(Bloomberg Opinion) — It’s hard to think of more potent symbolism: In one of his first public outings since President Donald Trump’s decision to blacklist Huawei Technologies Co., President Xi Jinping decided Monday to visit a rare earths plant.

Rare earths have traditionally been a tool of China’s political-economic fights. When Beijing fell out with Tokyo in a 2010 dispute about the ownership of some islands east of Taiwan, it cut export quotas for the minerals and halted shipments to Japan altogether.

That was a potentially powerful weapon. Japan’s technology industry depends on rare earths, which are useful in niche applications such as light-emitting diodes and the high-strength neodymium magnets popular in YouTube science videos. At the time, China accounted for around 97% of global production, leaving Japan Inc. at the mercy of Beijing’s customs officials – and, more to the point, their bosses.

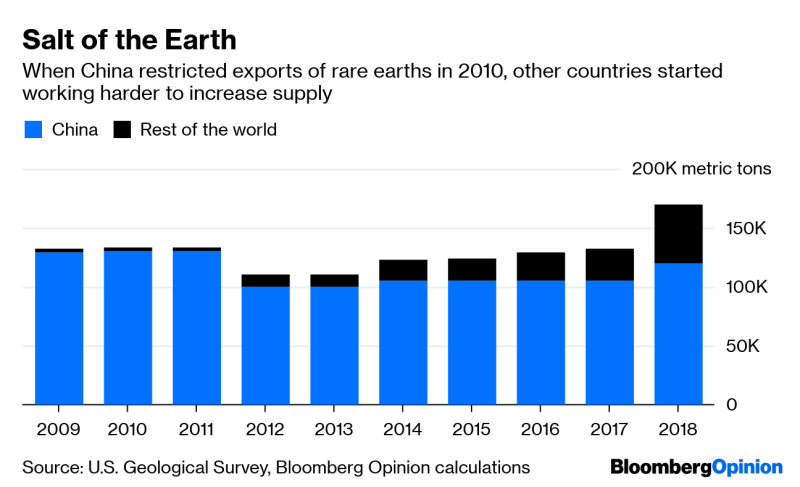

That bit of muscle-flexing hasn’t entirely worked in China’s favor. Global consumption of rare earths, which had gone up by 27% in the five years before the 2010 dispute, fell by 7.2% over the following five years as consumers found ways to reduce their dependence on an unreliable supplier.

Meanwhile, producers elsewhere that had spent years trying to get projects off the ground received a shot in the arm. Even after Chinese exports resumed, causing a price crash that threatened miners in Australia and the U.S. with collapse, they’ve kept plugging ahead. By last year, China’s share of the market had fallen to 71%, according to the U.S. Geological Survey.

Still, the advantage for President Xi is that an economy guided by industrial policy rather than free markets can make far-sighted investments in its future. At a time when the U.S. and its allies are increasingly treating China’s dominance of telecommunications infrastructure as a threat to national security, it’s striking how little interest they’re showing in China’s dominance of key raw materials supplies.

This is, if anything, even more telling in the emerging field of battery materials. The furious dealmaking of Tianqi Lithium Corp. and Ganfeng Lithium Co. mean that companies run by low-level Chinese officials either make or have a say in the production of about half the world’s lithium.

Thanks to its ownership of mines in the Democratic Republic of Congo, an offtake agreement with Glencore Plc, and its dominance of processing capacity, China produces about 80 percent of the world’s cobalt chemicals, too. Battery-grade nickel – another key ingredient for electric-car cells – is heading the same way, with Chinese-backed projects in Indonesia producing high-grade nickel and cobalt likely to dominate supply increases over the next few years.

In normal times, one wouldn’t want to worry too much about this. As with rare earths (and, in the 1970s, crude oil), any attempt to subject vital commodities to political control is likely to lead to demand destruction and efforts by consumers to diversify supply sources. But what’s happening with Huawei should be a hint that these are not normal times.

It’s unlikely that China could use its many fingers in the battery-materials pie to hobble geopolitical rivals permanently. Unlike with rare earths, it has negligible domestic mine production, so in the event of a political dispute pressure could be brought to bear on governments in Australia, Chile, Congo, and Indonesia – none of which are especially friendly to China.

Still, as batteries become more and more central to the energy needs of the world, even the prospects of a short-term supply disruption should be concerning. The 1973 Arab oil embargo lasted only five months, but its effects are still with us.

Governments outside China have so far taken a rather laissez-faire approach to rare earths and battery materials, even as President Trump frames imported BMWs as a national-security issue. Should the trade war deepen, don’t be surprised to see that attitude changing.

To contact the author of this story: David Fickling at [email protected]

To contact the editor responsible for this story: Matthew Brooker at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”56″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.