolster its domestic semiconductor industry amid an ongoing trade spat with the U.S. China’s Ministry of Information and Technology has singled out Nvidia’s H20 series of chips, which are used to power AI models and applications, saying domestic companies should not buy those chips.

Escalating Tensions Over Microchips

Officials in Beijing have stopped short of an outright ban on Nvidia’s microchips in the nation of 1.4 billion people. Rather, government officials say they are providing “guidance” to local companies and encouraging the purchase of Chinese made products.

The renewed focus on buying Chinese microchips and semiconductors comes amid escalating tensions with the U.S. over the technology. The administration of U.S. President Joe Biden has imposed export controls on microchips and processors to China, citing concerns that the technology will be used to further develop the country’s military capabilities.

China has accounted for 25% of Nvidia’s annual revenues in the past. In recent months, the chipmaker had found ways to continue selling its high-end microchips to Chinese companies without violating American export controls. Essentially, Nvidia is selling chips to China that are based on its popular H100 microchip but that have 50% less computing power.

Is NVDA Stock a Buy?

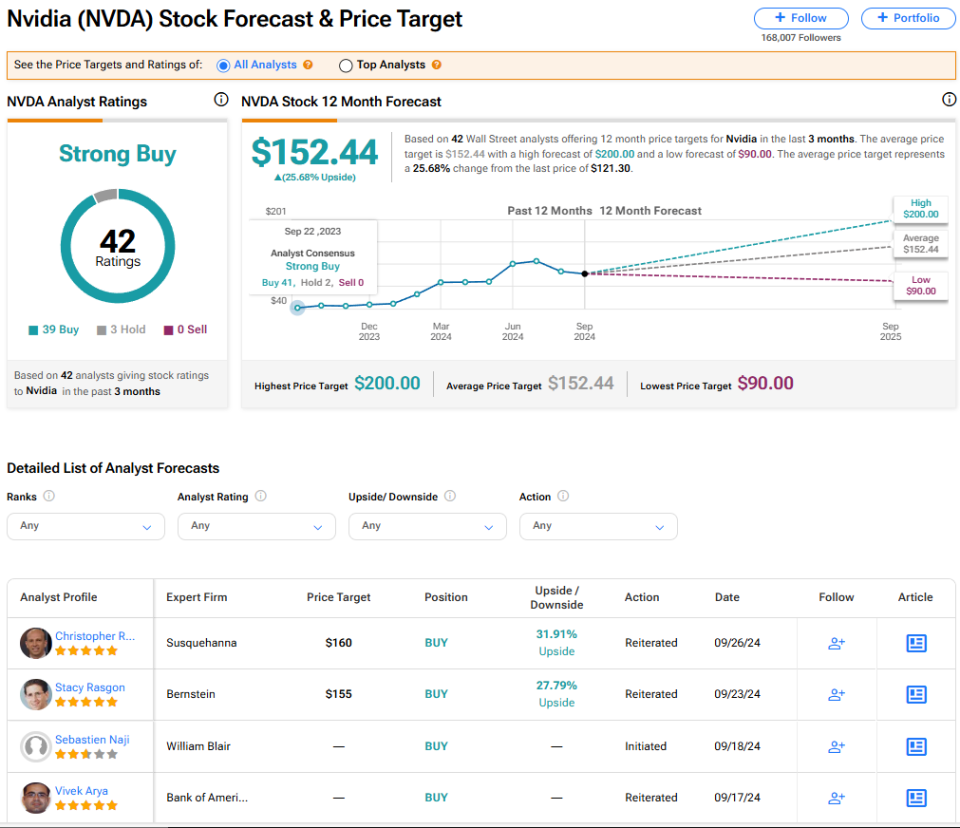

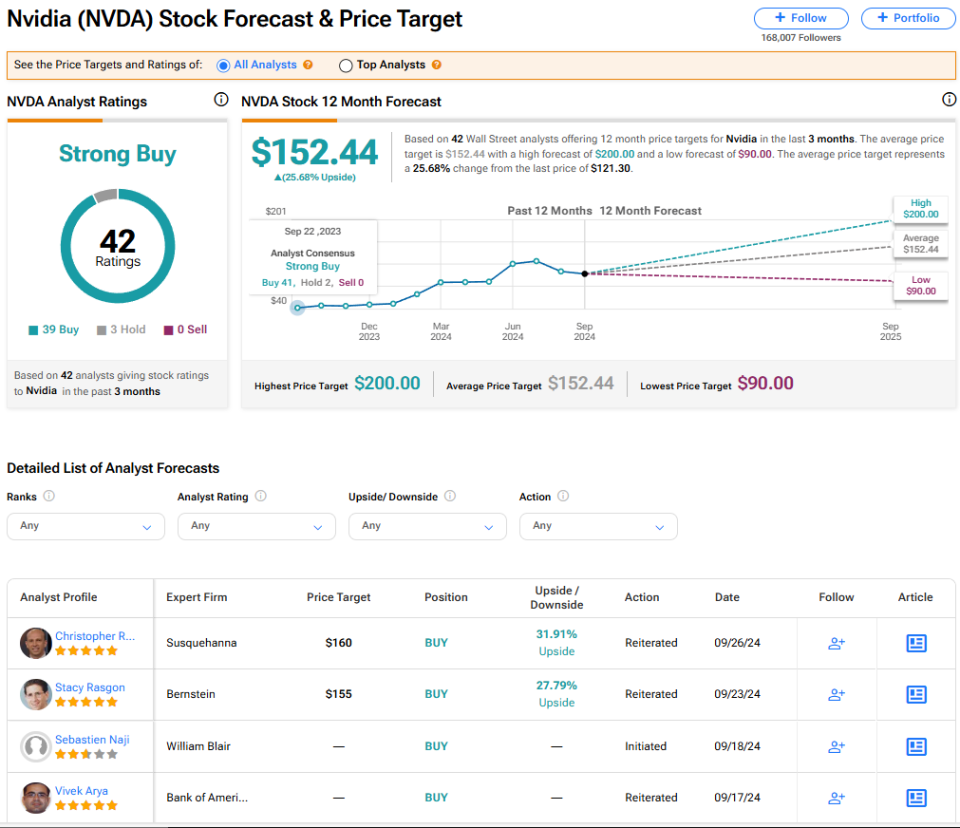

Nvidia’s stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 39 Buy and three Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average price target of $152.44 implies 25.68% upside from current levels.

Read more analyst ratings on NVDA stock