(Bloomberg) — The gap between megacap technology stocks in China and the U.S. is at its widest in at least a year, as Beijing tightens its grip on some of the nation’s biggest companies.

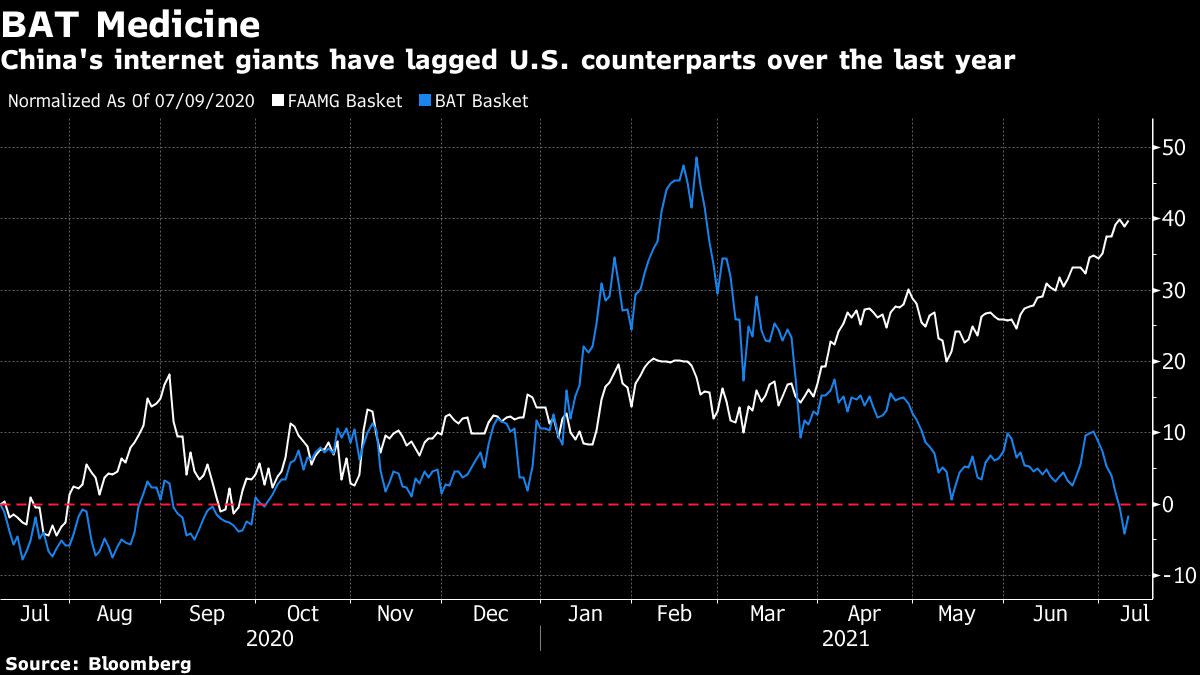

An equal-weighted basket of China’s three internet giants collectively dubbed BAT– Baidu Inc., Alibaba Group Holding Ltd. and Tencent Holdings Ltd. — fell about 2% in the 12-months through Friday, according to calculations by Bloomberg. That compares with a 40% surge in an equivalent portfolio of their U.S. peers — Facebook Inc., Amazon.com Inc., Apple Inc., Microsoft Corp. and Google’s parent Alphabet Inc. (FAAMG).

Chinese technology shares just suffered from their worst week in more than four months, after the nation’s cyberspace regulator ordered app stores to remove Didi Chuxing and issued a sweeping warning to the nation’s biggest companies, vowing to tighten oversight of data security and overseas listings. Beijing has also proposed rules that would require nearly all companies seeking to list in foreign countries to undergo a cybersecurity review.

They saw modest gains on Tuesday, with Tencent rising 0.7% as of 9:44 a.m. in Hong Kong, Baidu climbing 1% and Alibaba advancing 0.4%.

Looking at major gauges, the Nasdaq-100 Index is trading around the highest level versus the Hang Seng Tech Index, whose members include China’s biggest tech firms, since the latter’s official launch in July last year.

This underperformance has left the Asian stocks looking relatively cheaper. Baidu, Alibaba and Tencent are trading at an average of 21 times their estimated earnings, according to Bloomberg data. That compares with about 31 times for their U.S. peers.

(Updates with China tech share moves in 4th paragraph)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

Add Comment