Bloomberg News/Landov

Bloomberg News/Landov

China is not the villain in the global trading system that the Trump administration likes to portray it as, the International Monetary Fund said, in a new report released Wednesday.

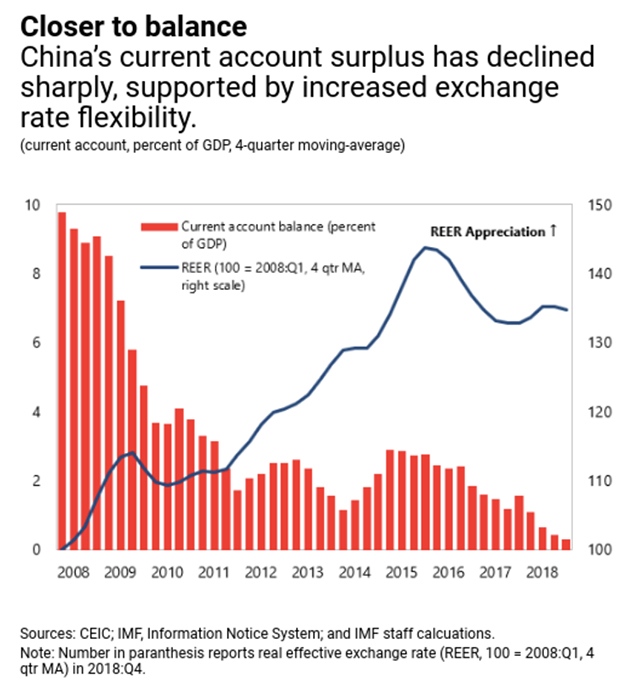

After years when China ran a large current account surplus based on export-led growth, the IMF said that China’s current account deficit, the widest measure of China’s trade balance, its current account, was “broadly in line with fundamentals” in 2018.

The country’s trade picture was helped by a massive increase in outbound tourism, that widened its deficit in services,

Who are the country’s with the largest trade surpluses?

Germany and the Netherlands top the list, as South Korea and Singapore, the IMF said.

But that doesn’t mean these countries should be the target of any aggressive bilateral trade campaign by the Trump administration.

Indeed, Gina Gopinath, the IMF’s new chief economist, said that aggressive bilateral trade negotiations favored by the Trump administration have had no discernible impact on global imbalances and have just caused harm.

The U.S. trade tariffs have led to increased prices for consumers, an erosion of business confidence and a disruption of trade patterns.

Gopinath said trade balances “reflect macro-policies that affect macro savings and investments,” and these are the policies that need reform.

For instance, in the euro-area, one policy that might bring better trade balance would be higher wage growth, the IMF report said.

And the U.S. and UK should find “growth-friendly” ways to lower their budget deficits, the report said.

Gopinath said the IMF welcomed the trade truce reached between the U.S. and China at the G-20 meeting in June, as any intensification of the bilateral trade dispute could have caused significant damage to the global economy.

If all the U.S. tariffs on Chinese goods, in place or threatened, had been enacted, it would have reduced the level of global GDP in 2020 by 0.5%, Gopinath said.

“So this is a significant cost to the global economy at a time when global trade is already very weak and investment is weak in the world,” Gopinath said.

The IMF is set to release its latest assessment on the health of the global economy next week.

Federal Reserve Chairman Jerome Powell has been citing the weaker global economic outlook as one reason many on the central bank feel a need to cut interest-rates. Morgan Stanley said this reflects the growing importance of the overseas economy on U.S. GDP.

Read: With U.S. stimulus fading, Fed can’t ignore stagnant global growth, Morgan Stanley argues

U.S. stocks were lower in morning trading on Wednesday on concerns that the trade war between China and the U.S. might heat up. The Dow Jones Industrial Average DJIA, -0.13% was down about 60 points to 27,276.